Serviços Personalizados

Journal

Artigo

Indicadores

-

Citado por SciELO

Citado por SciELO -

Acessos

Acessos

Links relacionados

-

Similares em

SciELO

Similares em

SciELO

Compartilhar

Análise Social

versão impressa ISSN 0003-2573

Anál. Social no.218 Lisboa mar. 2016

ARTIGO

The impact of an ageing population on economic growth: an exploratory review of the main mechanisms

O impacto do envelhecimento da população sobre o crescimento económico: uma análise exploratória dos principais mecanismos

N. Renuga Nagarajan*, Aurora A. C. Teixeira* e Sandra T. Silva*

*Universidade do Porto, Faculdade de Economia, CEF.UP, INESC TEC, OBEGEF, Rua Dr. Roberto Frias - 4200-464 Porto, Portugal. E-mails: renuga.phd@fep.up.pt, ateixeira@fep.up.pt e sandras@fep.up.pt

ABSTRACT

Although a myriad of important theoretical and empirical contributions on ageing populations exist, these are diffuse and lack an integrated vision of the distinct mechanisms through which ageing populations affect economic growth. This being the case, in this paper we survey the literature that provides insights regarding the ageing population and its effect on economic growth. In particular, we seek to uncover the main mechanisms by which ageing affects economic growth.

KEYWORDS: ageing; economic growth; mechanisms; literature review.

RESUMO

Apesar de existir uma infinidade de importantes contribuições teóricas e empíricas sobre o envelhecimento da população, tais contribuições surgem de forma difusa, carecendo de uma visão integrada dos mecanismos através dos quais o envelhecimento da população influencia o crescimento económico. No presente estudo, realizamos um estado-de-arte sobre esta questão, o qual fornece pistas importantes sobre os efeitos do envelhecimento da população acerca do crescimento económico. Em particular, procuramos descobrir os principais mecanismos através dos quais o envelhecimento influencia o crescimento económico.

PALAVRAS-CHAVE: envelhecimento; crescimento económico; mecanismos; revisão de literatura.

INTRODUCTION

Many developed countries are approaching an era of ageing populations due to an increase in longevity and decrease in fertility rates (Harper and Leeson, 2009). The decline in population growth has been noticeable since the mid-1970s, when the adult working-age population in several countries overtook child population (Mason and Lee, 2011).1 According to the World Health Organization (WHO),2 the proportion of people aged 65 and above in Europe is predicted to increase from 14% in 2010 to 25% in 2050. Hence, it is expected that in the near future, the prime working age group will be smaller than the old age group.

The involvement of women in the labor force is also considered to be negatively related to the fertility rate (Becker et al., 1990; Yong and Saito, 2012). In developed countries, more women have been actively participating in the labor market (Börsch-Supan, 2013). For instance, the growth rate of female employment in the Euro area (17 countries) increased from 1.3% in 1996 to 2.3% in 2007.3 Considering this scenario, whether or not to have a child has become a choice for female employees of the industrialized countries (Alders and Broer, 2004). As we know that human capital and the fertility rate are negatively correlated (Alders and Broer, 2004), the increasing trend among women to be better educated will in fact further decrease the fertility rate.

Alders and Broer (2004) also argue that the current demographic transfer faced by developed countries is no longer an exogenous shock. The authors stress that the increase of female capital in the labor market has led to a decrease in the fertility rate. Given this critical situation, they go on to suggest that the altruistic behavior of married couples will be a key factor in building future human capital. Additionally, it is argued that the current financial crisis is not helping to promote altruistic behavior in/among couples – which is essential.

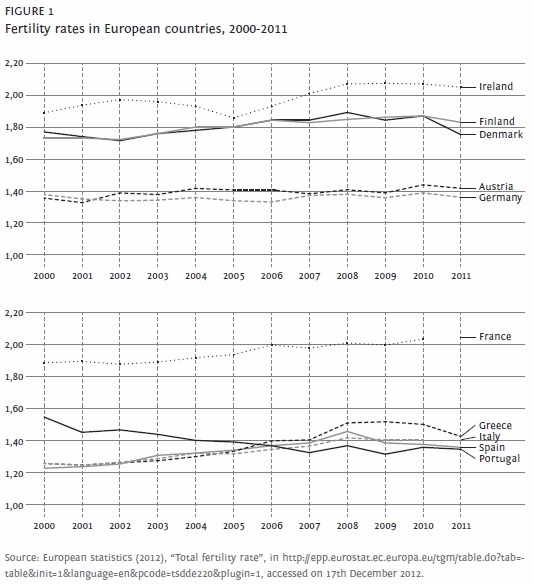

A falling fertility rate leads to populations with many working age individuals and fewer children to succeed them (Weil, 2006; Lee et al., 2011; Alam and Mitra, 2012; Navaneetham and Dharmalingam, 2012). For a highly developed country, the ideal fertility rate is associated with the 2.1 replacement level (Nimwegen and Erf, 2010). In 2011 the fertility rates of almost all the European countries had fallen below the replacement level (cf. Figure 1). In particular, for Portugal, Spain, Italy, Austria, and Greece, the fertility rate is now far below the replacement level. The average fertility rate for these five countries is below 1.5.

It is important to note that a decrease in the fertility rate alone will not turn a country into an ageing country. Along with a lower fertility rate, a decrease in the mortality rate and increase in life expectancy have also played an important role (Dalgaard, 2012; Yong and Saito, 2012).

This structural ageing of the population has profound consequences on a countrys (and its regions) economic growth (Albuquerque and Ferreira, 2015). Most economists argue that a country with a higher proportion of inhabitants in the old age group tends to be associated with decreasing productivity levels, lower savings, and higher government spending (Fougère et al., 2009; Bloom et al., 2010; Sharpe, 2011; Walder and Döring, 2012). The demographic transition makes room for an increase in the old age dependency ratio, meaning that the smaller working age group will be obliged to care for the older age group (Lindh, 2004; Navaneetham and Dharmalingam, 2012).

Although there are a myriad of important theoretical and empirical contributions on the ageing population, these are diffuse and lack consensus on the various mechanisms through which an ageing population affects economic growth. Thus, the main goal of this paper is to provide an in-depth literature survey on the interacting mechanisms between population ageing and economic growth.

Our paper is structured as follows. In Section 2 we provide a general overview of the literature on population ageing and economic growth, giving an account of the main mechanisms through which this influence occurs. Section 3 details the empirical studies in the area and Section 4 offers some concluding remarks.

THE IMPACT OF AN AGEING POPULATION ON ECONOMIC GROWTH: MAIN MECHANISMS

AN OVERVIEW OF THE INTERACTION BETWEEN AGEING AND GROWTH

Often in the past, demographic transition was considered to have a positive effect on economic growth as the proportion of the active working age group was greater than the non-working group (Lee et al., 2011). However, more recently many authors have revealed that the working population group has become smaller than that of retired people. As a result, this situation has transformed most countries into ageing countries (Weil, 2006; Bell and Rutherford, 2013; Börsch-Supan, 2013). Indeed, the European Commission (EC) (2006) highlights the fact that the majority of developed countries face a relatively greater proportion of inhabitants (especially retirees) in the non-working group than in the working group. Lopes and Albuquerque (2014) also demonstrate that population ageing is changing the age structure of the Portuguese workforce with considerable regional heterogeneity.

According to Bloom et al. (2010), the current global life expectancy is 65 years, and this is projected to increase to 75 years by 2050. In fact, some authors have even revealed that life expectancy in Japan has been the highest in the world since 2000 (Weil, 2006; Lee et al., 2011).

Most of the literature argues that there is a negative relationship between population ageing and economic growth (Narciso, 2010; Bloom et al., 2010; Lisenkova et al., 2012; Walder and Döring, 2012). According to these authors, individuals physical capacity, preferences, and needs will change in line with their advancing age. Hence, the inequality in age structure (a greater proportion in the old age group) is believed to affect a countrys productivity level. Analyzing the economic consequences of ageing in Portugal and focusing on multi-sectoral (or inter-industry) relationships, Albuquerque and Lopes (2010) uncovered a negative influence on the value added and employment of Portuguese industries due to the change in the consumption structure derived from ageing.

Even so, some authors, such as Prettner (2012) and Lee et al. (2011), claim that a positive interaction exists between ageing and economic growth. According to Prettner (2012), older individuals tend to save more. As a result, they provide more resources for investment, which positively affects economic growth. In fact, the rise in longevity will positively influence investment, particularly in R & D, which is generally recognized as an engine for economic growth (Aghion and Howitt, 1992).

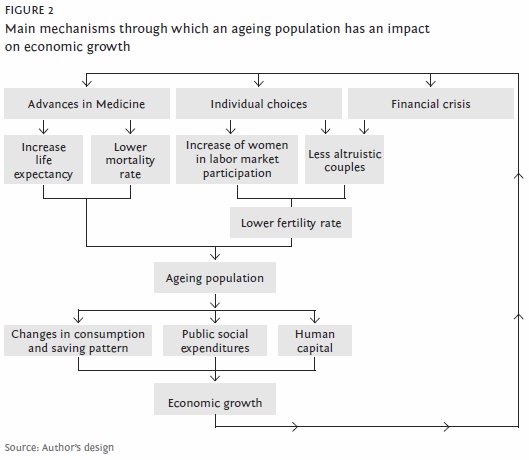

Figure 2 highlights the fact that the increase in the ageing population via medical advances and couples less altruistic behavior will affect economic growth mainly through three mechanisms: consumption and saving patterns, public social expenditure, and human capital (Bakshi and Chen, 1994; Tosun, 2003; Alders and Broer, 2004; Elmeskov, 2004; Lee and Mason, 2007; Mason and Lee, 2013; Meijer et al., 2013). The following section looks at these mechanisms in more detail. However, it is also important to acknowledge that a reverse causality exists between these two phenomena (in other words, economic growth may also influence the determinants of an ageing population).4

CONSUMPTION AND SAVING PATTERNS

The behavior of households in terms of consumption and savings may differ substantially between individuals working and retirement periods (Samuelson, 1958; Albuquerque and Lopes, 2010). The rise in population ageing will lead to changes in households consumption patterns. Some authors believe that ageing will to some extent change overall preferences and household needs (Walder and Döring, 2012; Velarde and Hermann, 2014). In fact, consumption patterns are alleged to be affected by ageing, through disposable income. Authors even stress that the increase in the elderly population will reduce the per capita income of all three generations (child, working group, and retiree) and lead to a net decrease in the familys total consumption (Lee and Mason, 2007). To some extent, the increase in the old age dependency ratio is expected to reduce the disposable income of the working population and lead to a further decline in the fertility rate (Hock and Weil, 2012).

Despite these negative effects, authors such as Aguila (2011) argue that the personal retirement account (PRA) systems followed by many countries will enable retirees to be more independent. Using PRA instead of pay-as-you-go systems will provide financial sustainability for retirees. Hence, the rise in population ageing will not affect the total consumption of the family if the retirees have opted for the PRA system. In line with this argumentation, it is considered that the ageing population will not affect the consumption level of the working group in a family. Nevertheless, Davies and Robert III (2006) argue that the savings rate of retirees will decrease as savings become their source of spending. Thus, with the rise in life expectancy, PRA systems are unable to assure financial sustainability for retirees till the end of their lives.

Private consumption has a considerable influence on demand (Walder and Döring, 2012). Some authors believe population ageing will prompt changes in household demand for certain goods (Bakshi and Chen, 1994; Mérette and Georges, 2009; Aguiar, 2011; Walder and Döring, 2012). Changes in the demand for goods and services will undoubtedly influence the total productivity level of a country. In fact, the demand for goods and services is crucial for defining both the production structure and the labor market, which are directly influenced by the age composition of a countrys population.

A country with an elderly population will face falling or stabilizing demand for property (housing) and higher demand in the stock markets, as older people are bigger risk-takers (Bakshi and Chen, 1994). Bakshi and Chen (1994) stressed that the retired age group will have fewer responsibilities as they are already in the later stages of life. Therefore, they will use their income to invest more heavily in risky assets.

Mérette and Georges (2009) argued that an ageing population will lead to higher demand for health services and a lower demand for housing. Even though a country with an ageing population tends to face a general decline in the demand for housing, Chen et al. (2012) argue that in Scotland the problem of ageing is not yet seen as a main determinant for changes in house prices. Therefore, for countries like Scotland there is no direct correlation between changes in the demand for housing and the rise in population ageing.

In addition to consumption of durable goods, households consumption in relation to non-durable goods is also expected to drop significantly during the retirement and unemployment period (Aguiar, 2011). Among perishable goods, food expenditure is one of the major forms of expenditure that declines after retirement (Aguiar, 2011; Aguila et al., 2011). The authors stress that the expenditure on food eaten outside the home will fall once an individual leaves their employment. In fact, retirees will replace their outside food consumption with home-cooked food as they have more leisure time after retirement.

There are some authors who are more positive about this ageing trend. They believe that population ageing will not affect consumption and household saving patterns, especially those of the working group (Alders and Broer, 2004; Hock and Weil, 2012). According to these authors, the decrease in the labor supply due to ageing tends to raise the wage rates of all generations and will increase the cost of having children. Therefore, in order to maintain its consumption level, the working age group must be willing to forgo having children.

PUBLIC SOCIAL EXPENDITURE

The old age dependency ratio is expected to increase in the near future (Díaz-Giménez and Díaz-Saavedra, 2009). The most common pay-as-you-go system is considered completely unsustainable due to the ageing phenomenon (Díaz-Giménez and Díaz-Saavedra, 2009; Aguila, 2011). Several authors predict that the current pay-as-you-go system will provoke an increasing deficit in government budgets (Tosun, 2003; Elmeskov, 2004; Díaz-Giménez and Díaz-Saavedra, 2009; Yong and Saito, 2012; Park-Lee et al., 2013). In fact, some authors consider that the rise in the government deficit has been due to the retirement of more educated workers (Díaz-Giménez and Díaz-Saavedra, 2009). For these authors, the more educated workers are, the higher the payroll taxes they pay during their working lives and the greater the pensions they will receive when they retire. Hence, a rise in retirement among educated workers is expected to double the governments expenditure on retirement. It largely depends on what types of retirement policies governments (or government agencies) adopt, as some policies may be able to offset the problem of increasing deficits in government budgets.

In fact, Aguila (2011) suggests that by following the PRA (personal retirement account) retirement plan, it is possible to avoid many of the limitations of pay-as-you-go systems and even be able to reduce the budget deficit. Government agencies raise taxes to accommodate the rise in welfare expenditure on ageing societies. This is assumed to affect the disposable income of the working group to some extent, and thus tends to cause a decline in the fertility rate (Hock and Weil, 2012). Subsequently, this type of response will further enhance the ageing phenomenon.

However, in the case of New Zealand, population ageing is believed to exert a positive influence on the government budget (Creedy and Scobie, 2002). Creedy and Scobie (2002) attest that the countrys percentage of gross domestic product (GDP) is predicted to increase from 22.7% in 2001 to 31.0% by 2051 due to ageing. Per se, population ageing tends to cause significant changes in government budget allocations. However, Eiras and Niepelt (2012) and Lisenkova et al. (2012) argue that population ageing will increase the allocation of government spending more to social security than to education and infrastructure investment. According to these authors, the changes in government priority will ultimately impact (negatively) the economic development of the country. Nevertheless, to some extent, the continuous rise in immigration will make it possible to mitigate the rise in government spending. Therefore, population ageing is believed not to have a negative impact on economic growth as long as there is a continuous flow of immigration (Blake and Mayhew, 2006).

Regarding population ageing, some authors have even proposed postponing the retirement age of an employee (Finch, 2014; Díaz-Giménez and Díaz-Saavedra, 2009). To a certain degree, prolonging the working life of an individual can overcome the pressure on the pension system. In fact, raising the retirement age is considered to be one of the European Unions (EU) policies (Finch, 2014).

Overall, the degree of negative effect of ageing on public expenditure depends on the type of government policy. Hence it is believed that the effect of population ageing makes it possible to mitigate the rise in public expenditure as long as retirement policies can be adjusted (by moving them to private pension schemes and raising the retirement age) and provided that the number of immigrant workers can be increased to compensate for the shortfall in the labor force.

HUMAN CAPITAL

Rises in population ageing tend to decrease the weight of the working group (Alam and Mitra, 2012; Bell and Rutherford, 2013; Börsch-Supan, 2013; Wu, 2013). Fougère et al. (2009) argue that the decline in the working population in Canada was due purely to the ageing population. The huge baby boom population that emerged between 1947 and 1966 started to retire at the age of 65 in 2012, leading to a larger ageing population in Canada (Sharpe, 2011). However, authors claim that countries can sustain economic growth despite the ageing population problem. According to some authors, such as Bloom et al. (2010) and Peng and Fei (2013), the increase in the retirement age and immigration will in fact help to overcome the decrease in the labor force. Furthermore, Elgin and Tumen (2010) state that with a decline in human capital, the economy will switch from traditional production (that employs young workers) to new human capital oriented production (that employs elderly workers). Therefore, according to this line of argument an ageing population will affect neither production nor growth dynamics. Elgin and Tumen (2010) also stressed that modern economies rely more on machines than the labor force. Thus, a fall in the labor force will have no significant effect on productivity. According to these authors, labor can be replaced by machines. This means that a decrease in the young working group has no effect on economic growth.

However, Lisenkova et al. (2012) hold a contrasting view of this phenomenon. Even though an increase in the retirement age will help to offset a decreasing labor market, workers of different ages are not perfect substitutes and so there will definitely be a decline in productivity per worker (Lisenkova et al., 2012). Thus, authors reveal that population ageing will decrease a countrys stock of human capital and subsequently exert a negative influence on its economic growth (Narciso, 2010; Lisenkova et al., 2012). Furthermore, an ageing population expected to reduce the labor force is assumed to affect economic growth due to the lower productivity levels. Even though the higher participation of women in the labor force increases labor productivity, this participation will further lower the fertility rates, which will eventually lead back to the initial problem (Alders and Broer, 2004).

There is also the argument that, apart from the increase in the retirement age, greater immigration is unable to help much with overcoming public spending due to this problem of ageing, as immigrants will also have rights under the pension and health care system (Elmeskov, 2004). Despite the negative effect on human capital accumulation identified by Lindh (2004), Ludwig et al. (2011) and other authors stressed that in relation to the US economy the increase in human capital investment will reduce the impact of an ageing population. The endogenous human capital acquired through formal schooling and on-the-job training programs will positively influence human capital technology (Ludwig et al., 2011). Hence in the case of the US, Ludwig et al. (2011) report that when we allow for endogenous human capital accumulation, the welfare losses in terms of lifetime consumption will be only about 8.7%, whereas when human capital is assumed as exogenous, these losses will rise to 12.5% (assuming that replacement rates to the pension system are constant).

SURVEYING THE EMPIRICAL STUDIES THAT ASSESS THE IMPACT OF AGEING ON ECONOMIC GROWTH

SOME BRIEF METHODOLOGICAL ASPECTS

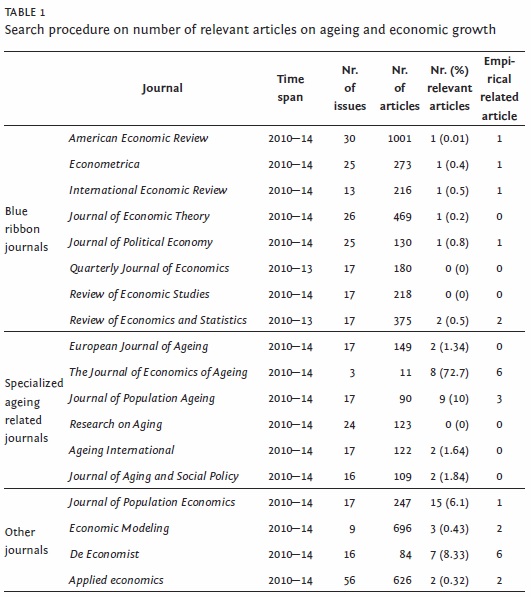

Although high quality empirical research on the impact of population ageing on countries economic growth does exist, (this latter often proxied by GDP growth rates), such literature is still relatively scarce. The following section summarizes some of the most relevant studies in this area, highlighting the main mechanisms through which ageing affects economic growth: consumption and saving patterns, public social expenditure, and human capital. The criteria for selecting the relevant papers involved an in-depth search within the blue ribbon journals (The American Economic Review; Econometrica; The International Economic Review; The Journal of Economic Theory; The Journal of Political Economy; The Quarterly Journal of Economics; Review of Economic Studies; and Review of Economics and Statistics), followed by an extensive search in specialized journals relating to ageing (such as: The European Journal of Ageing; The Journal of Economics of Ageing; The Journal of Population Ageing; Research on Aging; Ageing International; and The Journal of Aging and Social Policy), and through a snowball method, some selected articles in other journals considered as well (The Journal of Population Economics; Economic Modelling; De Economist; and Applied Economics ). We used a time span of five years (2010 – 2014) in our search procedure for all the journals, except for The Journal of Economics of Ageing, The Journal of Population Ageing, Economic Modelling, and Applied Economics. For The Journal of the Economics of Ageing, we carried out our search from the year 2013 – 2014, as their first volume was published only in 2013.

For The Journal of Population Ageing, and since there were few articles published between the years 2013 - 2014, we decided to consider a larger period, 2008 to 2014. The journals Economic Modelling and Applied Economics include a wide range of issues in the field of economics, and thus a vast amount of articles. The search in these two journals was undertaken only from 2013 to 2014.

For all types, the search procedure involved the consideration of exclusive empirical studies on economic growth and ageing. Particular attention was given to those articles assessing the possible distinct impact of ageing on economic growth by the main mechanism, estimation techniques, and countries. From the search, 54 articles considered the impact of ageing on economic growth. Of these 54 articles, 23 focus exclusively on empirical studies (cf. Table 1).

Of the articles identified, there were 7 studying the impact of ageing on economic growth through consumption and saving patterns, 10 through public expenditure, and 10 through human capital. In the following section, a further review will be carried out in relation to the empirical articles.

THE EFFECT THAT AN AGEING POPULATION HAS ON CONSUMPTION AND SAVING PATTERNS

Few empirical studies have addressed the impact of ageing on growth through consumption and saving patterns. Seven selected papers summarized in Table 1 considered the influence of population ageing on both developed and developing countries. Since we know that the effect of ageing depends on countries policies and household behavior, the results (Table 1) show both positive (Kopecky, 2011; Mason and Lee, 2013) and negative (Nardi et al. 2010; Aguila et al. 2011; Ewijk and Volkerink, 2012; Hurd and Rohwedder, 2013) impacts on economic growth.

The needs and preferences of households will change depending on peoples ages and their financial capacity. Analyzing the expenditures of households from developed countries (such as the USA, the Netherlands, and Germany), Nardi et al. (2010), Aguila et al. (2011), Ewijk and Volkerink (2012), Hurd and Rohwedder (2013) and Velarde and Hermann (2014) demonstrate a decreasing trend in the consumption patterns of the elderly. The fall in income after retirement has enabled households to adjust their consumption according to their financial capacity. Hence, an elderly household will alter its consumption substantially after retirement (e.g., Nardi et al., 2010; Aguila et al., 2011; Velarde and Hermann, 2014).

In the case of the USA, the empirical studies conducted by Aguila et al. (2011) and Hurd and Rohwedder (2013) show similar results. According to these authors, the food consumption of a household will decline after the retirement of its members. In fact, considering a linear model, Velarde and Hermann (2014) also found a similar result for households in Germany. According to the authors, retired members of German households behave in ways similar to those of USA households in terms of food consumption. Furthermore, their studies reveal that food expenditure will be the major category that is reduced after the retirement of inhabitants of these developed countries.

Nevertheless, in the case of the Netherlands, Ewijk and Volkerink (2012) find contradicting results. According to these authors, the rise in the elderly population in the Netherlands will increase the demand of non-tradable products (especially of services) in the long run. The authors believe that the consumption pattern of elderly households will only affect tradable goods. As a result of the ageing population, the Netherlands GDP share of the trade balance is projected to decrease to 4% in 2015. Moreover, Ewijk and Volkerinks (2012) simulation predicts a 3% rise in the budget deficit when ageing reaches its peak for that country in 2040.

Unlike Velarde and Hermann (2014), Hurd and Rohwedder (2013), Ewijk and Volkerink (2012) and Aguila et al. (2011), the empirical studies undertaken by Mason and Lee (2013) and Kopecky (2011) demonstrate a positive impact of ageing on economic growth through consumption and savings. Analyzing 34 countries (including developed and developing), Mason and Lee (2013) justify this positive relationship in mathematical terms.

According to these authors, a rise in life expectancy will prolong the capacity of an individual to continue in the labor market. Hence, the authors stress that extending a persons working life will increase a households income and consumption. In analyzing the relationship between the wealth index and the elderly (the over-60), Kopecky (2011) demonstrated that there was an increase in the consumption of retirees in the US from 18502000. According to the author the total savings of an old age group will decline as its members consumption on leisure activities increases upon retirement. In fact, the author stresses that men aged 65 and above spend approximately 43% more time on recreation than men aged 25–54. Nardi et al. (2010) believe that to some extent households medical expenses grow throughout their lives. The higher the survival rate, the higher the medical expenses. For these authors, US households above the age of 70 face a decrease in their savings and income in order to compensate for their rising health care expenses. Hence, increase in life expectancy will augment households medical expenses and decrease their savings.

THE EFFECT OF AGEING ON ECONOMIC GROWTH THROUGH PUBLIC SOCIAL EXPENDITURE

Ageing populations affect the governments earning and expenditure in many ways. Empirical analysis has been carried out to identify the influence of ageing populations through social expenditure (Thiébaut et al., 2013 and Okumura and Usui, 2014), GDP (Bettendorf et al. 2011; Tobing, 2012, and Lugauer, 2012), taxation (Planas, 2010), and the financial sector (Narayana, 2011 and Imam, 2013).

In a similar manner to households, the rise in population ageing is believed to influence the expenditure pattern of government agencies. Using France as a sample for their analysis, Thiébaut et al. (2013) underline the fact that the rise in the elderly population will increase demand for health care. As a result, this will increase the governments budget allocation to health care expenditure. Unlike Mason and Lee (2013), Thiébaut et al. (2013) argue that the rise in life expectancy will not guarantee a healthy old age group unless there is continuous demand for medical consumption. Therefore, in the case of France, Thiébaut et al. (2013) stress that a healthy ageing scenario will not be cost-saving. Hence the authors project that a rise in the number of elderly will not be able to support the countrys economic growth.

Along with Thiébaut et al. (2013), there are still authors who provide empirical evidence that ageing has a negative impact on economic growth through public social expenditure. Bettendorf et al. (2011) showed that the rise in life expectancy will negatively affect the percentage contribution of income tax to the GDP of the Netherlands. The authors stress that the rise in population ageing will reduce the tax income of the country. Even though the ageing population negatively affects income tax, the rise in the capital taxation is believed to positively affect the GDP of a country (Planas, 2010).

In fact, Planas (2010) demonstrates that the rise in the population ageing is expected to increase the capital taxation of the US. According to the author, younger decisive voters tend to support a higher tax rate on capital. The current demographic transition will lead voters to increase their saving and thereby shift the political preferences against capital taxation. In fact, in the case of the US, authors have proved that the imbalance in age structure will provide a reduction in business cycle fluctuations (Lugauer, 2012). According to the author the rise in the percentage of the old aged population and the decline in the percentage of the youth population will lead to GDP volatility in that country. Using standard panel data with lagged birth rates as an instrument, Lugauer (2012) finds a strong statistical relationship between the percentage of youth and GDP volatility for the United States.

Narayana (2011) also demonstrates that apart from the developed countries, the rise in the old age population will negatively affect the public net transfer of India. According to the author government spending on the elderly population is greater than the payment for previously accumulated public debt and interest. Nonetheless, Tobing (2012) believes that the rise in life expectancy will increase the gross domestic saving rate. For the author the lower fertility rate and higher survival rate will increase household savings. The changes in households behavior regarding savings are expected to increase the percentage contribution of savings to GDP.

Even though ageing increases the gross domestic saving rate, authors such as Imam (2013) feel that the rise in the ageing population will affect the banking industries. The author stresses that the rise in the proportion of the old age population will lead to financial instability for the banking sectors.

His simulation result shows a negative relationship between the old age dependency ratio and the banks returns on assets. For the author households tend to shrink their balance sheet once members are above a certain age, thus bringing about a negative wealth effect.

The US faced a continuous rise in the old age population (over 65) from 1850 to 2000 (Kopecky, 2011). However, Kopecky (2011) identified a continuous fall in the participation of the workers over 65 in the labor force during this period. According to the author, life expectancy did not increase the life span of the labor force. In fact the rise in life expectancy increased the life span of retirees.

Taking this into consideration, there are authors who believe that government policies regarding retirement play a vital role in enabling ageing employees to prolong their life span in the workforce (Okumura and Usui, 2014; Hurd and Rohwedder, 2011). The Japanese pension reforms in 1994 and 2000 have increased the pensionable age from 60 to 65 (Okumura and Usui, 2014). Furthermore, Okumura and Usui (2014) furnished empirical proof that in Japan individuals in their late 50s and early 60s expected to retire at a later age. The authors also demonstrate that individuals with lower incomes and education levels who expect to survive until 75 will retire at a later age. Hence, the increase in government spending on public pensions is able to be mitigated through government policies such as pension plans. Like Okumura and Usui, (2014), even in the case of the US, Hurd and Rohwedder, (2011) have shown similar behavior among elderly employees when there is a shift in the pension plan. The authors stressed that the shift in the pension plan from a defined contribution plan (DC5) to a defined benefit plan (DB6) will increase participation of older aged employees in the labor force and delay their retirement.

THE EFFECT OF AN AGEING POPULATION ON HUMAN CAPITAL

If workers of different ages are not perfect substitutes, in an ageing population the productivity level of any particular worker will be lower taking into account their diminishing physical ability to actively participate in the labor market (Dostie, 2011; Göbel and Zwick, 2012; Lisenkova et al., 2012; Mahlberg et al., 2013; Mason and Lee, 2013).

The rise in the proportion of the elderly in a population is thought to decrease the labor supply of that country. Garau et al. (2013) emphasize that the rise in the proportion of elderly employees in relation to younger people will negatively influence the Italian GDP and employment conditions. The authors predict that for Italy, as a consequence of a demographic transition, the fall in GDP will be greater than that in employment.

Some authors feel that the changes in the retirement plan will prolong the participation of older employees in the labor force (Okumura and Usui, 2014; Hurd and Rohwedder, 2011). However, unconnected with the pension plan, Bell and Rutherford (2013) argued that the preference and willingness of the elderly employee to remain in the labor force is thought to be a reason for the rise in the retirement age. According to these authors, employed workers who prefer to work fewer hours are significantly more likely to retire than those who do not. In the case of the UK, the author demonstrated that there is a significant increase in the proportion of older workers who are willing to work more hours. This means that older workers in the UK are willing to prolong their participation in the labor force.

However, Lisenkova et al. (2012) explain that in general, regardless of the sector under scrutiny, the age-specific effect will influence productivity in Scotland. Their aim was to ascertain whether age-specific features significantly influence output productivity in Scotland. The authors predict Scotlands output level for the period 2006 – 2106, based on a simulation exercise. The results show that when age-specific features are not taken into account, the changes in the output level will be lower, whereas when age-specific effects are considered, these changes will be higher. According to these authors, given that the physical strength of human beings begins to decline as they get older, the increase in the retirement age will mean a higher presence of more elderly people in the labor market, which will definitely have a negative effect on the productivity level. Furthermore, as an employee gets older, his/her average productivity will decline and possibly influence his/her standards of living (Dostie, 2011). Hence, the scenario could also have a negative impact on governments ability to ensure the funding of pension systems.

Even Göbel and Zwick (2012) and Lisenkova et al. (2012) agree that in general the impact of an ageing population on labor productivity is negative. Based on an empirical study, Göbel and Zwick (2012) state that the influence of this effect will differ according to the sectors analyzed. Göbel and Zwick (2012) analyzed the differences in the age productivity profiles between the metal manufacturing sector and the service sector in Germany for the period 1997–2005. Using the generalized method of moments (GMM) as an estimation tool, the authors obtained results showing that for the 55–60 working age group, there is no significant effect on productivity in the metal manufacturing and service sectors. Hence, the study concludes that an increase in the old-age group in Germany has no effect on the productivity level of the metal manufacturing and service sectors. However, in the case of Austria, Mahlberg et al. (2013) obtain contradicting results in analyzing the productivity level of elderly employees. Considering similar econometric methods (OLS, Fixed effect, Random effect, and GMM for the time period 2002 to 2005), the authors stress that there is a significant effect for the manufacturing and service sectors.

The authors showed that the productivity level of old age employees for Austria in the manufacturing, financial intermediation, transport, and communication sectors shows a negative effect. On the other hand, for construction, real estate, hotels, and restaurants the productivity level of elderly employees of that country reveals a positive significant relationship. Taking into account the empirical result of these authors (Göbel and Zwick, 2012; Mahlberg et al., 2013), it is obvious that the productivity level of old aged employees varies among sectors and countries.

As with Scotland, the productivity level of old age employees in Portugal also shows a declining pattern. Even though the elderly employee makes a smaller contribution to the firms productivity level in the case of Portugal, Cardoso et al. (2011) stressed that the wages of more elderly employees still remain below their productivity level. Therefore, increasing the participation of elderly employees will not raise the production cost(s) of a firm (in terms of their wage).

Moreover, in the case of Canada empirical studies demonstrate that the productivity level and the wage of a laborer over 55 were significantly positive during the period 1999 to 2005 (Dostie 2011). The empirical studies by Dostie (2011) not only demonstrate positive productivity levels among old age employees, but the author further showed that there is a huge gap between productivity and wages. Therefore, in hiring old aged workers, the firm will not face a rise in production costs (Ours and Stoeldraijer, 2011).

By no means do all the empirical studies demonstrate that the rise in population ageing has a negative impact on labor productivity. Even though an increase in life expectancy is thought to exert a negative influence on public expenditure (Thiébaut et al., 2013), authors such as Mason and Lee (2013) believe that medical benefits provided by the government will improve the fitness of the old age group and prolong the period in which they are able to participate in the labor market. Hence, by applying a simple conceptual accounting framework for the period 1994 – 2009, Mason and Lee (2013) demonstrate that life expectancy has extended the participation in the labor market in developed and developing countries. However, in the case of the US, Cervellati and Sunde (2013) discovered that the rise in the survival rate will lead to an increase in full time schooling and decrease in lifetime labor hours. According to these authors, an increase in the hours of schooling is associated with higher life time earnings.

SOME FINAL REMARKS ON THE RELATIONSHIP BETWEEN AGEING AND ECONOMIC GROWTH

The demographic dividend resulting from industrialization has improved the economic growth of developed countries (Bloom and Williamson, 1998). The imbalance in age structure (a higher proportion of the old aged group in the population) has led to many developed countries being dubbed ageing countries (Bloom and Williamson, 1998). Population ageing and its impact on economic growth through the main mechanisms has been discussed in some depth above. The current ageing problem faced by many developed countries is unprecedented (Börsch-Supan, 2013). Therefore, these ageing impacts can be considered a new experience and challenge for the world.

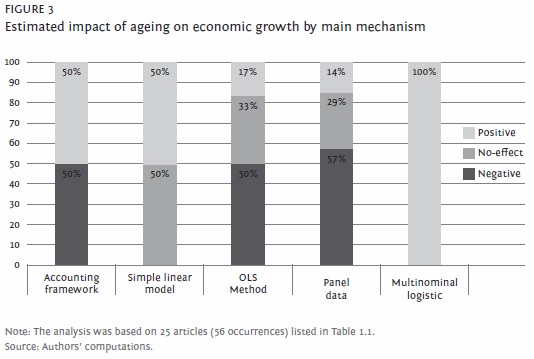

Our review of the literature has led us to conclude that an ageing population has affected economic growth through three main mechanisms: consumption and saving patterns, public social expenditure, and human capital. This literature review shows that the impact of ageing on countries performances is intimately related to the mechanism. Indeed, almost all the empirical studies that have focused on public social expenditure convey a negative impact of ageing, whereas the majority (36%) of empirical studies that focus on human capital do not find any statistically significant relationship between ageing and the economic growth proxy, while the positive impact is much more related to the consumption and saving patterns mechanism (cf. Figure 3). In short, the mechanism seems to have a non-trivial impact on the estimated relationship between ageing and economic growth.

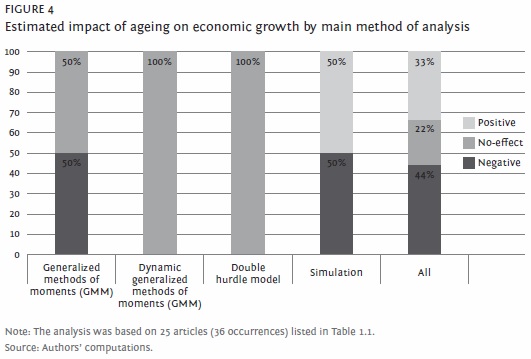

Estimation methodologies also seem to be associated with distinct effects of ageing on economic growth. Indeed, Figure 4 shows that the most frequent empirical methods (i.e., simulation, OLS, and panel data) are most often associated with negative correlations, whereas the simple linear model, multinomial logistic model, dynamic generalized methods of moments (GMM), and double hurdle model are more likely to generate positive or no significant effects.

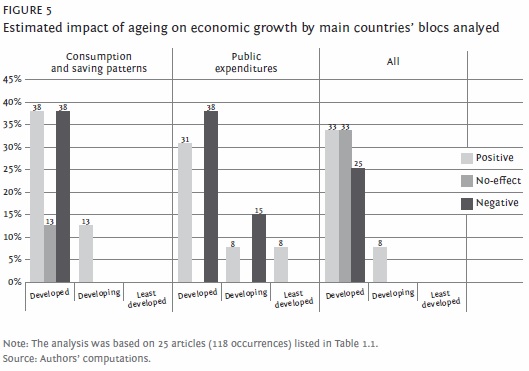

The evidence gathered does little to help in assessing the extent to which the impact of ageing on growth varies according to the mechanisms and countries analyzed. The bulk of the empirical evidence is concerned more with developed countries (see Figure 5).

Among the analyses, public expenditure and consumption and saving pattern mechanisms indicate more negative and significant relationships between ageing and growth. It is important, however, to acknowledge that developed, developing, and even the least developed countries are affected by the ageing population phenomenon. As Börsch et al. (2002) state, ageing population patterns are similar in most countries; the only observable difference concerns the timing. Furthermore, an ageing populations influence on economic growth has been labelled remarkable, especially during the current financial and economic crisis (Lee et al., 2011). Several economic studies (e.g., Creedy and Scobie, 2002; Alders and Broer, 2004; Weil, 2006; Sobotka et al., 2010; Börsch-Supan, 2013; and Albuquerque and Ferreira, 2015) not only confirm the existence of ageing populations all over the world, but also document and analyze the mechanisms that influence economic growth, as well as propose possible remedies for solving the problem.

The changes that both developed and developing countries are currently undergoing, leading to an era of global ageing populations, have their own consequences for economic growth dynamics through the distinct mechanisms detailed above: consumption and saving patterns (Fougère et al., 2009; Albuquerque and Lopes, 2010; Li et al., 2012; Walder and Döring, 2012; Mason and Lee 2013), human capital (Elgin and Tumen, 2010; Sharpe, 2011; Göbel and Zwick., 2012), and public social spending (Creedy and Scobie, 2002; Tosun, 2003; Elmeskov, 2004; Hock and Weil, 2012; Yong and Saito, 2012).

Realizing the gravity of the issues raised by population ageing, policy makers are desperate to find ways of tackling the issues. Policy implications such as the Blue card system introduced by European countries to encourage foreign immigration in order to overcome labor shortages, increasing the retirement age so as to lower government expenditure, increasing the working groups income tax and social planning, whereby couples are encouraged to have more children, are considered to be the major ones. However, for some reason, general policy plans are not yet regarded as an effective way of solving the problem. Knowing the degree to which the influence of ageing varies from country to country, and through which mechanisms, is essential for identifying adequate policies.

REFERENCES

AGHION, P. and HOWITT, P. (1992), A model of growth through creative destruction. Econometrica, 60, pp. 323-351. [ Links ]

AGUIAR, M. (2011), Consumption versus expenditure. Journal of Political Economy, 113, pp. 919-948. [ Links ]

AGUILA, E. (2011), Personal retirement accounts and saving. American Economic Journal: Economic Policy, 3, pp. 1-24. [ Links ]

AGUILA, E., ATTANASIO, O. and MEGHIR, C. (2011), Changes in consumption at retirement: evidence from panel data. The Review of Economics and Statistics, 93, pp. 1094-1099. [ Links ]

ALAM, M. and MITRA, A. (2012), Labour market vulnerabilities and health outcomes: older workers in India. Journal of Population Ageing, 5, pp. 241-256. [ Links ]

ALBUQUERQUE, P.C. and FERREIRA, J. (2015), Envelhecimento, emprego e remunerações nas regiões portuguesas: uma análise shift-share – Ageing, employment and remunerations in Portuguese regions: a shift-share analysis. EURE, 41 (122), pp. 239-260. [ Links ]

ALBUQUERQUE, P.C. and LOPES, J.C. (2010), Economic impacts of ageing: an inter-industry approach. International Journal of Social Economics, 37 (12), pp. 970- 986. [ Links ]

ALDERS, P. and BROER, D.P. (2004), Ageing, fertility, and growth. Journal of Public Economics, 89, pp. 1075-1095. [ Links ]

BAKSHI, G.S. and CHEN, Z. (1994), Baby boom, population aging and capital markets. Journal of Business, 67 (2), pp. 165-202. [ Links ]

BECKER, S.G., MURPHY, M.K. and TAMURA, F.R. (1990), Human capital, fertility, and economic growth. NBER Working paper No. 3414. [ Links ]

BELL, D.N.F. and RUTHERFORD, A.C. (2013), Older workers and working time. The Journal of the Economics of Ageing, 1-2, pp. 28-34. [ Links ]

BETTENDORF, L., et al. (2011), Ageing and the conflict of interest between generations. De Economist, 159, pp. 257-278. [ Links ]

BLAKE, D. and MAYHEW, L. (2006), System in the light of population ageing and declining fertility. The Economic Journal, 116, pp. 286-305. [ Links ]

BLOOM, D.E., CANNING, D. and FINK, G. (2010), Implications of population ageing for economic growth. Oxford Review of Economic Policy, 26, pp. 583-612. [ Links ]

BLOOM, E.D. and WILLIAMSON, G.J. (1998), Demographic transition and economic miracles in emerging Asia. The World Bank Economic Review, 12, pp. 419-455. [ Links ]

BÖRSCH-SUPAN, A. (2013), Myths, scientific evidence and economic policy in an aging world. The Journal of the Economics of Ageing, 1-2, pp. 3-15. [ Links ]

BÖRSCH-SUPAN, A., LUDWIG, A. and WINTER, J. (2002), Aging and international capital flow, MEA Discussion paper series 02010, Munich Center for the Economics of Aging (MEA) at the Max Planck Institute for Social Law and Social Policy. [ Links ]

CARDOSO, A.R., GUIMARÃES, P. and VAREJÃO, J. (2011), Are older workers worthy of their pay? An empirical investigation of age-productivity and age-wage nexuses. De Economist, 159, pp. 95-111. [ Links ]

CERVELLATI, M. and SUNDE, U. (2013), Life expectancy, schooling, and lifetime labor supply: theory and evidence revisited. Econometrica, 8, pp. 2055-2086. [ Links ]

CHEN, Y., et al. (2012), The impact of population ageing on house prices: a micro-simulation approach. Scottish Journal of Political Economy, 59, pp. 523-542. [ Links ]

CREEDY, J. and SCOBIE, G.M. (2002), Population ageing and social expenditure in New Zealand: stochastic projections. New Zealand Treasury Working Paper 02/28. [ Links ]

DALGAARD, C.D. (2012), Metabolism and longevity. In H. Strulik, C.D., et al. (eds), Long-Run Economic Perspectives of an Ageing Society, LEPAS. Grant Agreement: SSH-2007-3.1.01- 217275. [ Links ]

DAVIES, R.B. and REED, R.R. (2006), Population aging, foreign direct investment, and tax competition. SAID Business School, 1HPWP 07/10. [ Links ]

DÍAZ-GIMÉNEZ, J. and DÍAZ-SAAVEDRA, J. (2009), Delaying retirement in Spain. Review of Economic Dynamics, 12, pp. 147-167. [ Links ]

DOSTIE, B. (2011), Wages, productivity and aging. De Economist, 159, pp. 139-158. [ Links ]

EIRAS, G.M. and NIEPELT, D. (2012), Ageing, government budgets, retirement and growth. European Economic Review, 56, pp. 97-115. [ Links ]

ELGIN, C. and TUMEN, S. (2010), Can sustained economic growth and declining population coexist? Barro-Becker children meet Lucas. Economic Modelling, 29, pp. 1899-1908. [ Links ]

ELMESKOV, J. (2004), Aging, public budgets, and the need for policy reform. Review of International Economics, 12, pp. 233-242. [ Links ]

EUROPEAN COMMISSION, (2006), The Demographic Future of Europe – From Challenge to Opportunity, Directorate-General for Employment, Social Affairs and Equal Opportunities Unit E.1. [ Links ]

EWIJK, C.V. and VOLKERINK, M. (2012), Will ageing lead to a higher real exchange rate for the Netherlands?. De Economist, 160, pp. 59-80. [ Links ]

FINCH, N. (2014), Why are women more likely than men to extend paid work? The impact of work-family life history. European Journal of Ageing, 11, pp. 31-39. [ Links ]

FOUGÈRE, M., et al. (2009), Population ageing, time allocation and human capital: a general equilibrium analysis for Canada. Journal of Economic Modelling, 26, pp. 30-39. [ Links ]

GARAU, G., LECCA, P. and MANDRAS, G. (2013), The impact of population ageing on energy use: evidence from Italy. Economic Modelling, 35, pp. 970-980. [ Links ]

GÖBEL, C. and ZWICK, T. (2012), Age and productivity: sector differences. De Economist, 160, pp. 35-57. [ Links ]

HARPER, S. and LEESON, G. (2009), Introducing the journal of population ageing, Journal of Population Ageing, 1, pp. 1-5. [ Links ]

HOCK, H. and WEIL, D.N. (2012), On the dynamics of the age structure, dependency and consumption. Journal of Population Economics, 25, pp. 1019-1043. [ Links ]

HURD, M.D. and ROHWEDDER, S. (2011), Trends in labor force participation: how much is due to changes in pensions?. Journal of Population Ageing, 4, pp. 81-96. [ Links ]

HURD, M.D. and ROHWEDDER, S. (2013), Heterogeneity in spending change at retirement. The Journal of the Economics of Ageing, 1-2, pp. 60-71. [ Links ]

IMAM, P. (2013), Demographic shift and the financial sector stability: the case of Japan. Journal of Population Ageing, 6, pp. 269-303. [ Links ]

KOPECKY, K.A. (2011), The trend in retirement. International Economic Review, 52, pp. 287-316. [ Links ]

LEE, S.H. and MASON, A. (2007), Who gains from the demographic dividend? Forecasting income by age. International Journal Forecast, 23, pp. 603-619. [ Links ]

LEE, S.H., MASON, A. and PARK, D. (2011), Why does population aging matter so much for Asia? Population aging, economic security and economic growth in Asia. ERIA Discussion Paper Series, ERIA-DP-2011-04. [ Links ]

LI, X., LI, Z. and CHAN, L.W.M. (2012), Demographic change, savings, investment and economic growth, a case from China. The Chinese Economy, 45, pp. 5-20. [ Links ]

LINDH, T. (2004), Is human capital the solution to the ageing and growth dilemma?, OeNB workshop, 2/2004. [ Links ]

LINDH, T. and MALMBERG, B. (2009), European union economic growth and the age structure of the population. Economic Change and Restructuring, 42, pp. 159-187. [ Links ]

LISENKOVA, K., MÉRETTE, M. and WRIGHT, R. (2012), Population ageing and the labour market: modelling size and age-specific effects. Economic Modelling, 35, pp. 981-989. [ Links ]

LOPES, J. and ALBUQUERQUE, P.C. (2014), The characteristics and regional distribution of older workers in Portugal. Revista Portuguesa de Estudos Regionais, 35, pp. 39-57. [ Links ]

LUDWIG, A., SCHELKLE, T. and VOGEL, E. (2011), Demographic change, human capital and welfare. Review of Economic Dynamics, 5, pp. 94-107. [ Links ]

LUGAUER, S. (2012), Estimating the effect of the age distribution on cyclical output volatility across the United States. The Review of Economics and Statistics, 94, pp. 896-902. [ Links ]

MAHLBERG, B., et al. (2013), The age-productivity pattern: do location and sector affiliation matter?. The Journal of the Economics of Ageing, 1-2, pp. 72-82. [ Links ]

MASON, A. and LEE, R. (2011), Population aging and the generational economy: key findings. In R. Lee, A. Mason (eds), Population Aging And Generational Economy Project. A Global Perspective, Cheltenham, UK, and Northampton, MA, USA, Edward Elgar, pp. 3-31. [ Links ]

MASON, A. and LEE, R. (2013), Labor and consumption across the lifecycle. The Journal of the Economics of Ageing, 1-2, pp. 16-27. [ Links ]

MÉRETTE, M. and GEORGES, P. (2009), Demographic changes and the gains from globalisation: a multi-country overlapping generations CGE model, Department of Economics Working Papers No. 0903, University of Ottawa. [ Links ]

MEIJER, C., et al. (2013), The effect of population aging on health expenditure growth: a critical review. European Journal of Ageing, 10, pp. 353-361. [ Links ]

NARCISO, A. (2010), The impact of population ageing on international capital flows, MPRA Paper, 26457. [ Links ]

NARDI, M.D., FRENCH, E. and JONES, J.B. (2010), Why do the elderly save? The role of medical Expenses. Journal of Political Economy, 118, pp. 39-75. [ Links ]

NARAYANA, M.R. (2011), Lifecycle deficit and public age reallocations for Indias elderly population: Evidence and implications based on national transfer accounts. Journal of Population Ageing, 4, pp. 207-230. [ Links ]

NAVANEETHAM, K. and DHARMALINGAM, A. (2012), A review of age structural transition and demographic dividend in South Asia: opportunities and challenges. Journal of Population Ageing, 5, pp. 281-298. [ Links ]

NIMWEGEN, V.N. and ERF, D.V.R. (2010), Europe at the crossroads: demographic challenges and international migration. Journal of Ethnic and Migration Studies, 36, pp. 1359-1379. [ Links ]

OKUMURA, T. and USUI, E. (2014), The effect of pension reform on pension-benefit expectations and savings decisions in Japan. Applied Economics, 46, pp. 1677-1691. [ Links ]

OURS, J.C.V. and STOELDRAIJER, L. (2011), Age, wage and productivity in Dutch manufacturing. De Economist, 159, pp. 113-137. [ Links ]

PARK-LEE, E., et al. (2013), Oldest old long-term care recipients: findings from the national center for health statistics long-term care surveys. Research on Aging, 35, pp. 296-321. [ Links ]

PENG, D. and FEI, W. (2013), Productive ageing in China: development of concepts and policy practice. Ageing International, 38, pp. 4-14. [ Links ]

PLANAS, X.M. (2010), Demographics and the politics of capital taxation in a life-cycle economy. American Economic Review, 100, pp. 337-363. [ Links ]

PRETTNER, K. (2012), Population aging and endogenous economic growth. Journal of Population Economics, 26, pp. 811-834. [ Links ]

SAMUELSON, A.P. (1958), An exact consumption-loan model of interest with or without the social contrivance of money. Journal of Political Economy, 66, pp. 467-482. [ Links ]

SHARPE, A. (2011), Is ageing a drag on productivity growth? A review article on ageing, health and productivity: the economics of increased life expectancy. International Productivity Monitor, 21, pp. 82-94. [ Links ]

SOBOTKA, T., SKIRBEKK, V. and PHILIPOV, D. (2010), Economic recession and fertility in the developed world literature review. European Commission, Directorate-General Employment, Social Affairs and Equal Opportunities Unit E1 – Social and Demographic Analysis. [ Links ]

THIÉBAUT, S.P., BARNAY, T. and VENTELOU, B. (2013), Ageing, chronic conditions and the evolution of future drugs expenditure: a five-year micro-simulation from 2004 to 2029. Applied Economics, 45, pp. 1663-1672. [ Links ]

TOBING, E. (2012), Demography and cross-country differences in savings rates: a new approach and evidence. Journal of Population Economics, 25, pp. 963-987. [ Links ]

TOSUN, M.S. (2003), Population aging and economic growth political economy and open economy effects. Economics Letters, 81, pp. 291-296. [ Links ]

VELARDE, M. and HERRMANN, R. (2014), How retirement changes consumption and household production of food: lessons from German time-use data. The Journal of Economics of Ageing, 3, pp. 1-10. [ Links ]

WALDER, A.B. and DÖRING, T. (2012), The effect of population ageing on private consumption – a simulation for Austria based on household data up to 2050. Eurasian Economic Review, 2, pp. 63-80. [ Links ]

WEIL, D.N. (2006), Population Aging. NBER working paper, 12147. [ Links ]

WU, L. (2013), Inequality of pension arrangements among different segments of the labor force in China. Journal of Aging and Social Policy, 25, pp. 181-196. [ Links ]

YONG, V. and SAITO, Y. (2012), National long-term care insurance policy in Japan a decade after implementation: some lessons for aging countries. Ageing International, 37, pp. 271-284. [ Links ]

Received 12-01-2015. Accepted for publication 02-11-2015.

NOTAS

1The authors would like to thank two anonymous reviewers for the constructive and thoughtful comments. We are responsible for any errors or omissions.

2World Health Organization, Healthy Ageing, in http://www.euro.who.int/en/what-we-do/health-topics/Life-stages/healthy-ageing, accessed on 28th November 2012.

3European statistics (05-11-2012), Employment growth by sex, in http://epp.eurostat.ec.europa.eu/tgm/refreshTableAction.do;jsessionid=9ea7d07d30dcf6332e333a1e44eaacb69590a71ad79c.e34MbxeSaxaSc40LbNiMbxeNb3qSe0?tab=table&plugin=1&pcode=tps00180&language=en, accessed on 17th December 2012.

4Given that this paper focuses on the impact of ageing on growth, the important issue of reverse causality will not be developed. There are some contributions that study the causes of an ageing population (e.g., Bloom and Williamson, 1998; Alders and Broer, 2004; Elgin and Tumen, 2010; Dalgaard et al., 2012). Alders and Broer (2004) and Elgin and Tumen (2010) argue that a countrys economic growth negatively affects its population growth and its fertility rate. Specifically, Alders and Broer (2004) show that the fertility rate tends to decline when there is a positive productivity shock – this shock increases the cost of having children and creates a substitution effect between children and the consumption of goods. Moreover, increasing returns on human capital will increase investment and raise labor force participation, inducing a decline in fertility rates, since couples now choose to allocate their time resource between child bearing, investment in human capital, and work; this means fewer children. The international financial and economic crisis also has an important impact on demographic variables. The significant increase in unemployment rates and the income reduction observed during the crisis is contributing to a reduction in the fertility rate, especially for developed countries, since families have a greater role in supporting children than in supporting the elderly (Weil, 2006; Sobotka et al., 2010).

5Hurd and Rohwedder, (2011) defined DC as a stock of pension wealth at retirement. They do not focus on retirement at any particular age.

6Hurd and Rohwedder, (2011) defined DB as a pension plan that provides an annuity in retirement. They typically focus on retirement at particular retirement ages.