Serviços Personalizados

Journal

Artigo

Indicadores

-

Citado por SciELO

Citado por SciELO -

Acessos

Acessos

Links relacionados

-

Similares em

SciELO

Similares em

SciELO

Compartilhar

Tourism & Management Studies

versão impressa ISSN 2182-8458versão On-line ISSN 2182-8466

TMStudies vol.14 no.3 Faro set. 2018

https://doi.org/10.18089/tms.2018.14306

MANAGEMENT: SCIENTIFIC PAPERS

Analyzing customer profitability in hotels using activity based costing

A análise da rendibilidade de clientes nos hotéis através do custeio baseado em atividades

Ana Rita Faria1, Leonor Ferreira2, Duarte Trigueiros3

1 University of Algarve, ESGHT, Campus da Penha, 8005-139 Faro, Portugal, arfaria@ualg.pt

2 Nova School of Business and Economics, Campus de Carcavelos, Rua da Holanda, 1, 2775-405 Carcavelos, Portugal, leonor.ferreira@novasbe.pt

3 ISTAR-IUL, University Institute of Lisbon, Av. Forças Armadas, 1694-026 Lisbon, Portugal, dmt@iscte-iul.pt

ABSTRACT

This paper investigates the use of customer profitability analysis (CPA) in four and five star hotels located in Algarve (Portugal). Traditional accounting systems have been criticized for focusing on product, service or department profitability, and not on customer profitability, thus failing to provide effective information to marketing-related decisions. Results are reported by operating departments, whilst marketing activities focus on customer market segments. Recognizing the growing emphasis on customer value creation, and to overcome the mismatch between the provision and use of information in hotels, CPA techniques have been suggested. Notwithstanding their benefits, namely a strategic focus, hotels still apply traditional techniques. A structured questionnaire collected through personal interviews showed that CPA is far from widespread in hotel management; instead, hotels accumulate costs in profit centers and in cost centers. None of the surveyed hotels had adopted activity based costing, despite this technique being viewed as the most appropriate to calculate individual customer profitability.

Keywords: Customer profitability analysis, market segmentation profit analysis, activity based costing, hotel sector, Algarve.

RESUMO

Este artigo investiga a análise de rendibilidade de clientes nos hotéis de quatro e cinco estrelas do Algarve (Portugal). Os sistemas de contabilidade tradicionais focalizam-se na rendibilidade dos produtos, serviços ou departamentos não fornecendo informação eficaz para decisões de marketing. Os resultados são relatados por departamentos, sendo as atividades de marketing direcionadas para segmentos de mercado. Reconhecendo o foco na criação de valor para o cliente e o “desencontro” entre fornecimento e utilização de informação nos hotéis, a literatura tem sugerido técnicas de análise de rendibilidade de clientes. Apesar dos beneficios destas técnicas, nomeadamente o foco estratégico, os hotéis utilizam técnicas tradicionais. Um questionário estruturado recolhido presencialmente revelou que a técnica CPA está pouco difundida no setor; os hotéis acumulam custos por centros de resultados e por centros de custos. Nenhum adopta o custeio baseado nas actividades, embora seja o método mais apropriado para atribuir custos a clientes.

Palavras-chave: Análise de rendibilidade de clientes, análise da rendibilidade dos segmentos de mercado, custeio baseado em atividades, setor hoteleiro, Algarve.

1. Introduction

In the dynamic, complex and highly competitive business environment where hotels operate, customer satisfaction is of paramount importance. The features displayed by the hotel industry require a market orientation, given the intangible nature of the “product”, labor and capital intensity, high fixed-cost structure and erratic demand for perishable products and services. To achive this, effective marketing decisions have to be made (Downie, 1995; 1997). Marketing traditionally focused on revenues and attracting customers, but the marketing emphasis has shifted from revenues to profits and its pivotal purpose is the attraction and retention of profitable customers (Foster & Gupta, 1994). Nowadays, measuring and managing customer profitability is essential to improve profitability (Cardos & Cardos, 2014) and enhancing the profitability of customers is crucial to sustain long-term growth for the company and for its stockholders (Krakhmal, 2006). This triggers the need for better and improved management accounting systems that systematically track customer-related information and requires the use of innovative managerial accounting tools, such as Customer Profitability Analysis (CPA).

CPA is a contemporary management accounting technique that adopts the customer as the unit of analysis, providing information to manage the customer mix from a profit perspective (Noone & Griffin, 1998). The technique is based on the premise that customers differ in profitability. Most of the sales are generated by 20 per cent of the customers, while 20 per cent of the most profitable customers provide 150 to 300 per cent of total profits (Kaplan & Narayanan, 2001). CPA calculates the profit generated by each individual customer or customer group. The technique highlights strong profit contributors, enabling managers to develop product and marketing strategies towards the most profitable customers and away from the unprofitable ones (Noone & Griffin, 1998). The goal of a hotel should be to retain current profitable customers and to attract more and more profitable customers; however, the conversion of unprofitable customers into profitable ones should not be neglected, as it requires fewer resources than raising new profitable customers (Krakhmal, 2006).

Customer profitability analysis and customer segment profitability analysis are two ways of measuring customer profitability. Unprofitable customers can become profitable when an extended time horizon is assumed. This may justify using lifetime customer profitability analysis (Foster & Gupta, 1994), a technique that identifies customer profitability for the lifetime of customer relations, taking into account future revenues and costs (Cardos & Cardos, 2014). Guilding, Kennedy and McManus (2001) extended the boundaries of customer accounting, exploring the potential of applying novel customer accounting techniques, such as supplementary purchasing CPA and customer asset accounting, to hotel management. Supplementary purchasing CPA aims at segmenting customers according to diverse consumption patterns (i.e., purchase of hotel’s services following rooms). Customer asset accounting views customers as assets and uses the present value as the basis for their valuation. This complex calculation requires the estimation of customer cash flows, time horizon of customer relationship and cost of capital rate (Cardos & Cardos, 2014).

Hotel accounting systems have failed to provide information on the profits generated by different customers or market segments. They are often based on the Uniform System of Accounts for the Lodging Industry (USALI), an accounting standard developed specifically for the hotel industry in the USA, back in 1926, and currently in its 11th edition (HANYC, 2014). The USALI reports results by department, in line with the traditional organizational structure found in most hotels (Chin, Barney, & O’Sullivan, 1995; Krakhmal, 2006). It is “based on departmental accounting principles, reflecting the fact that rooms, food and beverage, and other services are produced in departments rather than in production lines, as in the case of manufactured products” (Harris & Brown, 1998:163). More than ninety years after its first edition, and despite the recognition that hotels are essentially market-oriented businesses, its major principles and original concept, based on traditional cost-oriented accounting methods, remain the same. Although it is not mandatory, the USALI has become the industry standard, mainly in large hotel groups and international chains (Chin et al., 1995; Harris & Brown, 1998). The expansion of US hotel chains internationally contributed to its popularity (Chin et al., 1995). Data collection companies require the use of the USALI to set industry norms that enable benchmarking. In addition, the USALI is the source of terminology most used in management contracts (Field, 1995).

However, it is argued that the information produced according to the USALI does not effectively support marketing decisions. In fact, the USALI’s major goal is to provide standardized financial information that assists in the evaluation of the performance of individual lodging properties. It is not a control instrument nor is it a basis for room pricing and other marketing decisions (Karadag & Kim, 2006). Marketeers are planning and working with market segments (e.g. business, leisure or conference guests) while accountants are reporting by operating department, thus a “mismatch between the use and provision of information for planning and control activities in hotels” exists (Downie, 1995:214). The management literature suggests techniques to improve the current information and consequently decision making in hotels. Such techniques report profit by customer or by market segment, and use the Activity Based Costing (ABC) system to assign costs to customers.

This study aims at understanding how Customer Profitability Analysis can be applied in a hotel environment and how hotels located in the Algarve, the main Portuguese tourist region, use this technique. The paper also contributes to enhance the knowledge about the use of the ABC method, regarded as a prerequisite for using CPA techniques.

The paper is organized as follows. Section 2 reviews the literature, focusing on the relevance and applicability of CPA and on the potential of ABC for cost allocation when the customer is the unit of analysis. The section also reviews studies on the use of such techniques in the hotel sector. Section 3 describes the methodology used in the research. Section 4 presents and discusses results. Section 5 summarizes the conclusions and introduces some suggestions for future research.

2. Literature review

Relevance and applicability of CPA in hotels

The relevance of analyzing customer profitability in service industries has been stressed by several authors. Kaplan and Narayanan (2001) suggest that CPA is particularly useful in companies that offer a complete range of services to differentiated customer groups. In the lodging industry, information generated by CPA should prevail upon product or department profitability, since customer´s behavior generally induces the costs of providing a service. For Krakhmal (2006), the more a company is customer- driven and service-oriented, the more labour, capital and time it dedicates to its customer base, the more useful CPA will be. Customer profitability should be performed regularly and included in current management reports.

Various authors argue that accounting systems in hotels provide information that, though useful to evaluate profitability by department and the overall operation profitability, does not address the costs to serve specific customer groups or the profit margins related to different market segments (vd. Downie, 1995, 1997; Dunn & Brooks, 1990; Nordling & Wheeler, 1992; Karadag & Kim, 2006; Krakhmal, 2006). According to Karadag and Kim (2006), to effectively support marketing decisions and to assist managers in devising marketing policies that increase the profitability of specific customers or customer groups, financial reporting should parallel the way the hotel maps its market. For Downie (1995), the use of market segmentation profit analysis (MSPA) may enhance the accounting input for marketing decisions in hotels, maximizing profit on the long run, and combining accounting and marketing activities. Karadag and Kim (2006) maintain that MSPA or CPA techniques respond to questions that cannot be directly answered from the lodging industry’s current systems. Specifically, how much to spend to atract specific market segments (marketing-resource- allocation), how to price rooms to each market segment at distinctive periods (pricing decisions), how many rooms allocate to each market segment in critical periods (customer mix priority decisions), how much revenue different market segments generate in products and services rather than rooms (revenue-contribution decisions), and finally, which is the relative profitability of each market segment (profitability- evaluation decisions). The authors also highlight the benefits of CPA regarding performance evaluation, namely for non- revenue-generating departments, such as the marketing department, to be accountable also for the business profits. As marketing managers may influence hotel revenues through marketing programs, it is not fair to blaim only the heads of revenue-generating departments when they do not fully control the methods used to improve revenue.

Dunn and Brooks (1990) initiated market-segment profit analysis in the hotel management literature. They proposed a model that relates marketing and financial goals, reporting revenues, expenses and profit margins by market segment, thus allowing hotel managers to take decisions based on profit maximization instead of sales maximization. Originally, this framework identifies the target market segments for profit measurement; next, it reports revenues by market segment, and, finally, it allocates overhead costs to market segments according to the functional relationships (cost drivers) between cost centers and market segments. For Dunn and Brooks (1990:82), “the key to market-segment profit reporting is the assessment of costs incurred to support the sales to each market segment”. The authors highlight the potential of ABC in this analysis. This approach, initially regarded as a more accurate way of calculating product costs (Cooper & Kaplan, 1991), has been suggested as the most appropriate and effective method to allocate costs to customers/market segments (Noone & Griffin, 1997, 1998, 1999; Downie, 1995, 1997; Karadag & Kim, 2006;Krakhmal, 2006; Cardos & Cardos, 2014).

Measuring Customer Profitability with Activity Based CostingDespite early references to CPA in the beginning of the 1960’s, it was only with the growth of activity-based costing in the late 1980’s, that attention was accorded to the subject (Guilding et al., 2001).

ABC focuses on activities as the main cost objects. Activities costs are then allocated to other cost objects, such as products, services, customers, distribution channels, and others vital to the company’s profitability (Foster & Gupta, 1994). One of the major perceived benefits of ABC adoption is the more accurate cost information for product costing (Cooper & Kaplan, 1991; Cohen, Venieris & Kaimenaki, 2005). However, ABC can serve other purposes, including cost reduction and management, cost modeling, product/service pricing, performance evaluation/improvement, budgeting and customer profitability analysis. The benefits of using ABC when customers are the unit of analysis have been highlighted. According to Cooper and Kaplan (1991), by revealing the linkages between the activities performed in the organization and the demand for organizational resources, ABC provides managers with a clearer idea of how customers generate revenues and use resources.

The emphasis on activities potentially improves customer service, a key element in the hospitality industry, and assists management in decreasing activities that cost more than they add in value, reducing unnecessary service delays or repetitions. This way, managers can achieve profit maximization, and still maintain or improve customer service quality and market share (Krakhmal, 2006). Noone and Griffin (1997, 1998) argue that ABC is the most effective and appropriate costing method to perform customer profitability analysis in hotels, since their characteristics resemble those of other service industries where ABC has been fruitfully applied.

Service companies are ideal candidates to adopt ABC due to their cost structures. Companies with overhead costs representing over fifteen per cent of total costs would benefit from ABC adoption (Vokurka & Lummus, 2001). Hotels have high indirect costs and a large fixed cost component (Brignall, Fitzgerald, Johnston & Silvestro, 1991; Pavlatos & Paggios, 2007; Zounta & Bekiaris, 2009). Thus, the cost structure of hotels indicates that the more accurate costing provided by ABC would be beneficial.

The implementation of CPA in a hotel requires, however, an adjustment in customary accounting approaches to revenue and cost allocation. This implies moving away from the traditional recording of revenues and expenses by operating departments (e.g., Rooms, Food and Beverage) and by service departments (e.g., Administrative and General, Information and Telecommunication Systems, Sales and Marketing, Property Operation and Maintenance, Utilities), as set in the USALI (HANYC, 2014), towards their identification by customer group.

Traditional accounting systems break down revenues by operating departments, while CPA requires the identification of revenues by market segments. The number of segments may vary depending on the hotel size or the emphasis of the marketing department (Dunn & Brooks, 1990). The more complex the unit is, in terms of market segments and the vitality of local competition, the more valuable the model will be (Nordling & Wheeler, 1992). The customer groups and the preliminary information on revenues required by CPA can be drawn from the property management system or from the yield management (YM) system [YM is a tool that aims to maximize revenue, charging higher rates and avoiding discounts when demand is high, and increasing occupancy through rate reduction, when demand is low (Downie, 1995)]. Alternatively, data may be obtained from the departmental reports. For the purpose of CPA, it may even be necessary to further segment these groupings (Noone & Griffin, 1998).

Cost distribution differs significantilly in the two approaches. Traditional systems allocate direct costs to the related departments, while indiret costs (overheads) are grouped in the service departments where they have arisen, and they are not distributed. In market segment accounting, costs are not categorized as direct or indirect. Instead, all costs to serve customers, except those that are non-attributable, are assigned to the related market segments as cost of revenue or cost to serve (Karadag & Kim, 2006). The small number of costs that can not be allocated to customers due to the absence of a cause and effect relationship (for example, auditing costs) should not be included in the customer profitability calculation; hence, these costs should be covered by the operational margin (Noone & Griffin, 1998; Krakhmal, 2006).

Activity accounting is built in the principle that costumers consume activities, while activities consume resources (Krakhmal, 2006). So, first, expenses recorded by the financial system in cost centers (operating departments and overhead categories) are distributed to the so-called “activity centers”. These represent the functional costs of providing services to customers (e.g., administration, banqueting, check-in and check-out, housekeeping, marketing, rooms, reservations, restaurant). Then, ativity center costs are assigned to the appropriate customers/market segments. ABC assumes cost drivers are identified in each stage, according to the functional relationships between the cost centers, the activity centers and the market segments. The cost drivers are basically the calculations for distributing costs in each of these stages. “First- stage drivers” reflect functional linkages between cost centers and activity centers; “second-stage drivers” represent the functional linkages between activity centers and market segments (Dunn & Brooks, 1990).

ABC superiority in relation to traditional costing systems has been asserted. In a limited setting (department, plant or location), the approach worked well and has helped many companies “to identify cost-and profit-enhancement opportunities through the repricing of unprofitable customer relationships, process improvements on the shop floor, lower-cost product designs, and rationalized product variety” (Kaplan & Anderson, 2004:132). However, large-scale ABC implementation and maintenance was time consuming, due to the need to interview and survey staff to obtain their time allocations to multiple activities, and costly, because of the need for constant update. This, associated with the traditional ABC failure to capture the complexity of operations, represented a major barrier to ABC widespread adoption (Kaplan & Anderson, 2004). To overcome ABC limitations, a new approach called Time-driven activity-based costing (TDABC), that uses time as the primary cost driver, emerged. In the new ABC resources are directly assigned to cost objects using estimates of simply two parameters: (i) the cost per time unit of supplying resource capacity; (ii) unit times of consumption of resource capacity by products, services, and customers (Kaplan & Anderson, 2004; Siguenza-Guzman, Abbeele, Vandewalle, Verhaaren & Cattrysse, 2013). Recent case studies demonstrate that TDABC is applicable in services businesses, particularly in hotels, and is suitable to analyze customer profitability (Dalci, Tanis & Kosan, 2010; Hajiha & Alishah, 2011; Basuki & Riediansyaf, 2014; Ardiansyah, Tjahjadi & Soewarno, 2017).

Studies on the use of CPA and ABC in hotels

The interest in techniques that may improve overall profitability in hotels has increased in recent years. Paradoxically, this has not been followed by an increase in CPA techniques usage. Most hotel managers are not aware of the profitability of different market segments, as management reports do not match costs with related revenues per market segment. Seldom do management accounting systems generate customer profitability figures (Krakhmal, 2006). The fact that most hotels have not implemented ABC, which is seen as pre-requisite to accumulate information related to customer profitability, may also justify the low rate of adoption of this contemporary techique.

Nordling and Wheeler (1992) described the implementation of a “market-segment accounting model” in the Las Vegas Hilton. The authors assessed the profit yield from ten market segments, although they did not use ABC in cost assignment. While the premium gaming and the convention segments contributed 30 cents and 24.3 cents, respectively, for every dolar of total operating income generated, the package-guest contributed only two cents. Therefore, the Las Vegas Hilton re-directed sales and marketing efforts, developed new pricing models for each segment and established priorities for room allocation.

Noone and Griffin (1999) documented the implementation of a customer profitability system on a three-star hotel in Dublin (Ireland). This analysis reinforced managers’ belief on the inadequacy of existing accounting and information systems to make customer-related decisions, and revealed non-awareness on the scale of profit/loss generated by each customer group.

In another study, on the American Lakefront Hotel, Atkinson and Brown (2001) observed the development of ABC techniques for market segment profitability analysis. However, they do not disclose findings of the implementation of such techniques.

Shanahan and Lord (2006) reported on the applicability of CPA in the hotel industry of New Zealand. According to the authors, CPA has limited usefulness, considering the high fixed costs and the importance of other performance measures, such as average daily room rates and occupancy levels. Only one in five hotel chains implemented CPA and merely at the customer group level. Among the reasons for the non-use are resource limitations to investigate such a system and the perception that other hotel chains do not use it.

Makrigiannakis and Soteriades (2007) found that managers in Greek hotels analyse market segment profitability to a sactisfatory degree, with the majority also calculating tour operator profitability. Pavlatos and Paggios (2007) found that, in Greek hotels, costs were mainly monitored in a profit center (100%) and cost center basis (82.4%). A lower, yet high, proportion (70.6%) monitored costs by customer category. A later study by Pavlatos and Paggios (2009a) confirmed that CPA is relatively highly adopted in the Greek hospitality industry and revealed that respondents ranked this tool in the high benefit category. In contrast, Zounta and Bekiaris (2009) concluded that Greek luxury hotels allocate costs per profit centers and per cost centers. Only 12.2% allocate costs per customer category.

Leitão (2002) inquired 147 hotels in Brazil, concluding that 81.6% of the hotels do not evaluate the individual profitability of customers, while 18.4% do it through a structured information system. Nevertheless, 85.8% valued having an electronic system able to provide such type of information.

In Portugal, Cruz (2007) examined performance measurement in an international joint venture in the hospitality industry. Hotelco was not making use of CPA techniques. Instead, Hotelco evaluated market segment profitability by the average room rate realized in each of the segments. No cost allocation was done to market segments. The short variety of Hotelco products, due to the standardization of the services offered, and the market based pricing policy were the reasons for the non-adoption of a sophisticated market segment profitability measurement system. Also in Portugal, Santos, Gomes and Arroteia (2012) investigated management accounting practices in hotels and found that CPA was not widely used.

In the USA, Karadag and Kim (2006) analyzed the value of accounting information to marketing decisions and the perceptions of marketers versus lodging industry controllers regarding CPA. The study reveals opposite positions between these two professional categories concerning the allocation of all company costs (both direct and indirect) among market segments: while just under half (45.4%) of the marketers agreed, the majority (62%) of the controllers strongly disagreed. When asked if they were using any method to determine market segment profitability, the percentage of marketers who responded in the affirmative was more than double that of the controllers. The main reasons for the scarce use of profitability measurement by controllers were “not a common practice of USALI”, “not requested by operator/management” and “not implemented by corporate office”. The most rated methods by both professional categories to measure profitability from each market segment were “sales alone” and “sales minus direct costs”, though some controllers also indicated “sales minus direct and indirect costs”. Budgeted lifetime sales minus direct and indirect costs was being used by only 4.7% of the marketers.

Although there are studies on the implementation of ABC in service organizations as diverse as hospitals, airlines, telecommunications companies, financial institutions, and even labor intensive service organizations where labor costs are a large piece of total operating costs such as restaurants, there is few evidence suggesting ABC has been widely implemented in the hotel sector.

Collier and Gregory (1995) found that none of the six hotel groups (UK and overseas-based) in their research of management accounting practices in hotels implemented ABC. Reasons for this included the integrated nature of the activities, the high margins and the maket based nature of pricing.

In contrast, in Greece, Pavlatos and Paggios (2007, 2009a, 2009b) observed that 23.5% of hotels have implemented ABC. According to Pavlatos and Paggios (2009b), 80% of ABC adopters used it for customer profitability analyisis. The satisfaction with the existing cost accounting system, the high cost of implementation and the lack of top management support were appointed as the main causes for rejecting ABC. The authors found that ABC systems in the hospitality industry do not embrace many cost drivers, and determine the cost of few activities (e.g., housekeeping, check-in/check-out, reservation, food production/service, marketing, and general administration). Moreover, they observed a positive correlation between the number of cost drivers and the number of activities. Finally, ABC adopters have a higher percentage of indirect costs and higher sales volumes than ABC non-adopters. Also in Greece, Zounta and Bekiaris (2009) reported that 70.8% of the managers of the surveyed hotels were aware of ABC, but only 14 of them were actually using it, resulting in an ABC adoption rate of 19.4%; 20% were neither aware nor were users of ABC.

ABC adoption rates in the Greek hotel sector are rather high when compared with previous surveys conducted in other countries. However, this is not surprising, considering the adoption rates reported in earlier works, such as in Cohen et al. (2005), who conclude that ABC diffusion in Greece is quite satisfactory and has been subject to a growing interest in recent years. In the same study, the authors found that 65% of companies in the service sector used this costing system.

Leitão (2002) found that only five (3.4%) of the hotels, in Brazil, used ABC; while in Nigeria, Adamu and Olotu (2009) found that none of the hotels surveyed used ABC, although 67% were aware of it. Nunes (2009) reported a quite satisfactory level of ABC adoption rate in five star hotels located in Portugal. In contrast, Santos et al. (2012) concluded that contemporary accounting techniques are not widely used by Portuguese hotels; only Activity-based budgeting scored above the scale average value, followed by ABC, CPA and Benchmarking.

Despite the low adoption of ABC in hotels, TDABC has recently been suggested, in particular for CPA. Dalci et al. (2010) found that customer segments considered unprofitable using traditional ABC were profitable under TDABC. Additionally, activities such as housekeeping, front-office, food preparation and marketing had idle capacity. With this information, managers were in a better position to implement strategies to maximize capacity utilization and the hotel’s overall profitability. Other studies also conclude that TDABC delivers more suitable data on the costs and profitability of customers than the traditional costing system in use and facilitates the identification of unused capacities and of non-value added activities. In addition, they also acknowledge that, by means of time equations, managers can determine the time required to perform activities and take actions to diminish this time and improve profitability. These studies analysed the feasibility of CPA implementation with TDABC in a large Iranian hotel (Hajiha and Alishah, 2011) and in a five-star hotel in Jogjakarta, Indonesia (Ardiansyah et al., 2017). Basuki & Riediansyaf (2014) examined the application of TDABC in the rooms division of a four- star hotel, also in Indonesia, and found that the hotel was operating with an extremely high profit margin in two of its room types. They also recognized that TDABC contributed to a more accurate and flexible cost calculation, thus producing better cost information for decision making than the original costing system.

Regardless the proclaimed benefits of CPA and ABC, research about the usage and usefulness of these two contemporary management techniques in the hotel sector is scarce. The literature review shows that they are not widely used by hotels. Nevertheless, studies in Greece reveal ABC adoption rates around 20% and a satisfactory use of CPA (Pavlatos & Paggios, 2007, 2009a, 2009b; Zounta & Bekiaris, 2009). The low use of CPA is not surprising as this technique is usually used together with ABC, and ABC is seen as a prerequisite to accumulate information related to customer profitability.

There has been minimal work regarding CPA and ABC in Portugal. This paper fills this gap by providing a deeper understanding of the application of these two techniques in the hotel sector.

3. Research methodology

The purpose of this study is to understand if hotels located in Algarve use CPA techniques and what are the main reasons for not using CPA. The degree of adoption of the ABC method is also examined. Since cost structure and USALI’s usage may be relevant to the adoption of CPA and ABC, those are previously assessed.

Universe and sample

The universe of this study is four and five star hotels and aparthotels in the Algarve. Data were obtained from the whole target population using the AHETA database (Hotel Association of Algarve). The scope is limited to Algarve due to its unique and prime identity as a tourist destination. At the time of data collection, the Algarve was the largest Portuguese region as measured by the number of rooms, lodging capacity and room nights (INE, I.P., 2010). Following similar studies (Mia & Patiar, 2001; Makrigiannakis & Soteriades, 2007), hotels with less than four stars were excluded from the sample, as it was considered that these would lack complex structures and a wide array of products and services, such as multiple food and beverage outlets, 24-hour service and personalized services, and thus unlikely to have implemented sophisticated management accounting practices and systems. The typology chosen is limited to hotels and apart-hotels, that is, “classic” lodging establishments that are also highly representative in the Algarve region.

The unit of analysis is the individual hotel, irrespective of whether it may belong to a hotel chain. The universe comprises 89 hotel units (57 hotels and 32 aparthotels) (henceforth named hotels). All 89 hotels were contacted and asked to cooperate with the study; 66 agreed to participate, yielding a 74.2% response rate. It is worth noting that the main hotel groups operating in Portugal are represented in this universe.

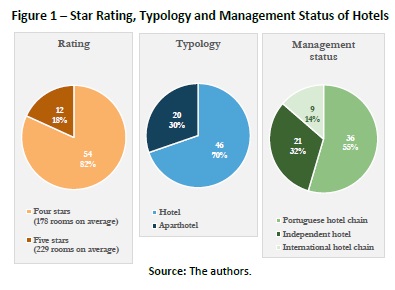

Figure 1 presents the most relevant features of the surveyed hotels. Most of them have a four-star rating, the prevailing tipology is hotels and more than two thirds are managed by a hotel chain.

Data collection

Primary data were collected through personal interviews with financial executives. The answers were recorded on a structured questionnaire.

During the interviews, other sources of information were requested, namely internal accounting reports (e.g. departmental statements), charts of accounts and key operating statistics and ratios produced by the hotel. The questionnaire included a few open questions to allow respondents to provide comments and additional information. In the case of hotels belonging to the same group with a centralized financial function, it was decided to fill only one questionnaire for the entire group, whenever the head of the finance department confirmed that management accounting procedures and practices were the same in all the units. In such cases, however, an individualized response to the subset of questions pertaining to the hotel characteristics was filled.

The validity of the questionnaire is supported by the fact that it closely follows procedures recommended by the extant literature, by the use of standard measures which are part of reference questionnaires widely used in management accounting studies and by critical appraisal in the part of hospitality industry experts, namely hotel managers, consultants and academics. In order to ensure that the questionnaire’s content was easy to understand, potential respondents were questioned and corrections were made. To minimize potential shortcomings, such as a low response rate, incomplete questionnaires, or poor quality of responses, the questionnaires were collected, as mentioned, trough personal interviews. To prevent any difficulties associated with the specific terminology of management accounting, the questionnaire was accompanied by a glossary. Meetings for data collection were appointed by telephone and took place in the finance departments of each hotel or at the head office. This procedure gave the researcher a chance to visualize in loco, and personally, the management accounting systems and to have access to key accounting documents which would have been difficult to acess otherwise.

4. Research findings and discussion Indirect costs versus total costs

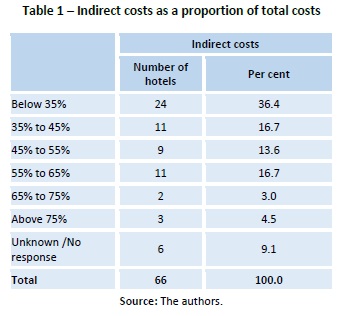

As observed in Table 1, in the majority of the hotels indirect costs represent more than 35% of total costs. In five hotels (7.5%), indirect costs exceed 65% of total costs.

To enable comparison with other studies, the estimated average and the standard deviation of the proportion of indirect costs was computed, yielding, 44.5 and 3.78, respectively. These findings confirm that indirect costs amount to almost 50% of total costs in hotels, as reported in the previous studies (Brignall, 1991; Pavlatos & Paggios, 2007), and that they would benefit with ABC implementation.

USALI adoption

Half of the hotels in the sample adopt the USALI. In hotels belonging to international hotel chains this proportion rises to 67%. However, only 44.4% of the hotels belonging to Portuguese chains adopt this accounting standard, a low proportion when compared to the implementation rate in independent units, i.e., 52.4%. Two independent hotels intend to adopt the USALI in the future. According to the hotel star rating, almost all of the five star hotels (91.7%) adopt the USALI, while the proportion of four star hotels adopting it is much lower (40.7%).

Although a higher usage rate of the USALI in hotels belonging to international hotel chains was expected, surprisingly, three do not use it. These hotels are subsidiaries of German and Spanish holdings that have internally developed reporting systems for the entire group. In one of these groups no change has been made to the current cost accounting system for the past 20 years, and management accounting information is consolidated quarterly with the other hotels in the group.

The analysis of the financial reports, commonly prepared by hotels on a monthly basis, reveals that, in general, hotels report profit by department, with only direct costs (cost of sales, labor costs and other expenses) being deducted from revenues. Hence, even though 50% of hotels do not use the USALI explicitly, they adopt its methodology, based on responsibility accounting principles, rather than on the allocation of indirect costs. As laid down in the USALI, most units allocate the costs of House Laundry and Staff Dining to various departments on an equitable basis reflecting usage, also charging Payroll Related Expenses directly to departments, in most cases when salaries and wages are calculated, something that is prompted by the payroll systems in use today. In addition, and contrary to the USALI guidelines, more than 20% of the hotels allocate Property Maintenance costs to the operating departments, while 16.7% allocate Utilities and 10.6% Interest, Depreciation and Amortization expenses. Not surprisingly, hotels belonging to international chains do not allocate any indirect costs to operating departments.

Cost objects

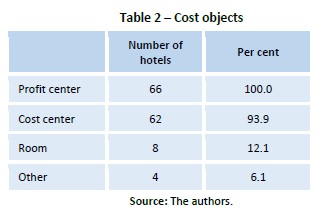

The data presented in Table 2 confirms that hotels accumulate costs mainly in profit centers (100%) and in cost centers (93.9%). Eight hotels (12.1%) accumulate costs per room, and only four hotels (6.1%) have other cost objects (e.g. cover, room nights). None of the hotels accumulates costs by customer or market segment categories. The results are aligned with those of Brignall et al. (1991), Pavlatos and Paggios (2007) and Zounta and Bekiaris (2009), who observed that hotels monitor costs essentially on a profit center and on cost center basis; however, these diverge with respect to cost monitoring by customer category, a common practice in Greece.

Some respondents mentioned having all profit and loss account variables computed on a customer basis (average). However, this common practice in the industry does not conform to the use of CPA that is calculating profit by individual customer or customer group, based on the sales and the costs that can be associated with them.

The findings are not surprising, given the adoption rate of the USALI, which measures the performance by profit department, in line with hotel’s organizational structure.

Profit centers and cost centers correspond to the departments within the hotel. These can be either operating departments (those that have contact with the customer and thus generate revenues and expenses) or support departments (those that have minimal contact with the costumer and do not generate revenues). As Brignall et al. (1991) conclude, departments are the hotel’s generic ‘product lines’, with costs not being traced directly to individual products or customers in each department.

More than 50% of the surveyed hotels have five to ten profit centers, almost 25% have one to four profit centers and 19.7% have more than 16 profit centers. The most common centers are Rooms (100%), Food and Beverage (100%), Telecommunications (75%) (no longer an Other Operated Department, as per the USALI’s 11th Edition) and Golf and Health Club/SPA (54.8%). Almost 70% of the hotels have five to ten cost centers; 19.7% have one to four cost centers and 6.1% have 11 to 15 cost centers, a much higher number than the four Undistributed Operating Departments envisaged in the USALI’s 10th Edition, in force at the time of data collection. It was observed that hotels belonging to chains have more profit centers than independent hotels and that hotels belonging to Portuguese chains have a higher number of cost centers in their information systems.

ABC use and awareness

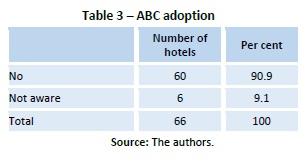

Regarding ABC use (Table 3), none of the hotels surveyed implements this contemporary technique, with about 9% of the respondents confessing that they are not aware of it. This lack of awareness is believed to be even larger as some respondents questioned the meaning of this concept but did not select “Not aware”.

These findings are in line with previous studies (e.g. Collier & Gregory, 1995; Leitão, 2002; Adamu & Olotu, 2009), who found little or no evidence of ABC usage, despite the high fixed costs associated with the industry. However, they contrast with those reported in other studies (Pavlatos & Paggios, 2007, 2009a, 2009b; Zounta & Bekiaris, 2009; Nunes, 2009).

It is worth noting that, not infrequently, the concept of activity is misunderstood. Often, “activity” is bewildered with “department”, when activities have their origin in departments and one department can participate in several activities. Applying CPA in conjunction with the ABC approach presupposes that costs be firstly attributed to cost centers (operating departments and overhead items), then allocated to activity centers (e.g. administration, banquets, check-in, check- out, housekeeping, etc. ), and finally assigned to the appropriate market segments.

Use of CPA

Hotels were asked to what extent did they use cost information for specific decisions or activities, using a ten item five-point Likert-scaled instrument anchored at no use (score 1) to very high use (score 5). Less than a quarter of the respondents indicated using cost information for customer profitability analysis: moderately (21.1%) or highly (3%) (average of 1.77; mode of 1). This reinforces the previous answers, as none of the respondents indicated “customer” as the hotel’s cost object.

Furthermore, when questioned if they were actually computing profit on a customer basis, the respondents commented “only revenues, not costs”. It is known that computing revenues/sales by costumer or market segments is a common industry practice. It was observed that such indicators are included in the monthly reports of several hotels belonging to Portuguese and international chains.

The respondents made the following comments about not using cost information for CPA:

i) We try to optimize the mix, but we do not find that costs vary from customer to customer or from group to group (Respondent of an international chain).

ii) It is difficult to allocate costs to customers, we must keep every customer, we cannot select them, except perhaps during peak periods, but that is unnecessary. This might be appropriate for city hotels with customers all year-round. Recently, hotels have been focusing on reducing costs (Respondent of an international chain).

iii) I cannot find any benefits in doing so. I know how much customers of different nationalities and in different regimes spend. For instance, half-board guests do not spend on other points of sale (Respondent of a Portuguese chain).

iv) Per customer, the only available information is that of revenue. Calculation to determine which customers generate more costs is unnecessary; we know some customers consume all that they are entitled to (Respondent of a Portuguese chain).

The comments reflect the major role played by seasonality, a marked characteristic of the hotel industry in Algarve. Hotels are not able to select customers in the low season. Finally, the answers mirror the economic crisis into which Portugal sunk, which has obliged hotels to restrain costs.

Respondents were then asked if they used CPA and other contemporary management accounting techniques. In a scale ranging from 1 (no use) to 5 (very high use), CPA recorded an average use of 1.76 and a mode of 1. Around 17% of the respondents were not aware of the technique. Nevertheless, CPA is the most used contemporary technique in surveyed hotels after benchmarking. Hotels belonging to Portuguese chains use it more, followed by hotels belonging to international chains.

Finally, to validate the answers, hotels were asked to what extent they report financial information related to customers/market segments. Circa 30% of the hotels do not report any information on customers/market segments and the remaining 70% only report sales. None of the hotels matches costs with customer groups, what substantiates the limited application of CPA in hotels. In the study of Karadag and Kim (2006), almost 30% of the controllers mentioned the use of sophisticated methods to evaluate market segments’ profitability (e.g. sales minus total costs), but more than one third used “sales alone” as the only method.

This deeply rooted industry practice of computing revenue data per market segment, which in most cases is sourced directly from the property management systems or the yield management systems, and using sales alone or the average room rate to evaluate profitability, as Cruz (2007) reports, may justify the low use of CPA, alongside with the factors identified in previous studies.

The low application of CPA in hotels, the absence of cost monitoring on a customer basis, and the low use of cost information for customer profitality analysis is not a surprise, in light of the relatively high USALI adoption rate and the perception that, generally, hotels report profits by department.

5. Conclusion

This study investigated the use of customer profitability analysis in four and five star hotels located in the Algarve region (Portugal). It contributes to enhance the knowledge about the use of the ABC method, regarded as a prerequisite for using CPA techniques.

The findings show that hotels accumulate costs by responsibility centers (profit centers and cost centers), that correspond to the hotel’s departments or functions. Cost management is not based on rooms, customers/market segments or activities. USALI is adopted by half of the hotels, although in general, hotels report profits on a departmental basis. Although ABC superiority over traditional costing methods has been asserted and advocated for CPA, and hotels’ high indirect cost structure would favour the application of ABC, none of the hotels implemented this costing technique.

This research identifies reasons for the non-adoption of CPA techniques which are in line with the literature review. Among them, the use of other performance indicators, such as the average room rate, uselessness of CPA and having costs higher than the potential returns.

Future research might provide a deeper insight into the reasons for the non-adoption of CPA techniques, and particularly from verifying to what extent seasonality may influence the use of such techniques. It is also suggested surveying the users of accounting information in hotels, namely marketers, to find out whether preparers and internal users are effectively “back to back” and if they would appreciate changes in the way financial information is reported.

REFERENCES

Adamu, A. & Olotu, A. (2009). The practicability of activity-based costing system in hospitality industry. JOFAR, 36-49. Accessed June 13, 2017 from http://ssrn.com/abstract=1397255 . [ Links ]

Ardiansyah, G. B., Tjahjadi, B., & Soewarno, N. (2017). Measuring customer profitability through time-driven activity-based costing: a case study at hotel x Jogjakarta. In SHS Web of Conferences (Vol. 34). EDP Sciences. [ Links ]

Atkinson, H. & Brown, J. (2001). Rethinking performance measures: assessing progress in UK hotels. International Journal of Contemporary Hospitality Management, 3(3), 128-135. [ Links ]

Basuki, B. & Riediansyaf, M. (2014). The application of time-driven activity-based costing in the hospitality industry: an exploratory case study. Journal of Applied Management Accounting Research, 12(1), 27- 54. [ Links ]

Brignall, T., Fitzgerald, L., Johnston, R. & Silvestro, R. (1991). Product costing in service organizations. Management Accounting Research, 2(4), 227-248. [ Links ]

Cardos, I. & Cardos, V. (2014). Measuring customer profitability with activity-based costing and balanced scorecard. Annales Universitatis Apulensis Series Oeconomica, 16(1), 52-60. [ Links ]

Chin, J., Barney, W. & O’Sullivan, H. (1995). Best accounting practice in hotels: a guide for other industries? Management Accounting, 73(11), 57-58.

Cohen, S., Venieris, G. & Kaimenaki, E. (2005). ABC: adopters, supporters, deniers and unawares. Managerial Auditing Journal, 20(8/9), 981-1000. [ Links ]

Collier, P. & Gregory, A. (1995). The practice of management accounting in hotel groups, in P. Harris (Ed.), Accounting and Finance for the International Hospitality Industry (pp. 137-159). Oxford: Butterworth- Heinemann. [ Links ]

Cooper, R. & Kaplan, R. (1991). Profit priorities from activity-based costing. Harvard Business Review, May-June, 69(3)130-135. [ Links ]

Cruz, I. (2007). Performance measurement practices in a globalized setting in the hospitality industry: an interpretive perspective (Doctoral dissertation). Instituto Superior de Ciências do Trabalho e da Empresa, Lisbon, [ Links ] Portugal.

Dalci, I., Tanis, V. & Kosan, L. (2010). Customer profitability analysis with time-driven activity-based costing: a case study in a hotel. International Journal of Contemporary Hospitality Management, 22(5), 609-637. [ Links ]

Downie, N. (1995). The use of accounting information in hotel marketing decisions, in P. Harris (Ed.), Accounting and Finance for the International Hospitality Industry (pp. 202-221). Oxford: Butterworth- Heinemann. [ Links ]

Downie, N. (1997). The use of accounting information in hotel marketing decisions. International Journal of Hospitality Management, 16(3), 305-312. [ Links ]

Dunn, K. & Brooks, D. (1990) Profit analysis: beyond yield management. Cornell Hotel and Restaurant Administration Quarterly, 31(3), 80-90. [ Links ]

Field, H. (1995). Financial Management implications of hotel management contracts: a UK perspective, in P. Harris (Ed.), Accounting and Finance for the International Hospitality Industry (pp. 261-277). Oxford: Butterworth-Heinemann. [ Links ]

Foster, G. & Gupta, M. (1994). Marketing, cost management and management accounting, Journal of Management Accounting Research, 6(3), 43-77. [ Links ]

Guilding, C., Kennedy, D. & McManus, L. (2001). Extending the boundaries of customer accounting: applications in the hotel industry, Journal of Hospitality and Tourism Research, 25(2), 173-194. [ Links ]

Hajiha, Z. & Alishah, S. (2011). Implementation of Time-driven activity based costing system and Customer profitability analysis in the hospitality industry: Evidence from Iran. Economics and Finance Review, 1(8), 57-67. [ Links ]

Harris, P. & Brown, J. B. (1998). Research and development in hospitality accounting and financial management, International Journal of Hospitality Management, 17(2), 161-181. [ Links ]

Hotel Association of New York City (HANYC) (2014). Uniform System of Accounts for the Lodging Industry, Eleventh Revised Edition, Michigan, American Hotel & Lodging Educational Institute. [ Links ]

Instituto Nacional de Estatística (INE), I. P. (2010) Estatísticas do Turismo 2009. [Online]. Lisboa-Portugal, 2010. Accessed December 17, 2012 from http://www.ine.pt.ISSN 0377-2306 . [ Links ]

Kaplan, R. & Narayanan, V. (2001). Measuring and managing customer profitability. Journal of Cost Management, 5(15), 88-96. [ Links ]

Kaplan, R. & Anderson, S. (2004). Time-driven activity-based costing - tool kit. Harvard Business Review, 82 (11), 131-138. [ Links ]

Karadag, I. & Kim, W. (2006). Comparing market-segment-profitability analysis as hotel marketing-decision Tools. Cornell Hotel and Restaurant Administration Quarterly, 47(2), 155-173. [ Links ]

Krakhmal, V. (2006). Customer profitability accounting in the context of hotels, in P. Harris e M. Mongiello (Eds.). Accounting and Financial Management, Developments in the International Hospitality Industry (pp.188-210). Oxford: Butterworth-Heinemann. [ Links ]

Leitão, C. (2002). Investigação da rentabilidade de clientes: um estudo no sector hoteleiro do Nordeste (Master thesis). Universidade de Brasília. [ Links ]

Makrigiannakis, G. & Soteriades, M. (2007). Management accounting in the hotel business: the case of the Greek hotel industry. International Journal of Hospitality and Tourism Administration, 8(4), 47-76. [ Links ]

Mia, L. & Patiar, A. (2001). The use of management accounting systems in hotels: an exploratory study. Hospitality Management, 20(2), 111-128. [ Links ]

Noone, B. & Griffin, P. (1997). Enhancing yield management with customer profitability analysis. International Journal of Contemporary Hospitality Management, 9(2), 75-79. [ Links ]

Noone, B. & Griffin, P. (1998). Development of an Activity-based customer profitability system for yield management. Progress in Tourism and Hospitality Research, 4(3), 279-292. [ Links ]

Noone, B. & Griffin, P. (1999). Managing the long-term profit yield from market-segments in a hotel environment: a case study on the implementation of customer profitability analysis. Hospitality Management, 18(2), 111-128. [ Links ]

Nordling, C. & Wheeler, S. (1992). Building a market-segment accounting model to improve profits. Cornell Hotel and Restaurant Administration Quarterly, 33(3), 29-37. [ Links ]

Nunes, C. (2009). O controlo de gestão na hotelaria portuguesa. (Master’s thesis). ISCTE-IUL, Lisboa. Accessed May, 28, 2014 from https://repositorio.iscte-iul.pt/bitstream/10071/2014/1/Disserta%c3%a7%c3%a3o%20Catarina%20Nunes.pdf .

Pavlatos, O. & Paggios, I. (2007). Cost accounting in Greek hotel enterprises: an empirical approach. Tourismos, 2(2), 39-59. [ Links ]

Pavlatos, O. & Paggios, I. (2009a). Management accounting practices in the Greek hospitality industry. Managerial Auditing Journal, 24(1), 81- 98.

Pavlatos, O. & Paggios, I. (2009b). Activity-based costing in the hospitality industry: evidence from Greece, Journal of Hospitality & Tourism Research, November, 33(4), 511-527.

Santos, L., Gomes, C. & Arroteia, N. (2012). Management accounting practices in the Portuguese lodging industry. Journal of Modern Accounting and Auditing, 8(1), 1-14. [ Links ]

Shanahan, I. & Lord, B. (2006). Management accounting in the corporate sector: recent research. Chartered Accountants Journal, March, 29-31. [ Links ]

Siguenza-Guzman, L., Van den Abbeele, A., Vandewalle, J., Verhaaren, H. & Cattrysse, D. (2013). Recent evolutions in costing systems: a literature review of time-driven activity-based costing. Review of Business and Economic Literature, 58(1), 34-64. [ Links ]

Vokurka, R. & Lummus, R. (2001). At what overhead level does activity- based costing pay off? Production and Inventory Management Journal; First Quarter, 42(1), 40-47. [ Links ]

Zounta, S. & Bekiaris, M. (2009). Cost-based management and decision making in Greek luxury hotels. Accessed March 28, 2011 from http://mpra.ub.uni-munchen.de/25459 . [ Links ]

Guest Editors:

· J. A. Campos-Soria

· J. Diéguez-Soto

· M. A. Fernández-Gámez

Received: 12.01.2018

Revisions required: 14.04.2018

Accepted: 10.07.2018