Serviços Personalizados

Journal

Artigo

Indicadores

Links relacionados

Compartilhar

Tékhne - Revista de Estudos Politécnicos

versão impressa ISSN 1645-9911

Tékhne n.12 Barcelos dez. 2009

The Interpretation of Verbal Probability Expressions Used in the IAS/IFRS: Some Portuguese Evidence[1]

Cláudia Teixeira*; Ana Fialho Silva**

(recebido em 5 de Janeiro de 2009; aceite em 20 de Agosto de 2009)

Abstract. One of the main arguments in favour of the adoption and convergence with the international accounting standards published by the IASB (i.e. IAS/IFRS) is that these will allow comparability of financial reporting across countries. However, because these standards use verbal probability expressions (e.g. probable) they require professional accountants to interpret and classify the probability of an outcome or event taking into account those terms and expressions and to best decide in terms of financial reporting.

This paper reports part of a research on the interpretation of verbal probability expressions used in the IAS/IFRS by the auditors registered with the Portuguese Securities Market Commission (CMVM). This analysis was made in isolation, that is, without considering a context.

The findings show that these terms and expressions are differently perceived by the auditors. Thus the paper provides evidence that suggests that it is fair to review the use of verbal probability expressions in accounting standards, namely the IAS/IFRS.

Keywords: verbal probability expressions (VPE); IAS/IFRS; auditors; comparability.

Resumo. Um dos principais argumentos a favor da adopção das normas internacionais de contabilidade publicadas pelo IASB (i.e. IAS/IFRS) é o de que estas normas permitem alcançar a comparabilidade do relato financeiro entre os países. Contudo, pelo facto de utilizarem termos e expressões que exprimem probabilidade (e.g. provável), estas normas exigem aos profissionais da contabilidade que interpretem e classifiquem a probabilidade de ocorrência de um determinado acontecimento através desses termos e expressões, e que decidam qual o critério mais adequado no âmbito do relato financeiro.

Este artigo apresenta parte de um estudo empírico sobre a interpretação dos termos e expressões que exprimem probabilidade utilizados nas IAS/IFRS, por parte dos auditores registados na Comissão do Mercado de Valores Mobiliários (CMVM). A análise desta interpretação foi levada a cabo sem o recurso a qualquer contexto.

Os resultados obtidos sugerem que estes termos e expressões são diferentemente interpretados pelos auditores. Deste modo, o artigo fornece evidência que sugere a necessidade de se repensar a utilização dos termos e expressões que exprimem probabilidade nas normas de contabilidade, nomeadamente nas IAS/IFRS.

Palavras Chave: termos e expressões que exprimem probabilidade (TEP); IAS/IFRS; auditores; comparabilidade.

1. Introduction

One of the main purposes of the international accounting harmonization process developed by the International Accounting Standards Board (IASB) is to achieve the comparability of financial reporting across countries. In order to do so, it is necessary - though not enough - to adopt an identical set of accounting standards. In fact, professional accountants (i.e. accountants and auditors) should also interpret and apply the standards similarly, so as to make possible the international comparability of financial statements (Doupnik & Riccio, 2006).

However, professional accountants are faced with accounting standards using verbal probability expressions (VPE), such as remote, possible, probable and virtually certain, to describe (in terms of probability) the occurrence of a certain event or result (Simon, 2002). Accountants and auditors have to give a meaning to such terms and expressions (Doupnik & Richter, 2003). Auditors, in particular, have to assure the proper application of accounting standards and to evaluate alternative accounting practices. These professionals evaluate the application of accounting principles and criteria used to prepare the financial statements and make recommendations to the companies regarding financial reporting issues.

The accounting standards use VPE to establish the recognition, measurement or disclosure criteria, and accountants and auditors often use and interpret those terms and expressions in their professional activities. This issue is vital, because an inconsistent and imprecise interpretation of VPE by professional accountants can endanger the proper interpretation and application of accounting standards and can represent a serious obstacle to global financial reporting comparability and convergence (Zeff, 2007).

The subject of the use of words versus numbers in the communication of probability in accounting and auditing is essential, for those working in the field and also for those researching, teaching or studying. Companies might have a standard understanding on the specific interpretation of VPE, but there is no evidence on that matter.

Therefore, it is necessary to further research this subject, using companies and professional organizations, thus changing from a theoretical perspective to a more practical approach (Chesley, 1986).

The VPE have been widely used in accounting standards, but little is known about the way they are interpreted. These terms and expressions have been investigated mainly over the last three decades and, essentially, in the United States context. Presently, some reference studies carried out in a European context (e.g. Simon, 2002; Doupnik & Richter, 2003; 2004), though with different scopes and in much lesser numbers, have partially altered this situation, as they investigate the interpretation of these terms and expressions by European professional accountants.

The findings show that these terms and expressions are differently perceived by the auditors. Thus the paper provides evidence that suggests that it is fair to review the use of verbal probability expressions in the accounting standards, namely the IAS/IFRS.

It is timely to investigate the way these terms and expressions are interpreted by both accountants and auditors, considering that a consistent interpretation of such terms and expressions is vital to promote and assure financial information comparability and, so, the needs of its users.

This paper reports part of a research carried out on the way the auditors registered with the Portuguese Securities Market Commission - the Comissão do Mercado de Valores Mobiliários (CMVM) - interpret some VPE used in the IAS/IFRS (Teixeira, 2008). This research represents the first study of Portuguese auditors interpretation of VPE used in the IAS/IFRS. The present paper mainly reports their interpretation in isolation, that is, without a context.

This study is relevant for those involved in regulating financial reporting as it reviews the interpretation of VPE used in the IAS/IFRS by the CMVM registered auditors and draws attention to the existing differences in the interpretation of those terms and expressions. The study is also important for preparers, auditors and users of financial statements, as it identifies the mean interpretation (expressed in percentage) of some VPE by Portuguese auditors.

The paper is structured as follows: In Section 2, the use of VPE in the IAS/IFRS and its influence on the recognition and disclosure criteria are both analysed. Then, in Section 3, a review of previous relevant literature on the subject is presented. In Section 4, the research objectives, the adopted methodology and also population and sample data are provided; as well as the main findings of the study. Lastly, the final comments are presented in Section 5.

2. The VPE used in the IAS/IFRS

The IASB has gradually taken on a particularly dominant role in the international accounting harmonization process. However, the international accounting standards published by the IASB (IAS/IFRS), developed with the objective of promoting the international comparability of financial reporting, use the already mentioned VPE. These terms and expressions are used in those standards to establish the thresholds for the recognition of accounting elements (i.e. financial statement items) such as, assets (e.g. IAS 12 [2]), revenues, expenses and losses (e.g. IAS 11 [3]) and liabilities (e.g. IAS 37 [4]); as well as to establish the thresholds for derecognizing, namely, assets (e.g. IAS 12).

The VPE used in the IAS/IFRS are framed in a positive or negative form, for example, probable and no longer probable (Doupnik & Richter, 2004). Nevertheless, most VPE have a positive form, as is the case of remote and virtually certain.

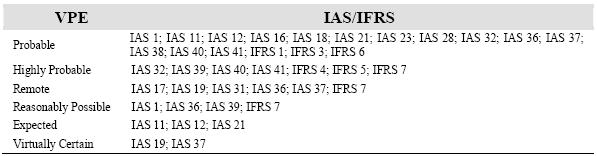

Table 1 shows a summary of some of the most frequently examined and used VPE in the IAS/IFRS (e.g. Simon, 2002; Doupnik & Riccio, 2006), without discriminating its form.

Table 1 – The Most frequently used VPE in IAS/IFRS

In fact, the VPE used in the IAS/IFRS are quite frequent and varied. Therefore, apart from the diversity of terms and expressions, there is also the issue of the number of occurrences of each VPE, which raises considerably the impact of their use.

Of all the VPE used in the IAS/IFRS, the term probable is the most used. As previously illustrated, this term also assumes both positive and negative forms.

Almost all standards have VPE: some of them are mentioned in concepts, while others are present in the recognition, measurement and disclosure criteria. The first may have an indirect impact on the interpretation and application of accounting standards, and those used in the recognition, measurement and disclosure criteria may have a decisive and direct impact on the interpretation and application of accounting standards.

3. Previous Studies on VPE interpretation in the accounting and auditing context

In this section, a review of previous studies published on this matter, within the scope of accounting and auditing, is presented; as well as their methodological approach and main conclusions.

Prior studies have mainly examined the numerical interpretation of the VPE used in the Statement of Financial Accounting Standards (SFAS) Nº. 5: Accounting for Contingencies [5], published by the Financial Accounting Standards Board (FASB). Therefore, the following terms and expressions are the most researched in the literature that reviews the interpretation of VPE in accounting and auditing scenarios: remote, reasonably possible and probable (e.g. Jiambalvo & Wilner, 1985; Chesley, 1986; Harrison & Tomassini, 1989; Reimers, 1992; Amer et al., 1994; 1995; Laswad & Mak, 1997; Aharony & Dotan, 2004; Doupnik & Riccio, 2006).

In the European context, the research in this area is still quite recent and there are few reference studies (e.g. Simon, 2002; Doupnik & Richter, 2003; 2004), which were mainly instigated by the recent developments in the international accounting harmonization process (e.g. the new harmonization of accounting standards in the European Union). Nevertheless, the most studied VPE are remote, probable and virtually certain.

The study conducted by Simon (2002) represents the first research on the interpretation of VPE used in accounting standards by European professional accountants. The thirty terms and expressions examined in that study fairly reflect the diversity and complexity of VPE used in this context.

The predominant research method for assessing the interpretation of VPE has been to survey respondents interpretation through the use of a research instrument (i.e. a survey questionnaire). The majority of the studies on this matter use samples with less than 100 respondents, except for those aimed at students, which register more respondents, though less skilled when compared to the respondents who are professional accountants.

Several methods have been used to assess the interpretation of VPE. For example, respondents have been asked to:

(i) analyse a series of VPE and subsequently to interpret them as numerical percentage (e.g. Chesley, 1986; Reimers, 1992; Amer et al., 1994; Laswad & Mak, 1997; Simon, 2002). This method provides useful indicators about the typical perception of the respondents on VPE;

(ii) assign a numerical range that best represents the probability associated to each VPE (e.g. Jiambalvo & Wilner, 1985; Chesley, 1986; Reimers, 1992; Amer et al., 1994; Laswad & Mak, 1997; Simon, 2002). This method helps to overcome the natural difficulty in assigning a single value, point or estimation (i.e. point estimates) to VPE;

(iii) examine the terms and expressions in the context of the activities they carry out, through the simulation of real professional situations (e.g. Jiambalvo & Wilner, 1985; Harrison & Tomassini, 1989; Amer et al., 1994). The simulation of a context will always be an attempt to recreate the reality, but in practice, this method falls short of its aim, since it is not feasible to generalize all possible scenarios for a given situation or event;

(iv) analyse the terms and expressions in isolation, that is, without a context (e.g. Chesley, 1986; Reimers, 1992; Laswad & Mak, 1997; Simon, 2002; Doupnik & Richter, 2003); and

(v) review the terms and expressions in context, that is, contextualized in standards, through excerpts of the accounting standards (e.g. Doupnik & Richter, 2004; Doupnik & Riccio, 2006). The main objective of this methodology is to understand the perception (expressed in percentage) of such VPE used in different accounting contexts, in order to observe a pattern in the interpretation of VPE along different accounting scenarios (e.g. recognition of liabilities, assets and losses). However, the respondents will always consider their own professional experience in the accounting contexts under analysis, which leads to the implicit consideration of a vast array of scenarios.

The majority of the previous studies have focused on the interpretation of VPE used within the context of SFAS 5 and aimed to evaluate the consistency of the interpretation of VPE among auditors. They, likewise, aimed to assess the consistency of auditors evaluation under the same circumstances and also to determine whether the decision made at the recognition and disclosure criteria established for accounting elements (e.g. contingent losses) was consistent with the percentages or ranges assigned to VPE by professional accountants.

Most of these studies reported inconsistent interpretations of those terms and expressions among professional accountants (e.g. Jiambalvo & Wilner, 1985; Harrison & Tomassini, 1989; Amer et al., 1994; 1995; Simon, 2002; Doupnik & Richter, 2003; 2004; Doupnik & Riccio, 2006). Such inconsistencies might result from the existence or absence of an accounting context.

The literature seems to agree that the use of VPE (and, in particular, the use of the term probable) is not appropriate to express probabilities, and that its inconsistent interpretation can affect the accurate application of accounting standards and comparability of financial reporting.

The results of recent studies, based on Grays (1988) theory, show that culture strongly influences the countries accounting systems and the way the financial information is there perceived (e.g. Doupnik & Richter, 2004; Doupnik & Riccio, 2006; Tsakumis, 2007; Teixeira, 2008; 2009). In this context, national culture can have a negative impact on the interpretation of VPE, as it compromises the consistent interpretation and application of the IAS/IFRS across countries.

Apart from the role played by culture in the interpretation of VPE by professional accountants in general, there are other factors that influence the perception and interpretation of those terms and expressions by auditors, namely the professional judgment and the effect incentives have on auditors decision-making process (e.g. Nelson & Kinney, 1997; Aharony & Dotan, 2004).

Likewise, prior literature provides empirical evidence that supports the existence of different interpretations of VPE by those involved in financial reporting, as a result of conflicting incentives in their analysis (Aharony & Dotan, 2004).

After a general review of previous studies on the interpretation of VPE used in the auditing and accounting standards; the next section presents the outcome of part of a research developed on the interpretation of some VPE used in the IAS/IFRS within the Portuguese context.

4. Empirical Analysis

4.1. Objectives

As a consequence of the new accounting harmonization strategy adopted by the European Union (EU), and considering the Regulation 1606/2002 of the European Commission, the expansion of the adoption and convergence with the IAS/IFRS is imminent in Portugal. Thus, it is timely to study the way the VPE are interpreted by the Portuguese auditors, as European auditing professionals.

This paper reports part of a research carried out in Portugal by Teixeira (2008) and aims to expand the knowledge on this matter. This research represents the first study on Portuguese auditors interpretation of some VPE used in the IAS/IFRS. The present paper mainly reports their interpretation in isolation, that is, without considering a context.

The main question this paper addresses is whether the CMVM auditors interpret these terms and expressions in isolation consistently with the interpretation of professional accountants from other countries.

4.2. Methodology

The methodology adopted in the empirical study follows the general literature and Simon (2002) and Doupnik & Richter (2003), in particular.

As noted earlier, the survey questionnaire is the most common research method used to assess the meaning of VPE.

According to the literature (e.g. Simon, 2002; Doupnik & Richter, 2003), the assignment of probability ranges to VPE is more suitable to represent its likelihood. Thus, the questionnaire designed for the empirical study included a group of nine VPE to be analysed in isolation; and the respondents were asked to indicate a numerical range that, in their opinion, was the most appropriate to represent the probability related to those terms and expressions. The VPE examined in isolation were selected from the IAS/IFRS and the literature. So, nine of the most studied VPE in the European context, namely virtually certain, reasonable assurance, possible, highly probable, reasonable certainty, reasonably possible, remote, probable and reasonably certain, were examined considering the Portuguese version[6].

Meetings were held with Portuguese auditing professionals[7] between September and October 2007, with the purpose of (i) validating the questionnaire in general and the selected nine VPE, in particular; and (ii) analysing the most effective way to get in touch with the auditors considering the research purposes.

The questionnaires began to be sent out in November 2007 and the data collection finished in January 2008.

In short, the questionnaire sent to the CMVM auditors asked the respondents to provide a numerical range (on a scale from 0% to 100%) that best represents the probability associated to those nine VPE written in Portuguese and examined in isolation. The questionnaire also asked questions concerning the characterization of the sample.

The data gathered from the questionnaires were treated with the statistical software program Statistical Package for the Social Sciences (SPSS). Statistical tests were carried out according to the research objectives. Thus, in order to be able to compare the results with those in the literature (Simon, 2002; Doupnik & Richter, 2003) the measure adopted was the magnitude of the mean ranges[8]. Then, the one-sample t-test was conducted to assess whether the mean responses for the examined VPE showed similar interpretation when compared with other studies. Following the literature (e.g. Simon, 2002; Doupnik & Richter, 2006) the outlier observations were removed from the data analysis[9].

4.3. Population and sample

In Portugal, the statutory auditors are called Revisores Oficiais de Contas (ROC). However, in this part, these professionals will be referred to as auditors and the national official designation, ROC, will be mentioned only when characterizing them according to the functions they carry out as auditing professionals in Portugal.

The CMVM auditors were chosen because they are certified professionals who are expected to have the required expertise and professional practice to make decisions about the interpretation of VPE used in the accounting standards. Therefore, and based on the information announced by the CMVM on the 21st of January 2008[10], the population considered in this study consists of 45 entities.

Of the 45 questionnaires mailed (that is, mainly e-mailed) to the CMVM auditors, 35 entities returned the questionnaire, which represents a response rate of approximately 78%.

The respondents were characterized according to (i) their professional experience, (ii) their main specialization, (iii) the functions (no more than two) they perform (or had previously performed) as auditors, and (iv) the knowledge they consider to have on IAS/IFRS.

In short, the sample is mainly composed by:

(i) experienced auditors, with a professional experience of more than ten years (94%);

(ii) auditors whose main professional specialization is auditing itself, that is, the statutory audit (83%);

(iii) auditors who have carried out, at least, functions as partner and ROC (66%);

(iv) auditors whose knowledge on IAS/IFRS is considered to be reasonable (77%).

4.4. Main Findings

According to the research objectives, the main purpose was to (i) examine how some VPE used in the IAS/IFRS - namely virtually certain, reasonable assurance, possible, highly probable, reasonable certainty, reasonably possible, remote, probable and reasonably certain are interpreted by the CMVM registered auditors, without considering a specific context, and then (ii) compare the results with the literature in order to see whether these interpretations are similar to (or different from) other European professional accountants. A significance level of 5% was adopted for all analysis.

Since the uncompleted questionnaires or those with outlier observations were excluded from the statistical analysis, the descriptive analysis resulted from the assessment of 26 questionnaires, which corresponds to a response rate of approximately 58%. The main reason mentioned by auditors to justify the uncompleted questionnaires was the absence of a context to assess the probability associated to the VPE.

The following table summarizes the descriptive statistics for the examined VPE and they are listed in order of increasing mean numerical range assigned by auditors.

Table 2 – Descriptive statistics[11] for the numerical range assigned to the VPE

| VPE | Mean | Median | Standard Deviation | Minimum | Maximum |

| Remote | 10 | 10 | 8 | 0 | 28 |

| Possible | 54 | 50 | 17 | 25 | 100 |

| Reasonably Possible | 64 | 64 | 16 | 40 | 100 |

| Probable | 74 | 78 | 19 | 25 | 100 |

| Reasonable Certainty | 77 | 81 | 15 | 40 | 100 |

| Reasonable Assurance | 78 | 76 | 13 | 40 | 100 |

| Reasonably Certain | 80 | 85 | 15 | 35 | 100 |

| Highly Probable | 88 | 90 | 7 | 70 | 100 |

| Virtually Certain | 92 | 95 | 13 | 40 | 100 |

Considering the mean calculated for the range assigned by the CMVM auditors, the expressions reasonable certainty, reasonable assurance and reasonably certain appear to have similar meaning by the way auditors express them, thus they might be considered as synonyms. The terms possible and probable show a significant dispersion as reflected both in standard deviation and in maximum and minimum values. However, there were found no significant differences in the way auditors interpret them.

As previously said, in order to be able to compare these results with those in the literature (Simon, 2002; Doupnik & Richter, 2003), the measure considered was the magnitude of the mean ranges.

Simon (2002) focused on British auditors who analysed VPE written in their native language, Doupnik & Richter (2003) examined both how US and German professional accountants interpreted VPE written in their native language (in English and German, respectively) and how German professional accountants interpreted VPE written in English. Therefore, and as the study examines the interpretation of VPE written in Portuguese by Portuguese auditors, the most feasible comparison is that with the interpretation of VPE written in the native language of the respondents. However, the results for some of the VPE (i.e. remote and probable) are closer to those shown by Doupnik & Richter (2003) for the interpretation of VPE written in English, by German professional accountants.

To contrast these results with those in the literature, the one-sample t-test was carried out to assess whether the magnitude of the mean ranges showed similar values when compared with other studies (see Table 3). Although, Table 3 also shows the results rounded to the nearest whole percentage, it was decided not to round the range mean when performing the statistical tests in order to compare the results with other studies.

Table 3 – Comparison of the range mean (for the examined VPE) in our study with those in the literature

|

Range Mean

| Portugal |

Simon (2002) United Kingdom

| Doupnik and Richter (2003) United States (US) | Doupnik and Richter (2003) Germany/Switzerland/Austria | |

| In Isolation VPE | VPE [12] (p-value) | VPE [13] (p-value) | VPE [14] (p-value) | VPE[15] (p-value) | VPE [16] (p-value) |

| Virtually Certain | 9 | 7 | 9 | 11 | 7 |

| Reasonable Assurence | 20 | -- | 12 | 14 | 12 |

| Possible | 28 | 37 | -- | -- | -- |

| Highly Probable | 15 | -- | -- | -- | -- |

| Reasonable Certainty | 19 | 16 | -- | -- | -- |

| Reasonably Possible | 23 | 26 | -- | -- | -- |

| Remote | 13 | 9 | 12 | 14 | 11 |

| Probable | 21 | 23 | 16 | 22 | 17 |

| Reasonably Certain | 16 | 16 | -- | -- | -- |

Significant differences were found in the CMVM auditors interpretation of some VPE when compared to the interpretations of other professional accountants. These were namely:

· the interpretation of the expression reasonable assurance is significantly different from the interpretation of US professional accountants (p-value=0,004) and from the interpretation of German speaking professional accountants (p-value=0,023 and p-value=0,003, respectively), as in Doupnik & Richter (2003);

· the interpretation of the term remote is significantly different (p-value=0,012) from the interpretation of the British auditors as identified by Simon (2002).

And quite close to be significantly different, came the following VPE interpretations:

· the interpretation of the term possible (p-value=0,053) when compared with the interpretation of the British auditors as identified by Simon (2002);

· the interpretation of the term probable (p-value=0,069) when compared with the interpretation of the US professional accountants as in Doupnik & Richter (2003);

· And also the interpretation of the expression virtually certain (p-value=0,079) when compared with the interpretation of the German-speaking professional accountants, as in Doupnik & Richter (2003).

In short, the term remote and the expression reasonable assurance show significant differences in the CMVM auditors interpretation, when compared to the European professional accountants, namely, the British in relation to the former, and the German, Swiss and Austrian, in relation to the latter. Nevertheless, the terms possible and probable and the expression virtually certain also show a less consistent interpretation, indicating a lack of consensus between Portuguese and professional accountants of other nationalities.

5. Final Comments

One of the main arguments in favour of the adoption and convergence with the international accounting standards published by the IASB is that these will allow comparability of financial reporting across countries. However, because the IAS/IFRS use VPE when establishing the recognition and disclosure criteria for accounting elements, they require professional accountants to interpret and classify the probability of an outcome or event taking into account those terms and expressions and to best decide in terms of financial reporting.

Auditors have to assure the proper application of accounting standards and to evaluate alternative accounting practices. These professionals evaluate the application of accounting principles and criteria used to prepare the financial statements and make recommendations to the companies regarding financial reporting issues. Therefore, the auditors professional judgment is particularly important, as accounting standards apply to specific cases, and demand the assessment of probability concerning uncertain events.

Once the IAS/IFRS do not have quantitative guidelines for the interpretation of VPE, auditors, apart from using their professional judgment, must also interpret the possible occurrence expressed by those terms and expressions. The professional judgment becomes even more relevant when one is dealing with less developed and emerging economies. The countries that fit into this description, frequently, do not have the professional organizations and institutes that can promote the research and teaching in areas related to professional practice with the necessary expertise and experience for the application of such standards.

In fact, if there is no agreement among auditors on how to interpret these VPE, there might be a potentially serious communication problem and, consequently, an inconsistent application of accounting standards (Amer et al., 1994), which will probably reduce financial statements usefulness (Simon, 2002). This issue is vital, because an inconsistent interpretation of VPE by professional accountants can endanger the proper interpretation and application of accounting standards and can represent a serious obstacle to global financial reporting comparability and convergence (Zeff, 2007).

In the Portuguese context, as shown in Teixeira (2008), the results related to the interpretation in isolation of the VPE remote and reasonable assurance show significant differences in the CMVM auditors interpretation when compared to those of other nationalities (namely by the British, Swiss, Germans and Austrians professional accountants). The results also show that the terms possible, probable and the expression virtually certain seem to reveal a lack of consensus between those professionals.

These VPE establish the recognition and disclosure criteria for accounting elements (e.g. contingent liabilities, assets and losses), thus, different interpretations in this domain can lead to the recognition or derecognition of accounting elements, as well as to the disclosure or non-disclosure of contingent liabilities.

Since the term probable is the most used in the IAS/IFRS, such a circumstance, due to its impact on financial statements, can affect the international comparability of financial reporting.

Considering the evidence provided in the literature regarding accounting and auditing contexts, it is fair to review the use of VPE in accounting standards, namely the IAS/IFRS, in order to make its interpretation easier by providing more useful guidelines for the understanding of those VPE in such specific contexts. On the other hand, accounting standards ambiguity is also harmful for the users of financial reporting, who must deduct from the financial statements (and from the auditors report) the possible occurrence of the reported events.

The debate over this issue and the explanation of the probability levels related to VPE might lead the regulators to reconsider the use of uncertain terms and expressions (Laswad & Mak, 1997). Nevertheless, it is necessary to improve and expand the knowledge on this matter and to examine whether the replacement of the ambiguous and vague terminology with more specific and consensual VPE will reduce the differences in their interpretation. If this does not occur, IASB could adopt the use of suitable numerical equivalents to replace the existing terms and expressions. The clarification of the meaning and interpretation of the VPE used in the accounting standards through their numerical equivalents would be useful both for those interpreting and applying the IAS/IFRS and for those who use financial statements for decision-making (Doupnik & Richter, 2004).

Acknowledgements

The authors wish to thank the following Portuguese statutory auditors and former partners in international auditing companies, Jorge Morgado, José Silva Fernandes and António Santos, whose expertise and helpful suggestions were essential for the development of the empirical study. Special thanks are due to the participants for giving their consideration and time to respond to the questionnaire. Sincere thanks to Delfina Gomes (University of Minho, Portugal) for the discussion and helpful comments regarding this research and also to Janete Borges for the statistical treatment of the data.

The authors also wish to express their gratitude to the anonymous reviewers for the helpful observations and suggestions made on an earlier version of the present paper.

References

Aharony, J. & Dotan, A. (2004), A Comparative Analysis of Auditor, Manager and Financial Analyst Interpretations of SFAS 5 Disclosure Guidelines, Journal of Business Finance and Accounting, Vol. 31, Nº 3/4, pp. 475-504. [ Links ]

Amer, T.; Hackenbrack, K. & Nelson, M. (1994), Between-Auditor Differences in the Interpretation of Probabilities Phrases, Auditing: A Journal of Practice and Theory, Vol.13, N. º 1, pp. 126-136.

Amer, T.; Hackenbrack, K. & Nelson, M. (1995), Context-Dependence of Auditors´ Interpretations of the SFAS N. º 5 Probability Expressions, Contemporary Accounting Research, Vol. 12, N. º 1, pp. 25-39.

Chesley, G. (1986), Interpretation of Uncertain Expressions, Contemporary Accounting Research, Vol. 2, N. º 2, pp. 179-199.

CMVM (2008). Sistema de Difusão de Informação: Auditores, http://web3.cmvm.pt/sdi2004/auditores/auditores_lista.cfm.

Doupnik, T. & Riccio, E. (2006), The Influence of Conservatism and Secrecy on the Interpretation of Verbal Probability Expressions in the Anglo and Latin Cultural Areas, The International Journal of Accounting, Vol.41, pp.237-261.

Doupnik, T. & Richter, M. (2003), Interpretation of Uncertain Expressions: A Cross-National Study, Accounting, Organizations and Society, Vol. 28, pp. 15-35.

Doupnik, T. & Richter, M. (2004), The Impact of Culture on the Interpretation of In Context Verbal Probability Expressions, Journal of International Accounting Research, Vol. 3, N.º 1, pp. 1-20.

Financial Accounting Standards Board, FASB, (1975), Statement of Financial Accounting Standard, N. º 5, Accounting for Contingencies, http://www.fasb.org/pdf/fas5.pdf.

Gray, J. (1988), Towards a Theory of Cultural Influence on the Development of Accounting Systems Internationally, Abacus, Vol. 24, N. º 1, pp. 1-15.

Harrison, K. & Tomassini, L. (1989), Judging the Probability of a Contingent Loss: An Empirical Study, Contemporary Accounting Research, Vol. 5, N. º 2, pp. 642-648.

International Accounting Standards Board, IASB, (1993), International Accounting Standard, N. º 11, Contratos de Construção, http://www.cnc.min-financas.pt.

International Accounting Standards Board, IASB, (1998), International Accounting Standard, N.º 37, Provisões, Passivos Contingentes e Activos Contingentes,http://www.cnc.min-financas.pt.

International Accounting Standards Board, IASB, (2000), International Accounting Standard, N. º 12, Impostos Sobre o Rendimento,http://www.cnc.min-financas.pt.

Jiambalvo, J. & Wilner, N. (1985), Auditor Evaluation of Contingent Claims, Auditing: A Journal of Practice and Theory, Vol. 5, N. º 1, pp. 1-11.

Laswad, F. & Mak, Y. (1997), Interpretations of Probability Expressions by New Zeeland Standard Setters, Accounting Horizons, Vol. 11, N. º 14, pp. 16-23.

Nelson, M. & Kinney, W. (1997), The Effect of Ambiguity on Loss Contingency Reporting Judgements, The Accounting Review, Vol. 72, Nº. 2, pp. 257-274.

Reimers, J. (1992), Additional Evidence on the Need for Disclosure Reform, Accounting Horizons, Vol. 6, pp. 36-41.

Simon, J. (2002), Interpretation of Probability Expressions by Financial Directors and Auditors of UK Companies, The European Accounting Review, Vol. 11, N. º 3, pp. 601-629.

Teixeira, C. (2008), A Interpretação dos Termos e Expressões que Exprimem Probabilidade Utilizados no Normativo do IASB: O Caso dos Auditores Registados na CMVM, Dissertação de Mestrado em Contabilidade e Auditoria, Universidade do Minho, Braga.

Teixeira, C. (2009), O Impacto da Cultura na Interpretação dos Termos e Expressões que Exprimem Probabilidade Utilizados no Normativo do IASB, Prémio Professor Rogério Fernandes Ferreira, Câmara dos Técnicos Oficiais de Contas, Lisboa.

Tsakumis, G. (2007), The Influence of Culture on Accountants´ Application of Financial Reporting Rules, Abacus, Vol. 43, N. º 1, pp. 27-48.

Zeff, S. (2007), Some Obstacles to Global Financial Reporting Comparability and Convergence at a High Level of Quality, The British Accounting Review, Vol. 39, pp. 290-302.

Notas

[1] Correspondence: Cláudia Teixeira, Instituto Superior de Contabilidade e Administração do Instituto Politécnico do Porto (ISCAP/IPP), Portugal; Mob: 00351914164867; E-mail: mclaudia@iscap.ipp.pt

[2] IAS 12, Income Taxes, IASC 1996, reviewed in 2000.

[3] IAS 11, Construction Contracts, IASC 1993.

[4] IAS 37, Provisions, Contingent Liabilities and Contingent Assets, IASC 1998.

[5] Hereafter referred to as SFAS 5.

[6] The Portuguese version: virtualmente certo(a), segurança razoável, possível, altamente provável, certeza razoável, razoavelmente possível, remoto(a), provável e razoavelmente certo(a).

[7] Portuguese statutory auditors, who were former partners in international auditing companies and academics.

[8] Simon (2002) name this measure as range mean, which is calculated as the difference between the two means derived from asking financial directors to provide a lower and upper numerical probability which might reasonably include a particular probability expression. The smaller the range mean, the greater the consensus regarding the interpretation of the probability expressions (Simon, 2002:619).

[9] As in Doupnik & Riccio (2006), all responses that assigned a percentage of (or above) 50% to the term remote were excluded.

[10] Considering the last change being made to the CMVM auditors list before the data analysis on the 28th of February 2008.

[11] As in Simon (2002), the results are rounded to the nearest whole percentage.

[12] Analysing VPE written in Portuguese.

[13] Analysing VPE written in English.

[14] Analysing VPE written in English.

[15] Analysing VPE written in English.

[16] Analysing VPE written in German.

[17] Titulo reconhecido pelo ISCTE.

Brief CV

*Cláudia Teixeira is an assistant lecturer in financial accounting at the School of Accounting and Administration of Oporto (ISCAP/IPP), Portugal. She has obtained a Master of Science in Accounting and Auditing from the University of Minho in Portugal. She has published her research work in national academic journals and was distinguished with an honourable mention by the Centre of Management Studies (CEGE/ISEG) of the Technical University of Lisbon, the Portuguese Order of Statutory Auditors (OROC) and the Portuguese Chamber of Chartered Accountants (CTOC) at the Prize Professor Rogério Fernandes Ferreira in 2009.

**Ana Fialho Silva. Membro Integrado do Centro de Estudos e Formação Avançada em Gestão e Economia da Universidade de Évora (CEFAGE-UE). Doutora em Gestão com especialidade em Contabilidade [17] pela Universidade de Saragoça. Docente da área científica de Contabilidade, do Departamento de Gestão, da Universidade de Évora, onde lecciona as disciplinas de Contabilidade Financeira I e II no 1º Ciclo, Teoria da Contabilidade, Contabilidade Financeira Avançada e Contabilidade Internacional, no curso de Mestrado em Gestão, área de especialização de Contabilidade, em regime de dedicação exclusiva, desde Abril de 1991.