Serviços Personalizados

Journal

Artigo

Indicadores

-

Citado por SciELO

Citado por SciELO -

Acessos

Acessos

Links relacionados

-

Similares em

SciELO

Similares em

SciELO

Compartilhar

Economia Global e Gestão

versão impressa ISSN 0873-7444

Economia Global e Gestão vol.17 no.2 Lisboa set. 2012

Integration strategy under demand uncertainty: a real option approach

Carlos Pinho*, Rui Fernandes** & Joaquim Borges Gouveia***

* PhD in Applied Economics from the University of Santiago de Compostela, Spain. Assistant Professor at Department of Economics, Management and Industrial Engineering of University of Aveiro, Portugal. Director of the PhD in Accounting of University of Minho and University of Aveiro. E-mail: cpinho@ua.pt

** PhD in Industrial Management at Aveiro University. CFO at Amorim Revestimentos S.A., board member at Amorim Cork GmbH, ACDN BV and Amorim Japan Corporation. E-mail: rfernandes.ar@amorim.com

*** PhD in Electrotechnical and Computer Engineering from Faculty of Engineering, University of Porto, Portugal. Full Professor at Department of Economics, Management and Industrial Engineering of University of Aveiro. E-mail: bgouveia@ua.pt

ABSTRACT

Global outsourcing has emerged as one of the major approaches to gaining a worldwide competitive edge for many industries. This paper investigates companies flexibility, in very uncertain markets, in adapting their internal capacity so as to become an alternative to outsourcing. The capacity to be installed and the related resources allocation will be determinant for timing the change. We intend to quantify the impact of anticipating a capacity expansion, treated as a partially irreversible investment. Unlike earlier studies, it provides analytical research on the probability of switching from outsourcing to an integration option, and the expected timing of the switch under two regimes: full and partial insourcing.

Keywords: Operations Integration, Outsourcing, Real Options, Uncertainty

Estratégia de integração com incerteza da procura: abordagem das opções reais

RESUMO

O outsourcing global emergiu como uma das principais abordagens em muitas indústrias, tendo em vista ganhar vantagem competitiva. Neste trabalho analisa-se a flexibilidade das empresas em adaptar a sua capacidade interna de forma a se tornar uma alternativa ao outsourcing em mercados com elevada incerteza. A capacidade a ser instalada e a afetação de recursos relacionados serão determinantes do momento de alterar a estratégia. Neste trabalho desenvolve-se um modelo de investimento parcialmente irreversível, tendo em vista a quantificação do impacto de antecipar um aumento de capacidade. Analisa-se ainda a probabilidade de alteração da escolha de outsourcing para uma situação de integração, sendo analisado o momento ótimo da alteração em dois regimes distintos: insourcing parcial ou total.

Palavras-chave: Integração de Operações, Subcontratação, Opções Reais, Incerteza

INTRODUCTION

The switch strategy between outsourcing and insourcing is time-consuming due to the increased sophistication of equipment and the training time required for production workers. One way to deal with this trend is to anticipate integration, for which a trigger moment is key. Earlier studies typically focused on the value generated from the flexibility associated with the option to outsource. This paper provides a model for the likelihood of exercising the option to insource, namely, the probability of switching from outsourcing and the expected time to making such a switch.

The model presents a simple, and yet unique, analytical framework for investigating questions related to insourcing. It also identifies a series of insights related to the value associated with the flexibilities (full or partial insourcing), the likelihood of insourcing, and the expected timing of the switch in strategy.

The use of the real options methodology is based on switching costs between outsourcing and required investments in insourcing that can also be applied for an inverse strategy. For this purpose, we consider the cost to switch from insourcing to outsourcing as the diseconomies of scale related with actual use of internal capacity.

In this study we emphasize two questions: (i) How can we value a decision on integration, using outsourcing as an alternative? (ii) How can we find the trigger moment to apply for that capacity increase decision?

We will explore two hypotheses:

• Regime 1: full insourcing

• Regime 2: partial insourcing

The remainder of the paper is organized as follows. The next section reviews the related literature. Then the third section presents the model and derivations under full and partial insourcing regimes. The fourth section presents the case study and the main results. The last section concludes and suggests future research.

LITERATURE REVIEW

The literature review will be presented in three parts considering: the use of real options in operational decisions and capacity options, managerial implications of outsourcing and insourcing advantages.

The first part deals with the use of real and capacity options in operational decision-making. Birge (2000) and Dixit and Pindyk (1994) provided good examples of how option pricing can incorporate financial risk attitudes into operational decision-making. A relevant stream of research deals with capacity decisions under demand uncertainty. In these papers, the firms decision to invest in a capacity increase resembles the insourcing decision in our model. Van Mieghem (1999) developed outsourcing conditions using price only and incomplete contracts for subcontracting decisions. Van Mieghem and Rudi (2002) established a newsvendor network in a single-period model, and under identically and independently distributed market demands. Van Mieghem (2003) provided a comprehensive summary of various capacity investment models. Tan (2004) determined the firms optimal production and subcontracting decisions that ensure the long-term availability of capacity at the facility of the subcontractor. Tomlin and Wang (2005) compared the values from several forms of chain design. In the same line, Lu and Van Mieghem (2009) investigated the firms network design from centralization to decentralization and mentioned the influence of fixed costs in centralizing operations in a single facility. Our emphasis provides insight into the probabilistic nature of insourcing and outsourcing in a continuous-time model.

The second part is related with managerial implications of outsourcing as an alternative to achieving competitive advantages (see Gilley and Rasheed, 2000). Only few authors have been investigating the impact of such an alternative on the firms economic performance (e.g. Fixler and Siegel, 1999; Jiang et al. (2006); Kurz, 2004; Mol et al., 2005; Ten and Wolff, 2001). Of the few stated studies, we can find some management impacts structured in different classes, for instance, Quinn and Hilmer (1994) made an overview on strategic implications; Lever (1997) placed special attention on financial and human resources implications; Rabinovich et al. (1999), Andersson and Norrman (2002), concentrated on logistic functions; Momme (2002) studied the impact in the control dimension by focusing on the core activities. Reitzig and Wagner (2010) concluded that a firm increases performance by conducting downstream activities and, Sharda and Chatterjee (2011) defended that there are similarities and differences between outsourcing firms and their performance, due to combinations of work designs, strategy and market relations. Other studies have focused on the benefits and risks of an outsourcing decision (e.g. Jiang et al. (2007); Schniederjans and Zuckweiler, 2004). Briefly we can identify three different approaches: the focus on strategic core competences (e.g. Quinn and Hilmer, 1994; Prahalad and Hamel, 1990; Sanders, et al., 2007), cost impacts (e.g. Holcomb and Hitt, 2007) and the resource management approach (e.g. McIvor, 2009). Despite these past considerations, we are also interested in the papers that study outsourcing from the operational planning level even though, based on scale economies reasoning, some companies outsource despite no cost advantage (Cachon and Harker, 2002). Specifically, our study will concentrate on outsourcing decisions when a company faces a potential capacity expansion, namely the decision whether to build or expand own production capacity. Mathematical models have been developed to evaluate the benefits of expanding capacity and outsourcing (e.g. Mieghem, 1999; Tsai and Lai, 2007). Kouvelis and Milner (2002) show that greater market demand uncertainty increases the reliance on outsourcing, whereas greater supply uncertainty increases the need for vertical integration. The option to outsource in production planning models results in production smoothing (Kamien and Li, 1990) and with different amounts of safety stocks needed in a supply chain (Malek et al., 2005). The effect of outsourcing on company productivity is dependent on the nature of the outsourced inputs (services or materials) (Gorg and Hanley, 2005).

The literature summarizes a number of advantages and disadvantages of outsourcing, although empirical data are still rare (Beaumont and Sohal, 2004; Bengtsson and Haartman, 2005; Gilley and Rasheed, 2000). Manufacturing cost reductions, lower investment and consequently fewer fixed capital costs are the most prominent of the disclosed advantages of outsourcing as they improve short term profitability. The modern theory of the firm has made considerable progress in explaining the determinants of vertical integration, assuming that the level of vertical integration results from independent transactional choices (Macher and Richman, 2008; Masten and Saussier, 2002; Novak and Stern, 2009; Whinston, 2003). Some approaches were made considering the uncertainty effect in an outsourcing option, based on production cost and degree of product differentiation (e.g. Hamada, 2010), market uncertainty and the optimal proportion of outsourcing (Alvarez and Stenbacka, 2007; Li and Wang, 2010), competition and foreign exchange uncertainty (Liu and Nagurney, 2011), and demand uncertainty from the outsourcing side (Boulaksil et al., 2011).

One prominent perspective to explain vertical integration is that of transaction cost economics. Its focus is on market failure and it captures ways to reduce risks by integrating economic activities under a coordinated management. According to transaction cost economics, the question of whether an activity should be integrated or not depends on the specificity of the investment, the frequency and the costs of interaction between firm and the supplier, the amount of uncertainty and an eventual opportunity for the supplier (Williamson, 2008), due for example to economies of scale (Argyres, 1996). Recently, Ciliberto and Panzar (2011) analyzed the relation between outsourcing decisions on downstream activities and the fixed costs at the upstream stages of a supply chain. Another perspective is the resource-based view of the firm focusing on internal capabilities as the main criteria for outsourcing decisions (e.g. Conner and Prahalad, 1996; Zander and Kogut, 1995). In the resource-based view of the firm, the management team devotes specific attention to the development of the organizations internal resources and capabilities as a key competitive advantage (Teece et al., 1997). Olausson and Magnusson (2011) devoted special attention to human resources requirements and coordination; Zirpoli and Becker (2011) addressed the problem of outsourcing product development tasks; Timlon (2011) argued for a socio-economic approach in strategic outsourcing decisions; Narayanan et al. (2011) studied task complexity and end customer orientation of outsourcing decisions.

A recent study on outsourcing timing used real options methodology (Moon, 2010). Our model focuses on an investment option, mainly on the moment triggering integration, instead of an outsourcing decision. In this way, we defend the application of the model to justify irreversible costs due to own capacity investments.

The research in this paper differs from previous literature mainly in four aspects: (i) we quantify the integration decision under demand uncertainty; (ii) our model determines critical demand quantities as the moment triggering a capacity investment; (iii) we examine the impact of the uncertainties in demand for products on the trigger moment; and (iv) our model incorporates the impact of positive shocks on products demand, bringing it closer to reality. Although previous research might have addressed one or two of the above points, none has been found that integrates all four.

The paper makes three contributions. First, it shows that the probability of switching to the insourcing option is related with demand volatility. Second, it discusses the partial insourcing choice, and third it shows the incremental benefits of the insourcing flexibility.

MODEL FORMULATION

In this section we will begin with a description of the model before providing the optimal timing of integration.

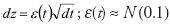

Demand is the main source of uncertainty affecting the decisions. We assume that the demand is a stochastic variable, denoted  and follows a geometric Brownian motion [similar assumption in Bengtsson (2001) and Fernandes et al. (2010)], subject to a Poisson process, such that:

and follows a geometric Brownian motion [similar assumption in Bengtsson (2001) and Fernandes et al. (2010)], subject to a Poisson process, such that:

Where:  ,

,  instantaneous drift,

instantaneous drift,  volatility,

volatility,  increment of a wiener process, where

increment of a wiener process, where  is a serially uncorrelated and normally distributed random variable;

is a serially uncorrelated and normally distributed random variable;  with probability

with probability  and demand shocks intensity represented by

and demand shocks intensity represented by

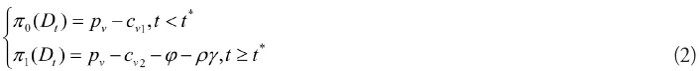

It can be expected that at a certain moment there will be a demand level that supports the integration decision, considering the future outcomes. To model our problem, we will assume a different profit function prior to (outsourcing) and after the decision (full or partial integration) that we will denote as  and

and  , respectively.

, respectively.

We consider that the integration will occur within a single period and instant production will be available to face demand changes. We assume that the decision to outsource is affected only by profit advantage, and not by competitive advantage through proper market positioning, such as the degree of product differentiation (also defended by Hamada, 2010).

The profit functions, by unit, before and after investment will be defined in the following equations, considering full integration:

With  representing the unit selling price,

representing the unit selling price,  is the unit outsourcing cost,

is the unit outsourcing cost,  the unit integration variable cost,

the unit integration variable cost, counts for own fixed operating costs,

counts for own fixed operating costs, is the investment value,

is the investment value,  discount rate,

discount rate,  is the moment when the change should occur.

is the moment when the change should occur.

The goal is the calculation of the demand critical point  , at moment

, at moment  , above which the investment in integrating activities is a more profitable alternative.

, above which the investment in integrating activities is a more profitable alternative.

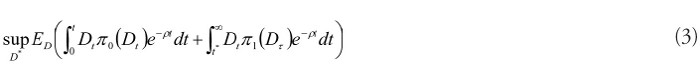

Analytically we will use the following objective function:

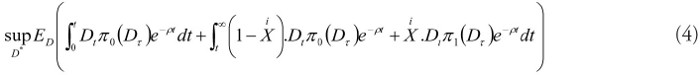

• For full integration regime:

• For partial integration regime ( represents the percentage of demand quantity to be produced using internal capacity):

represents the percentage of demand quantity to be produced using internal capacity):

With:

•  = first optimal time to invest;

= first optimal time to invest;

•  = unit profit function before investment, equation;

= unit profit function before investment, equation;

•  = unit profit function after investment;

= unit profit function after investment;

•  = demand during time.

= demand during time.

For the full integration regime, we will replace equations(2) with equation(3):

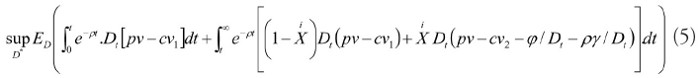

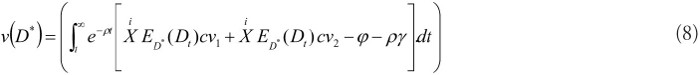

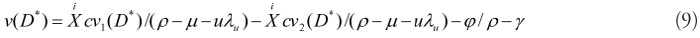

Simplifying equation (5), the objective function can be written as,

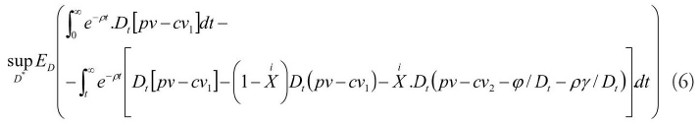

The first members do not depend on, so we can rewrite equation (6) as,

This equation maximizes profits from changing outsourcing to integration, under uncertain demand.

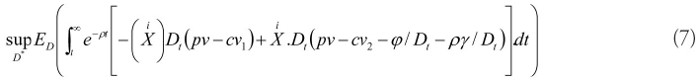

Using Oksendal (2003) theorem (also used by Pimentel, 2009), derived from Markoviana property, and simplified convergence theorem, we can write equation (7) as:

As we assume thatfollows a geometric Brownian motion subject to jumps modelled using Poisson process, the expected value at time  becomes:

becomes:

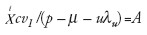

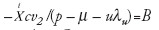

We are going to define a simple notation for each part of equation(9),

•

•

•

•

Equation (9) can be written as,

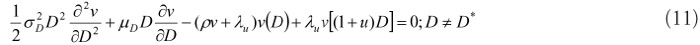

We can obtain the integration value , at the actual moment, determined by maximizing equation (10), which satisfies the following differential equation:

with

Initial condition:

•

Value matching condition:

•  with

with

Smooth condition:

•  with

with

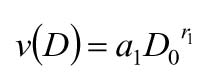

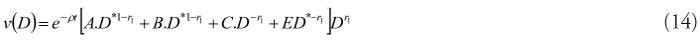

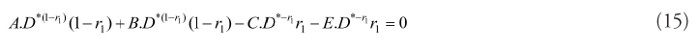

If we consider (11) a second order Cauchy-Euler function (Ross, 1996), the solution can be written as:

where is the result of the following non linear equation:

This can be solved numerically.

The solution of equation(11) is,

For a given value of and for , the value that maximizes is given by the solution of the following equation:

And finally, we can calculate finding the closed solution,

The flexibility source is the option to exercise. In this case, management can execute an integrating option.

CASE ILLUSTRATION AND RESULTS

To test our model we used data from the samples department of a flooring manufacturing company. The samples activity is intensive and depends heavily on the demand behavior, which stresses the decision of using outsourcing or integrated activities, mainly due to retailing market uncertainty. The sampling operations require one cutting machine and human tasks to be performed. The sampling process does not demand a specific workforce. The company can obtain these competences using outsourcing. Introducing the data referred in Table A1 into the model, we found the following results after solving the proposed model:

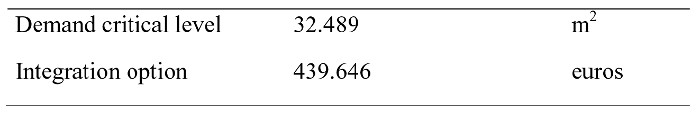

Considering the results computed in Table 1, the company should integrate activities when demand reaches 32.489 m2. The alternative to hold the decision is valued at 439.646 euros.

Table 1

Results of the evaluation

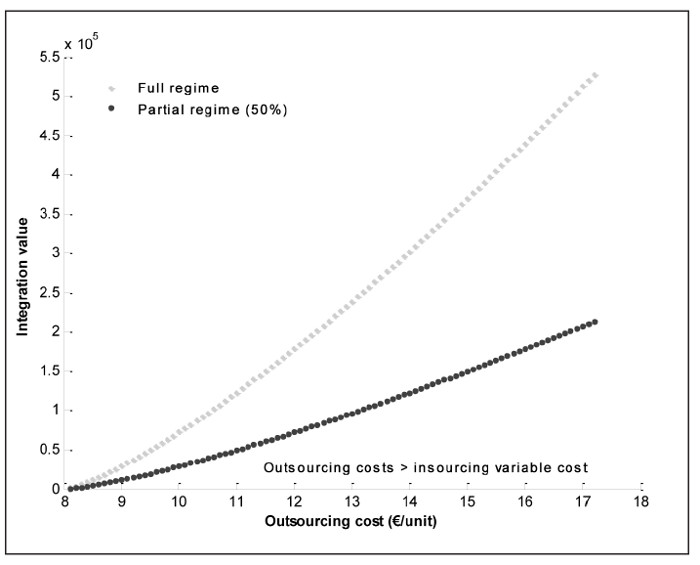

First the results will be analyzed considering economic features between outsourcing and integration, more specifically, the outsourcing costs and integration investment value.

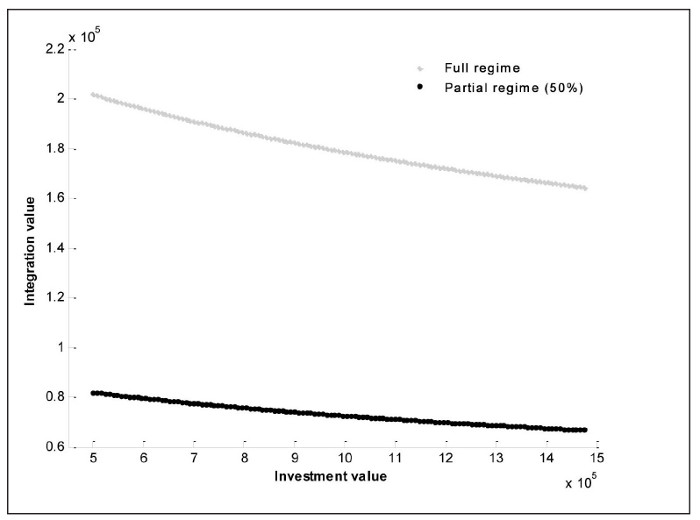

Figure 1 considers the costs associated with outsourcing; we find that higher outsourcing costs increase the value associated with integration, whenever internal variable costs are below the outsourcing alternative costs. In the full integration regime, the value of the opportunity is higher than in the partial alternative, which is consistent with an increase in the output of the internalized activities under a full integration. Figure 2 shows the impact of changes in investment value in both regimes. The results point to an inverse relation between integration value and investment value. The investment value is a fixed cost that is smoothed with higher internalized activities outputs, which justifies a higher integration value for the full regime than for the partial regime.

Figure 1

Integration value in pure and partial regime, considering different outsourcing costs

Figure 2

Integration value in pure and partial regime, considering different investment values

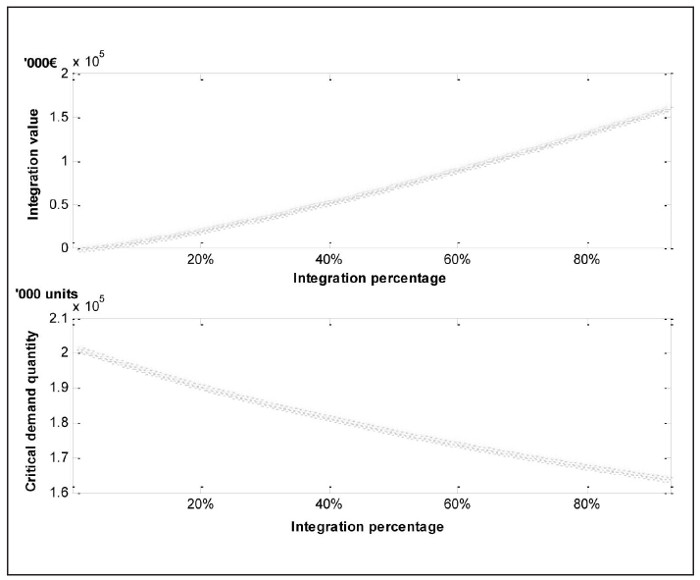

Second, the results will be analyzed considering the intensity of the partial integration regime.

In Figure 3 we compare the evolution of the integration value and the correspondent critical demand quantity. We can see that there is an inverse relation between both values. Considering only the partial regime, we simulated different scenarios for the integration percentage. As the integration percentage increases the value for the alternative between outsourcing and insourcing increases under an inverse evolution of critical demand level.

Figure 3

Integration value and critical demand quantity in partial regime, considering different integration percentages

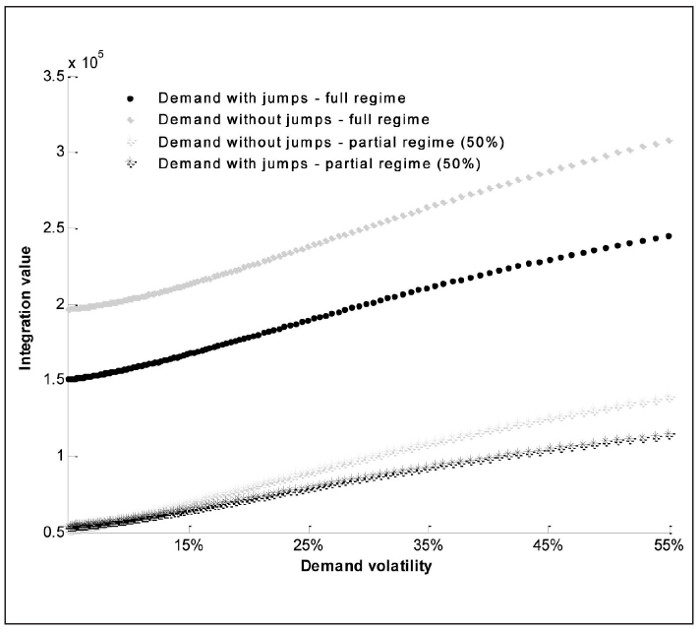

Third, the results will be analyzed considering the market demand behavior under shocks and volatility.

The results from Figure 4 should be analyzed in three stages: the impact of demand volatility, the impact of demand shocks, and that impact considering different regimes for the integration decision. For the first, we conclude that in high uncertain environments there is greater potential value for integration. We can conclude that insourcing can be a flexible measure to minimize the impacts of demand uncertainty at a certain moment and under a defined critical demand level. When we consider the impact of demand shocks, we conclude that the existence of shocks intensifies the evolution of demand (we have assumed that demand follows a geometric Brownian motion) and the critical demand to support the change is anticipated, which results in lower integration value. The full integration results in a higher integration value because it is possible to use more available internal capacity. Partial integration does not allow such a fast recovery on the investment value to support the capacity investments.

Figure 4

Integration value and demand volatility, with and without shocks – full and partial integration regime

CONCLUSIONS AND FUTURE DEVELOPMENTS

This paper presents an optimization methodology for the integration strategy of activities where detailed aspects involving integration decision value, trigger moment and critical demand impact are considered. An optimal profit approach is then modelled, where different regimes are incorporated, considering both full and partial insourcing.

Investments in own capacity require a numerical analysis in the presence of an alternative like outsourcing. The problem raised is critical as investments to integrate became more expensive than an outsourcing option. We exposed the potential value between two alternatives using the optimal moment for the decision.

The development of the trigger moment to promote the integration of existing outsourced activities, which is based on the critical demand value, provides a relevant tool for management purposes. The incorporation of positive shocks affecting the demand evolution promotes the use of the model in realistic environments.

Our model relies on two key assumptions. First, we assume that demand conforms to geometric Brownian motion, which implies that when the demand process hits zero, it stays at zero (when the firm can go out of business). Second, we assume an infinite horizon and stable parameter values over time. Investigating the sequential change from one strategy to another by using different trigger moments, linked with demand evolution, is worthy topics for future research.

REFERENCES

ALVAREZ, L. & STENBACKA, R. (2007), «Partial outsourcing: a real options perspective». International Journal of Industrial Organization, 25(1), pp. 91-102. [ Links ]

ANDERSSON, D. & NORRMAN, A. (2002), «Procurement of logistics services – a minutes work or a multi-year project?». European Journal of Purchasing & Supply Management, 8(1), pp. 3-14. [ Links ]

ARGYRES, N. (1996), «Evidence on the role of firm capabilities in vertical integration decisions». Strategic Management Journal, 17, pp. 129-150. [ Links ]

BEAUMONT, N. & SOHAL, A. (2004), «Outsourcing in Australia». International Journal of Operations & Production Management, 24(7), pp. 688-700. [ Links ]

BENGTSSON, J. (2001), «Manufacturing Flexibility and Real Options». Department of Production Economics, IMIE, Linköping Institute of Technology, Linköping, Sweden. [ Links ]

BENGTSSON, L. & HAARTMAN, R. (2005), «Outsourcing manufacturing and its effects on firm performance». Proceedings of 6th CINet Conference, CENTRIM, Brighton. [ Links ]

BIRGE, J. (2000), «Option methods for incorporating risk into linear capacity planning models». Manufacturing & Service Operations Management, 2(1), pp.19-31. [ Links ]

BOULAKSIL, Y.; GRUNOW, M. & FRANSOO, J.C. (2011), «Capacity flexibility allocation in an outsourced supply chain with reservation». International Journal of Production Economics, 129(1), pp. 111-118. [ Links ]

CACHON, G.P. & HARKER, P. (2002), «Competition and outsourcing with scale economies». Management Science, 48(10), pp. 1314-1333. [ Links ]

CILIBERTO, F. & PANZAR, J. (2011), «Outsourcing and vertical integration in a competitive industry». Southern Economic Journal, 77(4), pp. 885-900. [ Links ]

CONNER, K. & PRAHALAD, C.K. (1996), «A resource-based theory of the firm: knowledge versus opportunism». Organization Science, 7, pp. 477-492. [ Links ]

DIXIT, K. & PINDYK, S. (1994), Investment under Uncertainty, Princeton, University Press, Princeton. [ Links ]

FERNANDES, R.; GOUVEIA, B. & PINHO, C. (2010), «Overstock – a real option approach». Journal of Operations and Supply Chain Management, 3(2), pp. 98-107. [ Links ]

FIXLER, D. & SIEGEL, D. (1999), «Outsourcing and productivity growth in services». Structural Change and Economics Dynamics, 10(2), pp. 177-194. [ Links ]

GILLEY, K.M. & RASHEED, A. (2000), «Making more by doing less: an analysis of outsourcing and its effects on firm performance». Journal of Management, 26(4), pp. 763-790. [ Links ]

GORG, H. & HANLEY, A. (2005), «International outsourcing and productivity: evidence from the Irish electronics industry». The North American Journal of Economics and Finance, 16(2), pp. 255-269. [ Links ]

HAMADA, K. (2010), «Outsourcing versus in-house production: the case of product differentiation with cost uncertainty». Seoul Journal of Economics, 23(4), pp. 439-459. [ Links ]

HOLCOMB, T.R. & HITT, M.A. (2007), Toward a model of strategic outsourcing. Journal of Operations Management, 25(2), pp. 464-481. [ Links ]

JIANG, B.; BELOHLAV, J. A. & YOUNG, S.T. (2007), «Outsourcing impact on manufacturing firms value: evidence from Japan». Journal of Operations Management, 25(4), pp. 885-900. [ Links ]

JIANG, B.; FRAZIER, G.V. & EDMUND, P. L. (2006), «Outsourcing effects on firms operational performance: an empirical study». International Journal of Operations & Production Management, 26(12), pp. 1280-1300. [ Links ]

KAMIEN, M.I. & LI, L. (1990), «Subcontracting, coordination, flexibility, and production smoothing in aggregate planning». Management Science, 36(11), pp. 1352-1363. [ Links ]

KOUVELIS, P. & MILNER, J. M. (2002), «Supply chain capacity and outsourcing decisions: the dynamic interplay of demand and supply uncertainty». IIE Transactions, 34(8), pp. 717-728. [ Links ]

KURZ, C. J. (2004), «Outstanding Outsources: A Firm and Plant-Level Analysis of Production Sharing». Working Paper, University of California, San Diego. [ Links ]

LEVER, S. (1997), «An analysis of managerial motivations behind outsourcing practices in human resources». Human Resource Planning, 20(2), pp. 37-47. [ Links ]

LI, S. & WANG, L. (2010), «Outsourcing and capacity planning in an uncertain global environment». European Journal of Operational Research, 207(1), pp. 131-141. [ Links ]

LIU, Z. & NAGURNEY, A. (2011), «Supply chain outsourcing under exchange rate risk and competition». Omega, 39(5), pp. 539-549. [ Links ]

LU, X.L., & VAN MIEGHEM, J.A. (2009), «Multimarket facility network design with offshoring applications». Manufacturing & Service Operations Management, 11(1), pp. 90-108. [ Links ]

MACHER, J. T. & RICHMAN, B. D. (2008), «Transaction cost economics: an assessment of empirical research in the social sciences». Business and Politics, 10(1), pp. 1-63. [ Links ]

MALEK, L.; KULLPATTARANIRUM, T. & NANTHAVANIJ, S. (2005), «A framework for comparing outsourcing strategies in multi-layered supply chains». International Journal of Production Economics, 97(3), pp. 318-328. [ Links ]

MASTEN, S. & SAUSSIER, S. (2002), «Econometrics of contracts: an assessment of developments in the empirical literature on contracting». In E. Brousseau and J.-M. Glachant (Eds.), The Economics of Contracts – Theory and Application. Cambridge University Press, Cambridge, pp. 273-292. [ Links ]

MCIVOR, R. (2009), «How the transaction cost and resource-based theories of the firm inform outsourcing evaluation». Journal of Operations Management, 27(1), pp. 45-63. [ Links ]

MIEGHEM, J.A. (1999), «Coordinating investment, production, and subcontracting». Management Science, 45(7), pp. 954-971. [ Links ]

MOL, M.; TULDER, R. & BEIJE, P. (2005), «Antecedents and performance consequences of international outsourcing». International Business Review, 14(5), pp. 599-617. [ Links ]

MOMME, J. (2002), «Framework for outsourcing manufacturing: strategic and operational implications». Computers in Industry, 49(1), pp. 59-75. [ Links ]

MOON, Y. (2010), «Efforts and efficiency in partial outsourcing and investment timing strategy under market uncertainty». Computers & Industrial Engineering, 59(1), pp. 24-33. [ Links ]

NARAYANAN, S.; JAYARAMAN, V.; LUO, Y. & SWAMINATHAN, J. (2011), Journal of Operations Management, 29(1/2), pp. 3-16. [ Links ]

NOVAK S. & STERN, S. (2009), «Complementarity among vertical integration decisions: evidence from automobile product development». Management Science, 55(2), pp. 311-332. [ Links ]

OKSENDAL, B. (2003), Stochastic Differential Equations. An Introduction with Applications. 6th ed. Springer. [ Links ]

OLAUSSON, D. & MAGNUSSON, T. (2011), «Manufacturing competencies in high-tech NPD: on the impact of vertical integration and coordination». International Journal of Manufacturing Technology and Management, 22(3), pp. 278-300. [ Links ]

PIMENTEL, P. (2009), «Avaliação do Investimento na Alta Velocidade Ferroviária». Tese de Doutoramento. Universidade Técnica de Lisboa. Instituto Superior de Economia e Gestão. [ Links ]

QUINN, J.B. & HILMER, F.G. (1994), «Strategic outsourcing». Sloan Management Review, 35(4), pp. 43-55. [ Links ]

RABINOVICH, E.; WINDLE, R.; DRESNER, M. & CORSI, T. (1999), «Outsourcing of integrated logistics functions: an examination of industry practices». International Journal of Physical Distribution & Logistics Management, 29(6), pp. 353-373. [ Links ]

REITZIG, M. & WAGNER, S. (2010), «The hidden costs of outsourcing: evidence from patent data». Strategic Management Journal, 31(11), pp. 1183-1201. [ Links ]

ROSS, S. (1996), Stochastic Processes. 2nd ed., Wiley Series in Probability and Mathematical Statistics, John Wiley & Sons, Inc. [ Links ]

SANDERS, N.R.; LOCKE, A.; MOORE, C.B. & AUTRY, C.W. (2007), «A multidimensional framework for understanding outsourcing arrangement». Journal of Supply Chain Management, 43(4), pp. 3-15. [ Links ]

SCHNIEDERJANS, M.J. & ZUCKWEILER, K.M. (2004), «A quantitative approach to the outsourcing-insourcing decision in an international context». Management Decision, 42(8), pp. 974-86. [ Links ]

SHARDA, K. & CHATTERJEE, L. (2011), «Configurations of outsourcing firms and organizational performance; A study of outsourcing industry in India». Strategic Outsourcing: an International Journal, 4(2), pp.152-178. [ Links ]

TAN, B. (2004), «Subcontracting with availability guarantees: production control and capacity decisions». IIE Transactions, 36, pp. 711-724. [ Links ]

TEECE, D.J.; PISANO, G. & SHUEN, A. (1997), «Dynamic capabilities and strategic management». Strategic Management Journal, 18(7), pp. 509-533. [ Links ]

TEN, R.T. & WOLFF, E.N. (2001), «Outsourcing of services and the productivity recovery in U.S. manufacturing in the 1980s and 1990s». Journal of Productivity Analysis, 16(2), pp. 149-165. [ Links ]

TIMLON, J. (2011), «Sustainable strategic sourcing decisions: the logic of appropriateness applied to the Brazilian market». Strategic Outsourcing: an International Journal, 4(1), pp. 89-106. [ Links ]

TOMLIN, B., & WANG, Y. (2005), «On the value of mix flexibility and dual sourcing in unreliable newsvendor networks». Manufacturing & Service Operations Management, 7(1), pp. 37-57. [ Links ]

TSAI, W.H. & LAI, C.W. (2007), «Outsourcing or capacity expansions: application of activity-based costing model on joint products decision». Computers & Operations Research, 34(12), pp. 3666-3681. [ Links ]

VAN MIEGHEM, J.A. (1999), «Coordinating investment, production, and subcontracting». Management Science, 45(13), pp. 954-964. [ Links ]

VAN MIEGHEM, J.A. (2003), «Capacity management, investment, and hedging: review and recent developments». Manufacturing & Service Operations Management, 5(4), pp. 269-302. [ Links ]

VAN MIEGHEM, J.A. & RUDI, N. (2002), «Newsvendor networks: inventory management and capacity investment with discretionary activities». Manufacturing & Service Operations Management, 4(4), pp. 313-335. [ Links ]

WHINSTON, M. D. (2003), «On the transaction cost determinants of vertical integration». Journal of Law, Economics and Organization, 19(1), pp. 1-23. [ Links ]

WILLIAMSON, O. (2008), «Outsourcing: transaction cost economics and supply chain management». Journal of Supply Chain Management, 44(2), pp. 5-16. [ Links ]

ZANDER, U. & KOGUT, B. (1995), «Knowledge of the firm and the speed of the transfer and imitation of organizational capabilities: an empirical test». Organization Science, 6(1), pp. 76-92. [ Links ]

ZIRPOLI, F. & BECKER, M. (2011), «The limits of design and engineering outsourcing: performance integration and the unfulfilled promises of modularity». R & D Management, 41(1), pp. 21-43. [ Links ]

Appendix

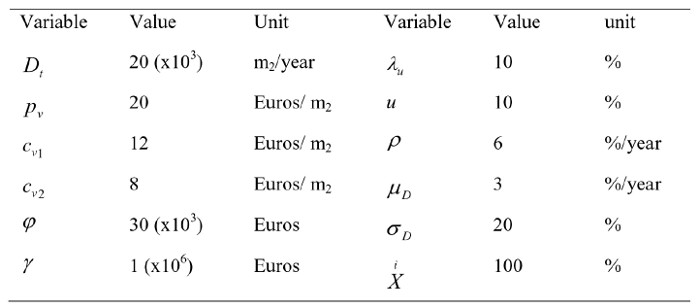

Table A1: Simulation data (annual base)