Introduction

In recent years small and medium enterprises (SMEs) have been subject of numerous studies for their capacity to generate work and for the role they play as creators of wealth. The difficulties SMEs have in obtaining financial resources together with the scant possibility of access to capital markets means that the credit market constitutes their main source of funding. For this reason, studying corporate governance and bank intermediation becomes of particular relevance particularly in debt maturity (Diego, 2017). Relationships with their creditors play a particularly important role for companies subject to greater information asymmetry.

A key issue concerning every firm is the choice of its capital structure, the debt structure, its impact on firm’s performance and the role of associated agency conflicts are extensively researched topics. A number of specific factors, such as the nature of ownership, play an important role in determining debt as they can reduce agency costs and increase business value (Hayat, Yu, Man, and Jebran, 2018). Seminal papers by Jensen and Meckling (1976) and Grossman and Hart (1982) create an image of a firm with separation of ownership from management, where clash of interests of two groups (owners and managers) demands control mechanisms to reduce resulting agency costs. The core of corporate governance is to implement and ensure such controlling mechanisms that balance interests of stakeholders of a firm and reduce agency costs. Implementing control mechanisms that ensure different interests of stakeholders and reduce agency costs is the main objective of corporate governance, with ownership structure playing a relevant role.

Our study contributes to the existing literature in different ways. This article identifies previous relationships between managerial ownership and debt structure (e.g. Florackis and Ozkan, 2009; Lundstrum, 2009). It also considers that the nature and concentration of ownership, the number of managers and shareholders are variables that help to capture more fully the way companies are managed. The analysis focuses on the institutional context of Portuguese SMEs which has specific characteristics: Portuguese companies have a very high concentration of ownership, contrasting for example the UK reality characterized by a very dispersed ownership and a high concentration of institutional holdings (Lundstrum , 2009). Moreover, the institutional context and the legal protection of the rights of Portuguese creditors and shareholders fit the continental model, which is distinct from the Anglo-Saxon model, namely in financial distress situations (Rajan and Zingales, 1995). The managers of Portuguese companies are more conservative, the size of companies is smaller and the capital market is less developed. Secondly, we broaden the scope of previous studies (e.g. Lundstrum, 2009, Allaya, Derouiche and Muessig, 2018)) by studying the extent to which nature and concentration of ownership condition debt policies.

In corporate governance, ownership structure is a crucial instrument in alleviating agency problems (Sun, Ding, Guo, and Li, 2016). Ownership concentration enables the controller to have massive influence in policy-making, particularly in the capital structure decision (e.g. Liu and Sun, 2010; Paramanantham, Ting and Kweh, 2018). Previous researches have emphasised the association between ownership concentration and corporate financing, with particular focus on capital structure decision (e.g. Bunkanwanicha, Gupta and Rokhim, 2008; Liu, Tian, and Wang, 2011). Only a few studies examined the association between ownership concentration and debt structure (Shyu and Lee, 2009).

Shareholders with concentrated ownership are found to help minimise agency problems through capital structure decision. Thus, understanding how ownership concentration affects debt structure is important. The shareholders can monitor and control their companies by deciding on their debt structure. Generally, shareholders favour debt financing in the companies to discipline and monitor managers’ activities, and thus, ownership concentration is associated with high debt levels (Paramanantham, et al 2018). Driffield, Mahambre and Pal (2007) found ownership concentration positively affects the leverage of family companies in Malaysia, Thailand, and Indonesia. This finding was corroborated by Pindado and La Torre (2011) namely, the existence of a positive relationship between ownership concentration and leverage. On the other hand, many scholars agree shareholders prefer debt rather than equity financing to retain their control in the firm and avoid ownership dilution (e.g. Lundstrum, 2009; Zhang, 2013). They explain that controlling shareholders generally supervise and control the discretionary activity of managers via debt financing (Paramanantham, et al 2018).

However, other studies point to a negative link between ownership concentration and leverage on debt level. Short, Keassey and Dexbury (2002) for example found large external shareholdings are negatively related to debt level. This is a result of active engagement of external shareholders in controlling management in debt restructuring. In companies with high concentration of ownership, agency costs are low and therefore shareholders do not use debt as an instrument to control managers (Zhang, 2013).

The relationship between managerial ownership and capital structure has been particularly prominent in literature (eg. Chung, 2012; Ganguli, 2013, Hayat, Wang and Ma, 2016). Empirical evidence shows significant differences between countries. Few studies ( e.g. Short, Keasey and Duxbury,2002; Brailsford, Oliver and Pua, 2002; Pindado and De La Torre, 2011) have considered the nonlinear relationship between managerial ownership and debt. They also considered the interaction between managerial ownership with its impact on debt. Again the results from these few studies do not match.

Hayat et al. (2016) refer that the relationship between managerial ownership and debt has further complications. According to Short et al. (2002), managerial ownership increases the discretionary power of managers. Managers get more control over the financial decisions like reduction of debt. They get more control over the firm and make financing decisions in their favour. Ganguli (2013) finds that entrenched management with comparatively less debt and no outside monitoring increases agency costs.

This study intends to make a contribution in this field in the context of Portuguese SMEs. Thus, its main objective is to study the effect of ownership in terms of the nature and structure of property in the maturity of corporate debt.

This work it is organized as follows: the importance of corporate governance and relationship bank in debt structure is reviewed in the next section; Section 3 presents the methodology, data and variables used; Section 4 presents the main results obtained and finally, the main conclusions of this study are discussed in Section 5.

1. Survey of the literature

Corporate governance incorporates a set of concerns that have received particular attention (Salas, 2002). The Organization for Economic Cooperation and Development (OECD, 2004) describes it as a system through which business is managed and controlled, specifying the rights and obligations of the different participants: the board of directors, management, shareholders, etc. This system sets out the rules and procedures for decision making, defines the structure by which objectives are set and provides the means to achieve and control them. Tirole (2006) states that the company's governance is a set of institutions that induces managers to internalize the interests of the stakeholders that participate in it.

The separation of ownership and control creates conflicts of interest between investors (owners and creditors) and management, hence the need to develop internal and external control mechanisms capable of harmonizing them, given the difficulty in completing contracts to resolve them (Baysinger and Hoskisson, 1990). Investors provide financial resources that need to be remunerated, and the company must implement a set of mechanisms that prevent some stakeholders from being privileged with value creation (Prowse, 1995).

From the above, it has been difficult to gather consensus on the concept of "corporate governance", a probable symptom of its complexity and scope. In spite of this, all the definitions have in common the idea that there is a question of sharing of power and results between the different parties, whose interests are not always coincident.

The managers prefer to have greater control over the company's decisions than the banks are willing to grant, and also contribute to reducing this dependence. Empirically Hoshi et al. (1993) observed that the greater the free cash flow of the company, the greater the incentive of owners and managers to reduce dependence on and control over banks.

The corporate governance literature has given importance to contractual problems between capital holders and managers and to the study of the mechanisms available to investors to control their resources and minimize conflicts. However, the work carried out on the concentration of ownership gives a new focus to the theory of the agency: it moves the main / agent relationship to the connection between majority and minority owners where the expropriation of "private benefits" takes on a preponderant role, provoking conflicts of interest (La Porta et al., 2000, Gregoric and Vespro, 2003).

The considerations made throughout this section are intended to study large companies. However, in the field of business finance, SMEs have gained greater importance because of the particularities they contain. These include the family nature of the ownership and control structure, which means that the contractual relations established in the company, as well as economic ties, often include family ties. In the first generation, the ownership of these companies is concentrated in the family nucleus and the direction usually falls to the founder. This coincidence between ownership and direction reduces agency costs caused by the conflict of interests between the principal and the agent. The relations that are established are very intense and can provide externalities that are manifested by a greater commitment, trust and loyalty between the contracting parties. All the participants of the company have a greater predisposition to value them, given the trust placed in the legitimate behaviour of the founder. However, relationships become more complex as the business grows and is subject to succession processes. New generations arise, ownership fragments, information asymmetries are greater, and agency problems increase between direction and ownership. The problems of agency are more difficult to solve, insofar as contractual relations coexist with family relationships (Schulze et al., 2001). Management positions in this type of business tend to remain within the family, without sufficient capacity being assured to perform this function, which can lead to significant losses for the company. The fact that the relationships between the stakeholders are based on family ties can condition not only the creation of value but also the way in which it is shared by the participants. The origins of power, within any company, provide the rights of control over resources or the existence of asymmetric information (Schulze et al., 2002). In the case of the family business there is another source of power that comes from the fact that the participant is a member of the controlling family. This duality gives it a privileged position within the organization, enabling it to enjoy "private benefits". The power obtained by the rights conferred by the resources is legitimate, contrary to the information asymmetry and kinship relations that allow the expropriation of income generated by other resources. Therefore, in addition to the mechanisms necessary to any organization, complementary mechanisms should be established to regulate family relations.

An open question that has gained relevance in the literature is related to the needs and characteristics of financing companies, associated with the nature of ownership. Céspedes et al. (2010) report that Latin American companies tend to seek capital debt, especially when loss of control is a problem. In turn, Brav (2009) finds that UK firms depend almost exclusively on foreign capital. In the same line, Anderson et al. (2003) and Ellul (2009) report that US family firms have higher indebtedness ratios relative to non-family members. Ellul (2009) recognizes that companies based in countries with high investor protection tend to have higher indebtedness values and, consequently, greater ability to attract foreign capital rather than equity.

Schulze et al. (2001) point out, however, that family businesses are not immune to high agency costs. This is due, in particular, to the absence of efficient capital market control, the inefficiency of the labour market in family businesses (eg. lack of promotion prospects for non-household managers) and self-esteem for family managers. Bopaiah (1998) also points out that the advantages associated with family leadership should be weighed against the drawbacks of family litigation, succession, and power struggles.

Another line of research that seeks to understand how companies are financed has underlying the asymmetry of information they are subject to in the credit and capital market. In this sense, Diamond (1984) states that banking intermediation plays an important role in collecting information by reducing the high levels of information asymmetry that family business are subject to. The information opacity associated with high levels of concentration of ownership generates moral hazard problems (Bopaiah, 1998), leading Hillbrecht (1999) to assert that shareholders must incur supervision costs and promote periodic detailed audits of minimize.

For Stiglitz and Weiss (1981), information asymmetry generates moral hazard and adverse selection problems, which causes an increase in the cost of external resources. The problem of moral hazard is posed a posteriori, unlike the adverse selection that is placed a priori. Adverse selection promotes an increase in the interest rate and gives rise to two effects of contradictory signals on the expected profitability of the bank: on the one hand, if clients comply with debt service, there is an expected increase in profitability, on the other hand, in the case of non-compliance, the risk increases and the profitability decreases (Stiglitz and Weiss, 1981). From a certain amount, the second effect overlaps the first, situation in which an increase in the interest rate leads to the decrease in the profitability expected by the bank. Under these circumstances, the bank no longer has incentives to raise the interest rate, preferring to ration credit. Adverse selection and moral risk have counterproductive effects on bank profitability, since banks receive the amount contractually established, they do not benefit from the high profits of credit borrowers (when they occur), but in return they incur losses when company cannot comply with debt service.

The problems that the asymmetry of information originates in the credit market lead the banks to adopt screening techniques in the pre-contractual phase, speeding up the selection process of credit bidders. In the post-contractual phase, banks develop monitoring and control techniques by putting into practice a set of mechanisms capable of penalizing companies that deviate from the previously established and thus minimizing agency costs (Ramakrishnam and Thakor, 1984). One means of control exercised over the borrower is to use short- or medium-term bank debt to finance long-term projects. Thus, the company is forced to periodically renegotiate contractual conditions, requiring a "correct" behaviour to maintain it’s financing on reasonable terms until the end of the project (Diamond, 1984).

Petersen and Rajan (1995) point out that the relationships established with the banking entities are fundamental to the company and the increase in the number of banking entities may be associated with inefficiency of management, insofar as the control exercised by each entity is less efficient, a phenomenon called free-rider (Bolton and Scharfstein, 1996, Hart, 1995). The problem of the free-rider is caused by the presence of several financial intermediaries in situations in which the company is in financial difficulties. In this case, the entity granting additional credit bears all additional risk arising from an insolvency situation, but may only benefit from part of the profit on success, and no entity risks giving credit. Strong banking relationships are essential if young and small firms are to be financed under the best conditions. In this line Keasey K. et al. (2015) report that young family firms have a capital structure where equity is predominant.

Another current in the literature indicates that the higher levels of indebtedness in family companies come from agency conflicts with management. According to Stulz (1988) higher levels of indebtedness provide greater supervision. Households who do not participate in management can increase debt, thereby inducing greater oversight by creditors, reducing potential opportunistic behaviour of management.

Finally, when households exercise control, through participation in the management body, the levels of indebtedness are lower. Two arguments support this rationale: first, because family management is risk-averse, then because, according to agency theory, family involvement in management can lead to lower levels of debt as a consequence of the substitution effect of management: more direct monitoring of household management reduces the need for recourse to debt as a mechanism to prevent opportunistic management behaviour (Harford et al., 2008).

In addition to the constraints mentioned, Suto (2003) argues that the size of the company can also exert a positive influence on the use of indebtedness. Du and Dai (2005) suggest that the relationship between company size and indebtedness tends to be positive, due to economies of scale, stronger bargaining power among creditors, and the opportunity for diversification associated with less risk of non-compliance.

In turn, the profitability, and according to the theory of pecking order, establishes an inverse relation with the recourse to the debt. This is because the conflict of interests between internal and external creditors leads to a preference for internal resources relative to external financing (Suto, 2003). Profitability can, however, be positively associated with recourse to debt, as lenders tend to lend more credit to firms with higher cash flows (Rajan and Zingales, 1995).

2. Methods

An important issue in business financing decisions stems from the relevance of different attributes (internal and external) (Rajan and Zingales, 1995; Hall, Hutchinson, Michaelas, 2004). Corporate governance, the costs of financial and agency difficulties associated with debt, profitability, growth, asset structure, size and age, have been associated with levels of indebtedness and suggested as business determinants of capital structure (Watson and Wilson, 2002; Sogorb-Mira, 2005; Heyman, Svaleryd and Vlachos, 2013; Degryse, de Goeij and Kappert, 2012). Several other variables have been considered in the literature as determinants of indebtedness, such as the nature of the property, the ownership concentration, the managerial ownership, the number of managers, the profitability and the number of banks (Chung and Chan, 2012, Pinto and Augusto, 2014).

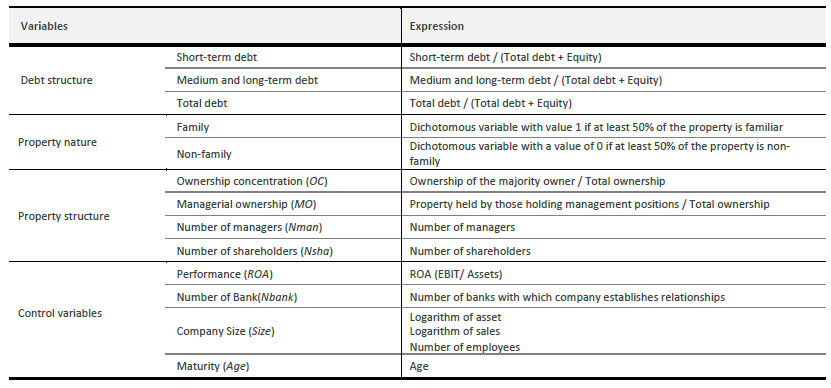

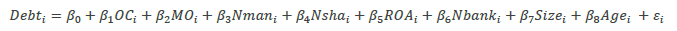

Three dependent variables are considered is this study to measure indebtedness: Short-term debt, medium and long-term debt and total debt (Table 1). Besides the dependent variables, Table 1 presents the independent variables considered in this study, demarcating the control variables.

The sample used in this study includes records of 14 203 SMEs listed in the Iberian Balances Analysis System (SABI) database. This data base contains information about Portuguese and Spanish companies, but only SMEs that met the following criteria were included in the sample:

Firms in the field of activity of manufacturing activity;

Number of employees between 5 and 250;

Complete information regarding the studied variables.

The financial information obtained from SABI relates to the year 2014. For data description, percentages are used for categorical variables, and means, with standard deviations (SD), for quantitative variables. The comparison between family and non-family firms, with respect to quantitative variables, was carried out with t-test. Applying Principal Component Analysis, the three variables considered as measures of the size of the companies were reduced to a single dimension indicator. Multiple linear regression models were estimated to explain each of the three debt variables considered in this study. However, given that family firms have specific characteristics that differentiate them in many aspects of non-family firms, we have chosen to analyse separately these two groups of companies. Thus, for family and for non-family firms, and for each of the three debt variables, the following model was considered:

Each model was estimated by ordinary least squares. The significance of the variables was evaluated based on robust standard errors, since evidence of heteroskedasticity was found (Breusch-Pagan test for heteroskedasticity). Nonsignificant variables were removed from the models.

All statistical analysis was performed with SPSS (Statistical Package for the Social Sciences), version 24, and STATA, version 14.

3. Results

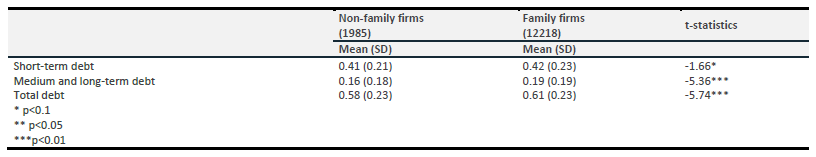

Among the 14 203 enterprises of the sample, 12 218 (86%) are family businesses. Table 2 presents the mean and standard deviation of the debt variables for family and non-family firms. For family firms, significantly higher levels of indebtedness were found, either in terms of medium and long-term debt or of total indebtedness. For short term debt, a higher mean value was found for family firms but, at the level of 0.05, no significance could be established.

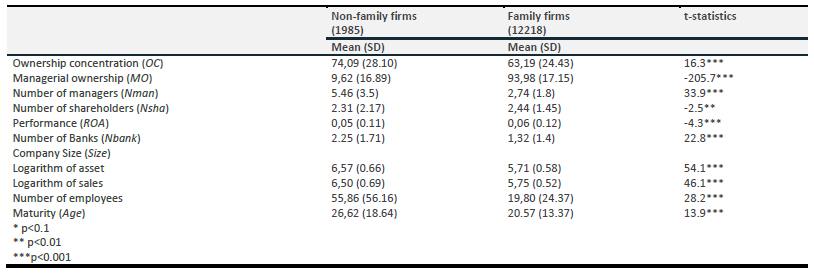

Family firms also have significantly higher values of managerial ownership, number of shareholders and performance (ROA) (Table 3), while, for the remaining variables, lower values for family firms was found.

Several regression models were estimated for each measure of indebtedness, with non-significant variables being removed one at a time.

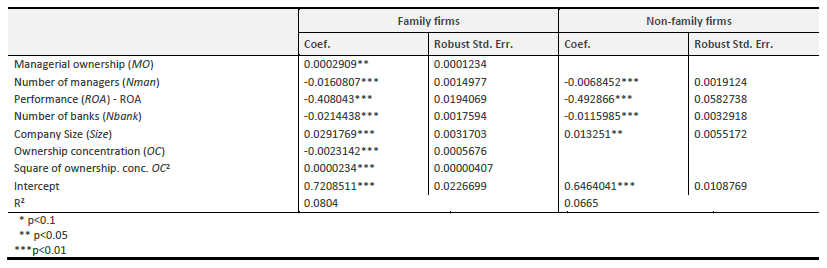

Regression coefficients for total indebtedness are reported in Table 4. For family firms, the model explains 8% of total debt variation. Managerial ownership has a positive effect on total indebtedness, as does the size. On the contrary, ceteris paribus, the increase in the number of managers, in the performance (ROA) and in the number of banks contributes to the decrease of total indebtedness. The ownership concentration initially has a negative but decreasing effect on total indebtedness, but this effect becomes positive and increasing to higher values of ownership concentration, since the square of this variable has a positive significant coefficient. More precisely, as the concentration of ownership increases to a certain extent, indebtedness decreases, but with a diminishing effect. From a certain point the effect becomes positive and increasing.

The model estimated for non-family firms provides evidence that size has a positive effect on total indebtedness (Table 4), but, on the contrary, the number of managers, the performance and the number of banks are negatively associated with total indebtedness. That is, ceteris paribus, large firms tend to have high levels of total indebtedness, while companies with high ROA values, or with many managers or with many banks tend to have low levels of total indebtedness. The model explains 6.7% of the variation of total indebtedness.

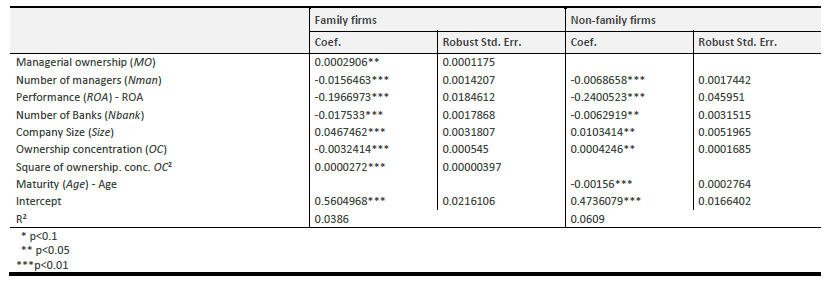

For short-term debt (Table 5), the estimated model for family firms reveals a relation of debt with the independent variables similar to the one obtained for total indebtedness. Managerial ownership has a positive effect on short-term debt, as does the size. On the other hand, ceteris paribus, a large number of managers or of the number of banks, as well as a high ROA, contributes to reduce short-term debt. For the ownership concentration, a non-linear relationship of the same type as that established for total indebtedness was observed: for lower values of ownership concentration, the effect is negative but decreasing, eventually becoming positive and increasing to higher values of ownership concentration.

For non-family firms, the model provides evidence that ownership concentration has a positive relation with short-term debt and with size (Table 5). On the other hand, ceteris paribus, firms with a high number of managers, ROA, age or number of banks tend to have a lower short-term debt.

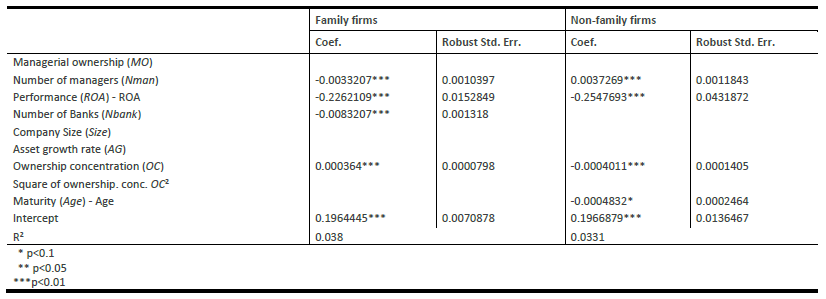

Analysing medium and long-term debt (Table 6), there is no evidence that managerial ownership has any effect on the level of indebtedness, neither for family nor for non-family firms. As in previous models, the regression coefficient for performance (measured by ROA) is negative and significant. Regarding the number of managers, for family firms, the sign of the coefficient remained negative, but for non-family firms it is positive. Thus, in contrast to what was observed for the other indebtedness variables, in non-family companies, a higher number of managers is associated with higher levels of medium and long-term debt. Similarly, the coefficient of ownership concentration has opposite sign for family and non-family businesses, being positive for the former and negative for the latter. Furthermore, for family companies, there is also a negative and significant association with the number of banks, while for non-family businesses this variable is no longer significant. For non-family firms the maturity (age) is also significantly related with medium and long-term debt, more precisely, ceteris paribus, older firms tend to have lower levels of medium and long-term debt.

Conclusions

In this study, using a sample of 14 203 Portuguese SMEs, cross-sectional, additional empirical evidence is provided for the effect of government on debt structure. This issue is of particular importance for companies at the level of aggregate economic activity, financial stability and even at the level of the financial system architecture. In addition, our empirical analysis focuses on SMEs, which represent over 99.5% of the Portuguese economy, where the banking system plays a central role in financing these businesses units.

This study expands the knowledge of debt structure inducers emphasizing the importance of the relationship between corporate governance and the structure of debt in the Portuguese context, using two proxies: property nature and property structure.

This study provides evidence that the higher the performance, the lower the indebtedness, regardless of whether or not the company is familiar. Furthermore, either for family or non-family firms, the company size has a positive impact on the total debt and short-term debt. Moreover, family and non-family businesses are similar in the relation that total debt and short-term debt establish with the number of banking institutions and the number of managers (as these numbers increase, levels of indebtedness decrease).

However, results suggest that the debt structure is clearly distinct when one considers the nature of ownership. Significantly higher values of indebtedness were found for family firms. Also, management ownership is a determinant factor in the way family businesses structure their indebtedness but is not relevant in non-family ones. In addition, in family firms, ownership concentration has a non-linear U-shaped relation with total debt and short-term debt. For non-family firms, this study revealed a linear positive relation of ownership concentration with the short-term debt, but no significant relation was found with total debt.

The main constraint of this study stems from the difficulty of collecting information and the fact that a significant number of studies focus on countries with very different legal, regulatory and market institutions from the Portuguese reality.

An important limitation of this study is that it only contemplates cross section data of the year 2014; a panel data study and more recent information would be desirable. Panel data methodologies allow us to characterize the change in the response variable over time and the factors that influence this change and can provide more efficient estimates.

In spite of the identified limitations, the study allowed us to deepen our knowledge of the impact that corporate governance (in particular the nature of ownership) has on debt maturity.

As a future work proposal, this research should be extended to other sectors of activity, besides manufacturing, in the context of Portuguese SMEs, and broaden the time horizon under study. Another line of inquiry should incorporate other features of corporate governance enriching the proposed empirical model.