Serviços Personalizados

Journal

Artigo

Indicadores

Links relacionados

Compartilhar

Tourism & Management Studies

versão impressa ISSN 2182-8458

TMStudies vol.9 no.1 Faro 2013

How benefits management helps balanced scorecard to deal with business dynamic environments

Como a gestão de benefícios auxilia o balanced scorecard em contextos dinâmicos de negócio

Jorge Gomes1, Mário Romão2

ISCTE-IUL, University Institute of Lisbon, Portugal; 1 jorgemvgomes@hotmail.com; 2 mario.romao@iscte.pt

ABSTRACT

In the rapidly-changing environments characterizing most industries today, organizations face intense competitive pressure to do things better, faster and cheaper. The business environment of the 1990s has been subjected to rapid and accelerated change that creates more and more uncertainty and complexity. Most markets are becoming increasingly dynamic. Organizations can no longer rely on a traditional analytical approach to understand their industry or market, since that market is changing in rapid and unexpected ways. In spite of its worldwide dissemination, Balanced Scorecard (BSC) has demonstrated inadequacy in certain circumstances. Some of the original advantages of the BSC can nowadays be interpreted as weaknesses. We suggest that in business dynamic environments the benefits management approach, by using the benefits dependency network can help BSCs to guide and support the benefits achievement related with investments, in a complementary way. By using a case study we try to show how a BSC exhibits limitations to deal with business disruptive environments and how a benefits management approach brings a strengthened business implementation vision, from strategy down to operations.

Keywords: Balanced Scorecard, benefits management, resource based view, dynamic environments.

RESUMO

Nos contextos turbulentos e dinâmicos que caracterizam a maioria das indústrias de hoje, as organizações enfrentam uma intensa pressão competitiva para um melhor desempenho, em menor tempo e com menor custo. O ambiente de negócios da década de 90 foi sujeito a uma mudança profunda e acelerada, que criou mais incerteza e complexidade. A maioria dos mercados está a tornar-se cada vez mais dinâmica. As organizações já não podem contar com uma abordagem analítica tradicional para compreender a sua indústria ou mercado, uma vez que este está a mudar de forma inesperada. Apesar da sua disseminação em todo o mundo, o Balanced Scorecard (BSC) tem demonstrado alguma inadequação em determinados ambientes. Algumas das vantagens originais do BSC têm sido interpretadas, nos dias de hoje, como limitações. Sugere-se assim que, em ambientes de negócio dinâmicos, a abordagem de gestão de benefícios, por meio da rede de dependência de benefícios, possa auxiliar o BSC a orientar a realização dos benefícios relacionados com os investimentos, complementando a sua ação. Usando um estudo de caso, mostramos como o BSC evidencia limitações em ambientes disruptivos de negócio e como a abordagem de gestão de benefícios acrescenta uma visão mais robusta na implementação do negócio, desde a estratégia até às operações.

Palavras-chave: Balanced Scorecard, gestão de benefícios, visão orientada aos recursos, ambientes dinâmicos.

1. Introduction

Organizations today face intense competitive pressure to do things better, faster and cheaper. Most markets are becoming increasingly dynamic; organizations cannot rely on an analytical approach to understanding their industry or market, since that market is changing in rapid and unexpected ways. Equally, they cannot rely on the collection of resources that have provided them with competitive advantage in the past. Rather, they must learn to develop capabilities that allow them to integrate, reconfigure, gain and release resources (Eisenhardt and Martin, 2000).

With a shift from the industrial economy towards a new economy that is now predominantly characterized by intangible assets, such as knowledge and innovative capability, organizations have to manage increasing levels of complexity, mobility and uncertainty (Voelpel et al. 2005). The ability to manage knowledge-based intellect is of critical importance in this new environment (Quinn, 1992). Competition in this new economy is now increasingly characterized by the rapid emergence of brand-owning companies that devote their energies to organizational fitness (Beer, 2002).

For many companies competitive advantage is a continuous process of performance improvements and search for better practices and development of new capabilities. This includes a search for more efficient process technologies, new or improved products and procedures in the manufacturing process but also development of dynamic capabilities (Teece, Pisano and Shuen 1997) to respond and adapt to change and new trends in the sector. Prahalad and Hamel (1990) argue that sustainable competitive advantage is dependent upon building and exploiting core competences.

Porter's recent work emphasizes the need for firms and countries to broaden and upgrade their internal advantages in order to sustain and extend competitive advantages (Porter 1991, 1992).

Firms obtain sustained competitive advantage by implementing strategies that exploit their internal strengths through responding to environmental opportunities, improving internal weaknesses and eliminated the external threats (Barney, 1991).

For managers the challenge is to identify, develop, protect, and deploy resources and capabilities in a way that provides the firm with a sustainable competitive advantage and, thereby, a superior return on capital (Amit & Schoemaker, 1993).

Teece et al., (1997) originally defined the dynamic capabilities approach as ways of exploiting existing internal and external firm specific competences to address changing investments.

Some authors have long recognized the importance of firm differences and distinctive competencies (Selznick, 1957; Ansoff, 1965; Andrews, 1971; Hofer and Schendel, 1978).

The resource-based view (RBV) of the firm is an influential theoretical framework for understanding how competitive advantage within firms is achieved and how that advantage might be sustained over time (Barney, 1991; Nelson, 1991; Penrose, 1959; Peteraf, 1993; Prahalad & Hamel, 1990; Teece, Pisano & Shuen, 1997; Wernerfelt, 1984). This perspective focuses on the internal organization of firms, and so is a complement to the traditional emphasis of strategy on industry structure and strategic positioning within that structure as the determinants of competitive advantage (Henderson & Cockburn, 1994; Porter, 1979).

The RBV approach assumes that organizations can be conceptualized as sets of resources that are heterogeneously distributed across the organizations and their differences persist over the time (Amit and Schoemaker, 1993; Mahoney & Pandian, 1992; Penrose, 1959; Wernerfelt, 1984) and emphasizes firm-specific capabilities and assets and the existence of isolating mechanisms as the fundamental determinants of firm performance (Penrose, 1959; Rumelt, 1984; Teece, 1984; Wernerfelt 1984).

The writings of authors such as Irvin and Michaels (1989), Wernerfelt (1989), Prahalad and Hamel (1990), Grant (1991), or Stalk, Evans, and Shulman (1992) further evidence a continuing interest in core skills and capabilities as a source of competitive advantage.

According to Barney (1991) a firm resource to have the potential of generating competitive advantage, it must have the following the four empirical indicators: (1) valuable, in the sense that it exploits opportunities, (2) rare, among a firm’s current and potential competition (3) imperfectly imitable and (4) without strategically equivalent substitutes.

The researches have theorized when firms have resources that are valuable, rare, inimitable and non replaceable, so called VRIN attributes, they can achieve sustainable competitive advantage by implementing fresh value-creating strategies that cannot be easily duplicated by competing firms (Barney, 1991; Conner and Prahalad, 1996; Nelson, 1991; Peteraf, 1993; Wernerfelt, 1984, 1995).

According to Amit & Schoemaker (1993), managerial decisions concerning such resources and capabilities are ordinarily made in a setting that is characterized by: (1) Uncertainty about (a) the economic, industry, regulatory, social, and technological environments, (b) competitors behavior, and (c) customers preferences; (2) Complexity concerning (a) the interrelated causes that shape the firm's environments, (b) the competitive interactions ensuing from differing perceptions about these environments; and by (3) intra organizational conflicts among those who make managerial decisions and those affected by them. These conditions of uncertainty, complexity and conflict are usually difficult to articulate or model.

To answer to the new business constrains, better, faster and cheaper, the successful organizations have developed three broad strategies: (1) Companies have hired, trained and empowered employees to use information and skills so that the organization will be more knowledgeable and responsive to pressures for change, (2) many companies have chosen to collaborate more fully with key stakeholders, particularly customers, suppliers and employees to design more effective, efficient process, (3) companies have begun to better understand what creates success, however they define it and to effectively manage process to achieve success.

Recently, scholars have extended RBV to dynamic markets (Teece et al.,1997), in these markets, where the competitive environment is continuously changing the dynamic capabilities by which the firms managers integrate, build, and reconfigure internal and external competencies to address rapidly changing environments (Teece et al.,1997) become the source of sustained competitive advantage.

While extreme forms of dynamic competition (termed "hypercompetition" by D'Aveni 1994) are characteristic of product markets, dynamically competitive conditions also are present in the markets for resources. Indeed, competitive conditions in product markets are driven, in part, by the conditions of competition in the markets for resources (Barney 1986).

2. The performance measurement

With performance measurement an organization can monitor the implementation of its plans and determine when plans are unsuccessful and how to improve them. According to Atkinson et al., (1997) the performance measurement system must do four things: (1) Help the company evaluate whether it is receiving the expected contribution from employees and suppliers, the elements of its internal group and the expected returns from customer group; (2) Help the company evaluate whether it is giving each stakeholder group what it needs to continue to contribute so the company can meet its primary objectives; (3) Guide the design and implementation of process that contribute to the companies secondary objectives; (4) Help the company evaluate its planning and he contracts, both implicit and explicit that it has negotiated with its stakeholders by helping it evaluate the effect of secondary objectives on its primary objectives.

Reilly & Reilly (2000) identifies a role of characteristics that managers would like to see in a measurement system: (1) The system should ensure that value is created for the stakeholders and help managers in their decision making by giving insight into future outcomes; (2) Measurements should be systematic; (3) Measurements should help the company accomplishment a strategy by tracking its activities; (4) A measure should be logical and express what stakeholders want delivered; (5) The number of measurements within the organization should be limited by including only those that are most important; (6) Measurement standards should take into consideration what is going on in the rest of the industry; (7) A measurement system should inspire users to understand the system and create a culture that understands the power of the information that measurements provide. Results should be openly communicated and the system should be easy for everyone to use.

Ittner & Larcker (2003) highlights the mistakes that companies make when trying to measure nonfinancial performance: (1) Not linking measures to strategy – A major challenges for companies is determining which nonfinancial measures to track; (2) Not validating the links - Not validating the model leads to measuring too many things, and areas of performance that don't have much effect on what really matters; (3) Setting the right performance targets - Outstanding nonfinancial performance does not always translate into outstanding financial performance; (4) Measuring incorrectly - Researches also indicated that 70% of the companies used metrics that lacked statistical validity.

Once a performance measurement system has been developed it has to be implemented. This system will have to interact with two fundamental environments: (1) Internal – The organization; (2) External – The market where the organization competes that includes two distinct elements, customers and competitors (Neely et al., 2003).

According to Atkinson et al., (1997) most companies use formal performance measurements systems that are extensions of their financial reporting systems and they justify this practice because the financial reporting system provides measures that are generally regarded as reliable and consistent and connected with the primary objective of creating profits for the shareholders. The traditional financial accounting measures can give misleading signals for continuous improvement and innovation, and are out of step with the skills and competencies needed by today´s organizations (Maltz et al., 2003). Measurement has been recognized as a crucial element to improve business performance (Sharma et al., 2005).

3. Limitations of the traditional frameworks

Increasing turbulence of the external business environment has focused attention upon resources and organizational capabilities as the principal source of sustainable competitive advantage and the foundation for strategy formulation (Grant, 1996).

A business manager should be able to analyze the environment to profit the opportunities or face the threats. Organizations need to build strength and fight their weakness available in the business environment.

The Balanced Scorecard (BSC) is one of the most popular frameworks with a wide usage and is known as a multi-dimensional approach to performance measurement and management that is linked specifically to organizational strategy. The BSC suggests that as well as financial measures of performance, attention should be paid to the requirements of customers, business processes and longer-term sustainability. Thus four areas of performance are defined now labelled as financial, customer, internal business and innovation and learning and it is suggested that up to four measures of performance should be developed in each area.

The "balance" of the scorecard is reflected by the balance between lagging (outcome measures) and leading (performance drivers) indicators, and between financial and nonfinancial measures (De Haas, 2000). A major strength of the Balanced Scorecard approach is the emphasis it places on linking performance measures with business unit strategy (Otley, 1999). According to Neely (1998), one of the hidden strengths of a balanced measurement framework is that it forces management teams to explore the beliefs and assumptions, which underpin their strategy.

In spite of its worldwide dissemination, the BSC has demonstrated inadequacy in certain circumstances. Interestingly, some of the advantages of the BSC can also be interpreted as disadvantages. Atkinson et al., (1997) note BSC model incomplete because fails to: (1) Adequately highlight the contributions that the employees and suppliers make to help the company achieve its objectives; (2) identify the role of the community in defining the environment within which the company works; (3) identify performance measures to assess stakeholders contributions. Smith (1998) note that the BSC fails to account for the role of employees motivation and finally while BSC provides constructs for multiple measures and overcoming the limitations of single measures, there is no clear provision for very long-term measures; the distinctions between means and ends is not well define, and the model probably needs additional empirical validation (Maltz et al., 2003).

The BSC does not define appropriate balance, particularly in terms of stakeholder value. In addition, a BSC designed around a company's strategy is not necessarily complete, and the linkages among measurements and between perspectives are not explicit (Reilly & Reilly, 2000). The BSC contains a serious flaw because if a manager were to introduce a set of measures based solely on it, he would not be able to answer one of the most fundamental questions of all – what are our competitors doing (the competitor perspective)? (Neely and Kennerley, 2003).

According to Voelpel (2005), the BSC when applied in the new economy displays significant limitations in dealing with new rapidly changing and networked corporate environment. BSC has been very much engaged in improving measurable performance in order to optimize operational efficiency (Roos et al., 1997; Bontis et al., 1999; Russ, 2001). The BSC follows this logic of seeking efficiency and enables organizations to react to changes by aligning business processes to a defined strategy what causes severe damage to the firm in the innovation economy. Voelpel (2005) identifies on BSC five major problems categories that could endanger the organizations survival: (1) The BSC is a measurement tool that is relatively rigid; it tends to force indicators into one of the four perspectives; (2) The BSC creates a static organization that tends to struggle with the challenges of a highly competitive and changing business world; (3) The external innovative connectivity of an organization is difficult by BSC, which proves to be mostly an internal document thereby depicting a critical limitation in its ability to account for the external environment and systematic linkages; (4) The BSC’s inability to deal with knowledge creation, learning and growth, the BSC follows the traditional logic of innovation, working internally, keeping secret from the external environment; (5) The BSC has a linear thinking with no room available for understanding more complex business processes.

4. Balanced scorecard limitations

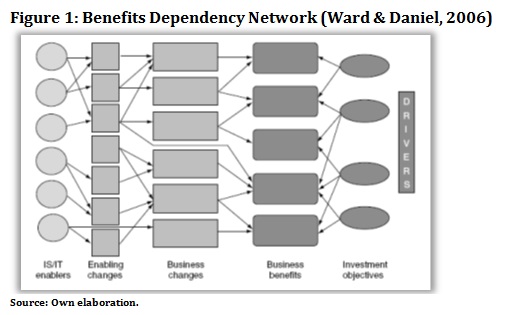

Using the five major problems categories identified by Voelpel (2005) we suggest that a Benefits Management (BM) approach could help BSC to achieve the benefits related with investments in a logical complementary.

The purpose of the benefits management process is to improve the identification of achievable benefits and to ensure that decisions and actions taken over the life of the investment lead to realizing all the feasible benefits (Ward & Daniel, 2006). But, perhaps more importantly, the approach and the associated tools and techniques change the nature of the involvement of business managers and other stakeholders in the management of the investment throughout its lifecycle.

(a) Rigidity – The BSC tends to force indicators into one of the four perspectives it limits the view on the company, since it leaves little room for cross-perspectives that might have a simultaneous impact on the company. Those that do not fit or cannot be categorized within the given framework of the four dimensions are in danger of being neglected. BSC might not only enhance a confirmation bias, enabling managers only to see what they want to see (or measure), but it ignores the changing nature of today’s business environment.

The BSC concept provides no mechanism for maintaining the relevance of defined measures (Hudson et al., 2001). Neely et al., (1995) also found that the problem for managers is usually not identifying what could be measured, but reducing the list of possible measures to a manageable (and relevant) set. Platts and Kim (2002) agree that simply looking at different measures simultaneously is not enough. The linkages between them must also be understood. Mooraj et al., (1999) state that the BSC fails to identify performance measurement as a two-way process. It focuses primarily on top-down performance measurement. Hudson et al., (2001) also acknowledge this and write that BSCs have a lack of integration between the top-level, strategic scorecard, and operational-level measures.

(b) Immobility - The BSC creates statics organizations that tend to struggle with the challenges of a highly competitive and changing business world (Voelpel, 2005). Within the BSC approach, a centrally defined strategy is translated into certain measures that align all company activities to achieving these BSC goals. This increases and possibly maximizes the focus on the given goal, but limits any further activities and initiatives that might go beyond the originally set targets (Voelpel, 2005). In such an aligned organization, employees, for instance, might have a clear perception of their job, the achievements of BSC metrics, but they will only do little more than achieving just these (Falk and Kosfeld, 2004).

(c) Inadequacy to external innovative connectivity - The BSC is a management and measurement tool that is primarily focus is in driving performance and translating strategy into action promoting the organizational efficiency. The BSC ignores the needs of linking the organization to innovative enhanced economy where the companies evolve, establish partnerships, and compete, developing the products and services to answer to the market needs. Mooraj et al., (1999) note that the BSC does not consider the extended value chain in which employee and supplier contributions are highlighted. The BSC may be too narrowly defined. Business is more and more based on networks of firms or so called business ecosystems in which successful firms collaborate within their network and thereby improve their own performance significantly (Iansiti & Levien, 2004). Since today’s business operations are not carried out anymore in isolation until the final product is delivered, but accompanied closely by stakeholder interaction, so the BSC approaches should consider these networks both competitive and collaborative. The BSC is based on the view of the firm in relative isolation and adversarial in relationships with suppliers. Such limitations with regard to a systemic systems orientation become more pronounced, the more a company has to deal with rapid and disruptive change as well as a networked environment such as in today’s business world (Voelpel, 2005).

(d) Dealing with knowledge creation, learning and growth - The BSC follows the traditional logic of innovation through internal developments, which work on an innovation from its beginning to its end, keeping it secret from the external environment and especially from competitors. The nature of innovation is similarly changing from incremental towards more and more dynamic, from closed to open, meanwhile becoming increasingly networked. In contrast to the BSC internally focused learning and growth perspective the organizations should acknowledges the potential of the entire system. It needs to become a cross-section through all business areas that transcends the traditional internal innovations focus. Innovation, a key factor to intellectual capital (IC) is viewed by the BSC as an internal business process and categorized under this perspective, appearing to be a routine process rather than a creative endeavour by skilled employees all over the company. Knowledge, learning and growth have become essential and good measurement systems need to acknowledge that innovation has to be practiced in all business areas.

The difficulty, which is not limited to the BSC only, is to measure such distributed innovation (Voelpel, 2005).

(e) Linear thinking - As business processes become more complex, the understanding of most of the key success factors within a firm, especially today, needs to take a cross-perspective into account. Simple cause-and-effect relationships are not sufficient anymore to understand complex relationships that the BSC tries to reduce to a linear one-way relationship. Customer satisfaction for instance might be linked to various factors such as employee satisfaction, quality, delivery time, and so on. The problem of how to link the indicators of the BSC is still unsolved (Andréasson and Svartling, 1999).

The predominant mindset connected to the application of the BSC is that of a mechanistic and linear thinking, making it difficult to deal with an interconnected and networked world (Voelpel, 2005).

5. Benefits management

Tracking the markets and the competitors often, making the changes and redefining the performance measures should be the role of any organization operating in a dynamic environment. Analysing and choosing the right drivers that will be the input to the business case for investments that lead to changes on the ways of the work is done. The majority of value from investments comes from the business changes that it enables the organization to make: (1) Adoption of new or redefined processes (2) New roles and responsibilities. (3) Operation of new teams, groups, divisions. (4) New governance arrangements. (5) Use of new measures and metrics (6) Use of new appraisal and reward schemes. (6) New practices for managing and sharing information.

The investment is in enabled change, not just technology, to achieve improvements in business and organizational performance through better processes, relationships and ways of working. The achievement of benefits obviously depends on effective implementation of the technology, but evidence from project success and failure suggests that it is organizations inability to accommodate and exploit the capabilities of the technology that causes the poor return from many investments. While business changes may be considered as the way the organization wishes to work ‘for ever more’, it is recognized that the organization will be undertaking other investments and changes (Ward & Daniel, 2006).

The benefits management helps the BSC on the (a) rigidity and (b) immobility problems because BM answers continuously to the market requests through the business drivers and agreeing with all the stakeholders on the goals and benefits of the investments building a cause-and-effect network that highlights all the changes needed on the business. This network show how the goals and benefits were reached putting on the stakeholders the responsibility of tracking and achieving the goals and benefits. Since the objectives are phrased in terms of targets for achievement wanted from the investment, the benefits can be identified by considering the performance improvements that will be realised if each of these objectives or targets is achieved. The performance indicators follow all benefits and business changes and give a full perspective how the investments were tracking and accomplish. Further benefits identified were analysed and prosecuted.

The benefits management approach encourages a range of staff to work together because no single individual or group has all the knowledge necessary to identify all the benefits, changes and IT enablers.

(c) The linking BSC to the external innovation environment could improve keeping a open mindset to the markets, competitors, and rapidly reacting to all the situations that generates disadvantage to the organization introducing new ways of doing the work powered by the IS/IT investments, “upgrading” constantly the resources. The BM approaches through the benefits dependency network, draw on a map all the objectives, benefits and changes needed from the business drivers and the path to reach them, setting responsibilities, targets and performance measures.

(d) (e) In dynamic environments is crucial a close market survey in order to observe the way how consumers, competitors and suppliers are touched by the different factors that shape the business. The benefits management enhance the discussion and the agreement around the business objectives and related benefits answering to external and internal drivers.

The BSC is grounded in a mechanistic mindset. Business processes become more complex, the understanding of most of the key success factors within a firm, especially today. In a knowledge driven company, simple cause effect relationships are not sufficient anymore to understand complex relationships that the BSC tries to reduce to a linear one-way relationship.

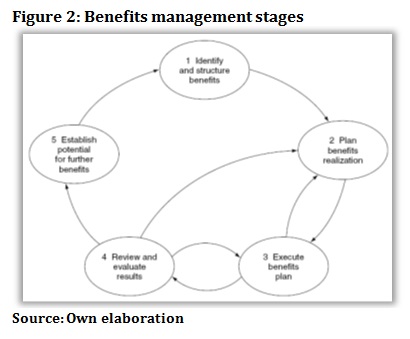

The BSC discipline through the performance measures applied to all organization tasks causes a total focus on the measures accomplishment that leads to successful achievement of the priority objectives, therefore, no room left for other initiatives besides the pre-defined ones. The benefits management consider five stages: (1) Identifying and structuring benefits – For each proposed benefit suitable business measures are developed and they are structured in order to understand the linkages between technology effects, business changes and business objectives. (2) Planning benefits realisation – For each benefit, specific responsibility for realising the benefit is allocated within the business. (3) Executing the benefits realisation plan – Carrying out the necessary business changes detailed in the benefits realisation plan. (4) Evaluating and reviewing results – Review provides an explicit tool for evaluating whether the proposed business benefits have actually been delivered. (5) Potential for further benefits - As a result of the post-project review, it may become apparent that further benefits are now achievable.

The benefits management process includes a post-implementation benefits review as an important component of the project. This review should not concentrate on the use of technology or on the project management, rather technology and project audits should be carried out separately. Instead, the benefits review should explore which of the planned benefits have been realized, whether there were any unexpected benefits arising and which planned benefits are still expected but may need additional attention to ensure they are realized. Actions should then be put in place to ensure that these benefits are realized.

6. Case study

The VIAPAV investment was a result of a disruptive solution on the products line of the company’s portfolio. The organizations BSC shows the inability to deal with these disruptive solutions once the system are extremely focused on implementing the organization strategy in a top-down way, rejecting all new activities or initiatives. The system revealed incapacity to deal and to build a logical cross-perspective in a cause-and-effect process that improved the flexibility and create a set of system indicators that track the development of the investment.

Building the BDN of VIAPAV case study investment (Gomes, 2011) shown on Figure 3 and Figure 4, highlights that the objectives and the related benefits were achieved by the combination of the business changes (T1 to T4) powered by the enabling changes (F1 to F6) and IS/IT enablers (I1 to I4).

Figure 3

Figure 4

These frameworks shows in a simple way the cause-and-effect actions to fulfil the end goals.

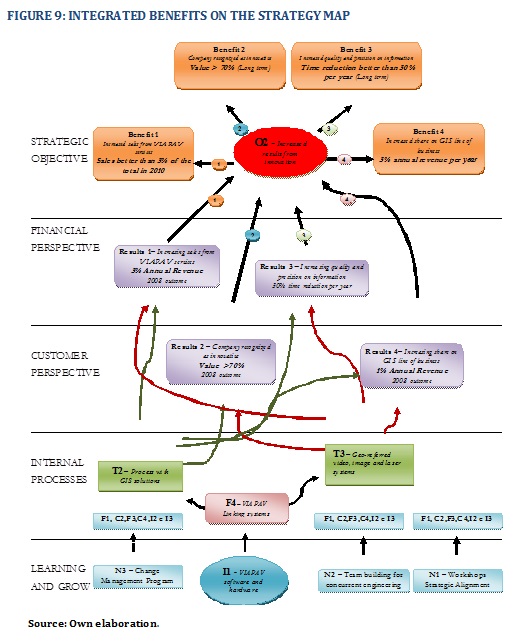

Following the O2 objective we are able to build a specific stream that shows how the increased results from innovation were reached (Figure 5).

Figure 5

In this first stage the organization have chosen the investments to perform, identified the business objectives (short-term) and benefits (long-term) to be realized through the business changes enabled by IS/IT investments. The linkage to the strategic objectives (BSC) should be supported on the business case. The business case includes the benefits realization plan with the routes to objectives mapped, the responsible nominations and the established metrics and targets. In the customer perspective of the BSC, managers identify the customers and the market segment in which the business will compete.

The customer perspective enclosed several generic outcomes including, customer satisfaction, customer retention, new

customer acquisition, customer profitability, market and account share and so on. The core of the business strategy is the customer value proposition which describes the unique set of products and service attributes, customer relations and corporate image. The value proposition defines how the organization differentiates itself from competitors and helps the organization to connect its internal processes to improved outcomes with its customers.

Figure 6 shows how the benefits were linked to the financial and customer perspective with the responsible for the achievement and short and long-term targets.

Figure 6

The internal process and learning and growth perspectives are located in an area where the benefits are more intangible. These two perspectives are directly linked to the enabling changes and business changes from the BM model.

In this approach business changes has been described as new ways of working that will be required by the organization in the near future. The changes include a wide range of different types, for instance: new processes, new roles or responsibilities, new governance, new measures and metrics, new practices for managing and sharing information.

There is also a wide range of enabling changes that may be required in order to ensure that the business changes really occur and promote the realization of the identified benefits. These enabling changes are only required to be undertaken once and may be necessary to allow the business changes.

Enabling changes required were the following ones: training in how to use the new system and technologies, education in how the new systems can improve the performance, mapping of current processes and the design of new processes, definition of new roles, job descriptions, responsibilities and organizational structures, establishment of rules and practices, definition of new application and information governance structures.

The internal process reminds us that the organizational background activity is driven by objectives and goals to ensure that the customer and financial objectives are achieved. Once an organization has a clear picture of its customer and financial perspectives it can then determine the means by which it will achieve the differentiated value proposition for customers and the productivity improvements, the business changes, to reach the objectives and realize de business benefits.

The foundation of any strategy map is the learning and growth perspective, which defines the core competencies and skills, the technologies and the corporate culture. These topics enable the organization to align its human resources and information technology with its strategy.

Figure 7 depicts how the business changes and IS/IT enablers were linked to the internal process and learned and growth perspectives with the responsible for the achievement and the target.

Figure 7

7. Benefits achievement

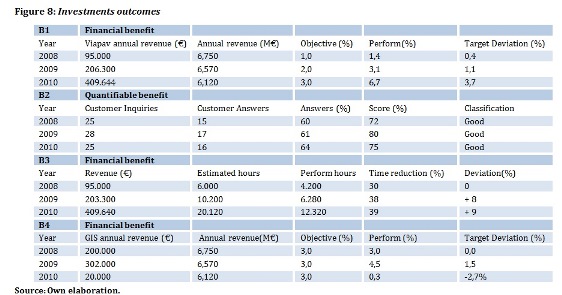

Figure 8 shows the project outcomes (2008) and also highlights the benefits tracked annually for the years 2009-2010. The expected benefits were achieved on different levels of realization.

· B1 and B3 have exceeded expectations.

· B1 weighted, in 2010, 7% of the company’s total income.

· B3 has reduced the performed hours in almost 40%.

· B2 reached good reviews from inquiries, but the organization will continue investing on a closer customer relationship.

· After a good start (2008-2009), B4 dropped dramatically, mainly due to lack of private and government investments following the deep crisis in euro zone. Exporting this type of technologies and services will be the solution in the near future.

Integration of the Benefits Dependency Network on the BSC Strategic Map is shown on the Figure 9 .

8. Conclusions

Given the dynamic and rapidly changing environment in which the organizations compete, it is important that organisations effectively manage their outcomes from investments. To achieve that they have to continuously improve their measurement systems so that it remains appropriate and aligned with their strategies.

Although an increasing number of companies have been using non financial performance measurements in areas such as customer loyalty and employee satisfaction, few have realized the potential benefits of these relatively new measurement systems.

We claim that the integration of the Balanced Scorecard and the Benefits Management approach can increase the effectiveness of the strategic projects portfolio and improve the confidence of business sponsors that their investments in projects will return benefits that they perceived to be of value.

Our case study provides an example on how Benefits Management can help Balanced Scorecard with a continuous market follow up and a client intimacy management strategy. Using a Benefits Management approach we have shown how to collect the business drivers, discuss with all the relevant stakeholders, agree on the objectives and the benefits, as well as on on the organizational changes and on the right set of IS/IT enablers.

Benefits Management adds value providing relevant information to the strategic framework of the BSC, by identifying the goals and the benefits and by mapping the way to get them, supported on the right combination of organizational changes, enabling factors and IS/IT enablers.

Benefits Management considers both short and long term business benefits. Short term benefits are more likely to be realised, and give the stakeholders an idea on if and how the program is going to achieve its goals. Long term benefits may not appear until long after the program has closed and may generate less commitment and enthusiasm.

The authors claim that Benefits Management provides a richer and more useful decision support and monitoring tool, making the strategy implementation visible, testable and measurable.

Developing a Benefits Dependency Network results in a clear statement of the benefits from an investment, the activities and the IT capabilities required to achieve those benefits. A complete Benefits Dependency Network also shows how different groups need to work together to achieve the desired benefits.

Benefits Management not only increases the value of investment but also avoids spending money on projects that would not have delivered benefits, increasing greatly the likelihood of the benefits expected from the investment being realized.

References

Amit, R., & Schoemaker, P.J.H. (1993). Strategic assets and organizational rent. Strategic Management Journal, 14(1), 33-46. [ Links ]

Andréasson, M., & Svartling, A. (1999). The balanced scorecard: A tool for managing knowledge? Retrieved June 7, 2012, from https://gupea.ub.gu.se/bitstream/2077/2476/1/Andreasson_1999_7.pdf. [ Links ]

Andrews. K.R. (1971). The concept of corporate strategy. Homewood: Dow Jones-Irwin. [ Links ]

Ansoff, H.I. (1965). Corporate strategy. New York: McGraw Hill. [ Links ]

Atkinson, A., Waterhouse, J., & Wells, R., (1997). A stakeholder approach to strategic performance measurement. Sloan Management Review, 38(3), 25-37. [ Links ]

Barney, J. (1991). Firm resources and sustained competitive advantage. Journal of Management, 17(1), 99–120. [ Links ]

Barney, J. (1986). Strategic factor markets: Expectations, luck and business strategy. Management Science, 32, 1231-1241. [ Links ]

Beer, M. (2002). Building organizational fitness. In S. Chowdhury (Ed.), Organizations 21C (pp. 311-330). New Jersey: Financial Times Prentice Hall. [ Links ]

Bontis, N., Dragonetti, N.C., Jacobsen, K., & Roos, G. (1999). The knowledge toolbox: A review of the tools available to measure and manage intangible resources. European Management Journal, 17(4), 391-403. [ Links ]

Conner, K.R., & Prahalad C.K. (1996). A resource-based theory of the firm: Knowledge versus opportunism. Organization Science, 7(5), 477–501. [ Links ]

Eisenhart, K.M., & Martin, J.A. (2000). Dynamic capabilities: What they are? Strategic Management Journal, 21, 1105-1211. [ Links ]

D’aveni, R. (1994). Hypercompetition: Managing the dynamics of strategic manoeuvring. New York: The Free Press. [ Links ]

De Haas, M. (2000). Strategic dialogue: In search of goal coherence. (Doctoral dissertation, Eindhoven University of Technology, 2000). Retrieved Mai 12, 2012, from http://alexandria.tue.nl/extra2/200011691.pdf. [ Links ]

Falk, A., & Kosfeld, M. (2004). Distrust: The hidden cost of control. Retrieved June 8, 2012, from http://ssrn.com/abstract=590102. [ Links ]

Gomes, J. (2011). Gestão de benefícios numa empresa de Geoengenharia. Master thesis, ISCTE). Retrieved June 12, 2012, from https://repositorio.iscte.pt/handle/10071/4702. [ Links ]

Grant R.M. (1996). Toward a knowledge-based theory of the firm. Strategic Management Journal, 17, 109-122. [ Links ]

Grant, R.B. (1991). A resource based theory of competitive advantage: Implications for strategy formulation. California Management Review, 33, 114-135. [ Links ]

Henderson, R., & Cockburn, I. (1994). Measuring competence? Exploring firm effects in pharmaceutical research. Strategic Management Journal, 15, 63-84. [ Links ]

Hofer, C.W., & Schendel, D. (1978). Strategy formulation: Analytical concepts. St. Paul: West Publishing Company. [ Links ]

Hudson, M., Smart, A., & Bourne, M. (2001). Theory and practice in SME performance measurement systems. International Journal of Operations and Production Management, 21(8), 1096-1115. [ Links ]

Iansiti, M., & Levien, R. (2004). The keystone advantage: what the new dynamics of business ecosystems mean for strategy, innovation, and sustainability. Boston: Harvard Business School Press. [ Links ]

Irvin. R.A., & Michaels, E.G. (1989). Core skills: Doing the right things right. The McKinsey Quarterly, 4-19. [ Links ]

Ittner, C.D., & Larcker D.F. (2003). Coming up short on nonfinancial performance measurement. Harvard Business Review, 81(11), 88-95. [ Links ]

Mahoney, J.T., & Pandian, J.R., (1992). The resource-based view within the conversation of strategic management. Strategic Management Journal, 13(5), 363–380. [ Links ]

Maltz, A.C., Shenhar, A.J., & Reilly, R.R. (2003). Beyond the balanced scorecard: Refining the search for organizational success measures. Long Range Planning, 36, 187-204. [ Links ]

Mooraj, S., Oyon, D., & Hostettler, D., (1999). The balanced scorecard: A necessary good or an unnecessary evil? European Management Journal, 17(5), 481–491. [ Links ]

Neely, A., Gregory, M., & Platts, K., (1995). Performance measurement system design: A literature review and research agenda. International Journal of Operations & Production Management, 15(4), 80-116. [ Links ]

Neely, A., & Kennerley, M., (2003). Measuring performance in a changing environment. International Journal of Operations Management and Production Management, 23(2), 213-229. [ Links ]

Neely, A. (1998). Measuring business performance: Why, what and how. London: Economist Books. [ Links ]

Nelson, R. (1991). Why do firms differ, and how does it matter? Strategic Management Journal, 12, 61-74. [ Links ]

Otley, D. (1999). Performance management: a framework for management control systems research. Management Accounting Research, 10, 363–382. [ Links ]

Penrose, E.T. (1959). The theory of the growth of the firm. New York: Wiley. [ Links ]

Porter, M.E. (1992). Towards a dynamic theory of strategy. Strategic Management Journal, 12, 95-118. [ Links ]

Porter, M.E. (1991). The competitive advantage of nations. New York: Free Press. [ Links ]

Porter, M.E. (1979). How competitive forces shape strategy. Harvard Business Review 57 (2), 137–145. [ Links ]

Peteraf, M.A. (1993). The cornerstones of competitive advantage. Strategic Management Journal, 14 (3), 179–191. [ Links ]

Platts, K.W., & Tan, K.H. (2002). Designing linked performance measures – A connectance based approach. Pre-prints 12th Intern. Seminar on Production Economics, 2, 367-373. [ Links ]

Prahalad, C.K., & Hamel, G. (1990). The core competence of the corporation. Harvard Business Review, 68(3), 79-91. [ Links ]

Quinn, J.B. (1992). Intelligent Enterprise: A Knowledge and Service Based Paradigm for Industry. New York: Free Press. [ Links ]

Reilley, G., & Reilley, R., (2000). Using a measure network to understand and delivery value. Journal of Cost Management, 5-14. [ Links ]

Roos, J., Roos, G., Dragonetti, N.C., & Edvinsson, L. (1997). Intellectual capital: Navigating in the new business landscape. Houndsmills: Macmillan. [ Links ]

Rumelt, R.P. (1984). Towards a strategic theory of the firm. In R.B. Lamb (Ed.), Competitive Strategic Management (pp. 556-570). Englewood Cliffs: Prentice-Hall. [ Links ]

Russ, R. (2001). Economic value added: Theory, evidence, a missing link. Review of Business, 22(1), 66-71. [ Links ]

Sharma, M.K., Bhagwat, R., & Dangayach, G.S. (2005). Practice of performance measurement: experience from Indian SMEs. International Journal of Globalisation and Small Business, 1(2), 183-213. [ Links ]

Selznick, P. (1957). Leadership in administration: A sociological interpretation. New York: Harper and Row. [ Links ]

Smith, M. (1998). Measuring organizational effectiveness. Management Accounting, 34-36. [ Links ]

Stalk, G., Evans, P., & Shulman E. (1992). Competing on capabilities: The new rules of corporate strategy. Harvard Business Review, 57-69. [ Links ]

Teece, D.J., Pisano, G., & Shuen, A. (1997). Dynamic capabilities and strategic fit. Strategic Management Journal, 18(7), 510-533. [ Links ]

Teece, D.J. (1984). Economic analysis and strategic management. California Management Review, 26(3), 87-110. [ Links ]

Voelpel, S., Leibold, M., Eckhoff, R., & Davenport, T., (2005, July). The Tyranny of the Balanced Scorecard in the Innovation Economy. Paper presented at 4th International Critical Management Studies Conference - Intellectual Capital Stream. Cambridge University, United Kingdom. [ Links ]

Ward, J., & Daniel, E. (2006). Benefits Management, Delivering Value from IS and IT Investments. UK: John Wiley & Sons. [ Links ]

Wernerfelt, B. (1995). The resource-based view of the firm: ten years after. Strategic Management Journal, 16(3), 171-174. [ Links ]

Wernerfelt, B. (1989). From critical resources to corporate strategy. Journal of General Management, 5, 171-180. [ Links ]

Wernerfelt, B. (1984). A resource-based view of the firm. Strategic Management Journal, 5(2), 171–180. [ Links ]

Article history

Submitted: 18 June 2012

Accepted: 14 October 2012