Serviços Personalizados

Journal

Artigo

Indicadores

-

Citado por SciELO

Citado por SciELO -

Acessos

Acessos

Links relacionados

-

Similares em

SciELO

Similares em

SciELO

Compartilhar

Tourism & Management Studies

versão impressa ISSN 2182-8458

TMStudies no.7 Faro dez. 2011

The Changes of the Meeting Industry in Krakow in the Context of the Global Crisis

As mudanças da indústria de reuniões em Cracóvia no contexto da crise global

Krzysztof Borodako1, Jadwiga Berbeka2, Katarzyna Klimek3, Agata Niemczyk4 and Renata Seweryn5

1Senior Researcher, Tourism Department, Krakow University of Economics email: Krzysztof.Borodako@uek.krakow.pl

2Associate Professor, Tourism Department, Krakow University of Economics email: Jadwiga.Berbeka@uek.krakow.pl

3Senior Researcher, Tourism Department, Krakow University of Economics Scientific Fellow, University of Applied Science of Western Switzerland, HES-SO Valais email: Katarzyna.Klimek@uek.krakow.pl

4Senior Researcher, Tourism Department, Krakow University of Economics email: Agata.Niemczyk@uek.krakow.pl

5Senior Researcher, Tourism Department, Krakow University of Economics email: Renata.Seweryn@uek.krakow.pl

ABSTRACT

The main purpose of the paper is to identify changes in the meeting industry in Krakow. One of the reasons for the changes was the global crisis. An attempt to prove the thesis has been undertaken. Research on the meeting industry in Krakow was conducted on the basis of a questionnaire addressed to operators of facilities that can organise business events of this type. The respondents were asked about quantitative data connected with the business tourist traffic, but the questions also concerned opinions connected with the development of this market segment. At the beginning of the study, a review of literature devoted to the issues of shaping the demand for business tourism, with special consideration of the impact of the economic crisis on it, was conducted. In the empirical part, research results conducted in Krakow in 2008 -2010 were presented. They illustrate the number of MICE type events in the city, their structure and seasonality. The sectors of the parties ordering MICE type events in the city were listed. The number of participants of the events was analysed, divided into national and international participants. The results of the research conducted in Krakow allowed for the ascertainment that the economic crisis affected the changes of the level, and above all, the structure of MICE type events organised in the city, which was visible in 2010, therefore with some time delay. Fewer events were organised in the city, but they were more numerous in terms of the number of participants. This has an economic and psychological justification, and it can be deduced that the aforementioned changes were induced by the economic crisis.

KEYWORDS: tourism, meeting industry, crisis, Krakow.

RESUMO

O objetivo principal do trabalho é identificar as mudanças no setor das reuniões de negócios em Cracóvia. Aqui fazemos a tentativa de provar a tese de que uma das razões para as mudanças foi a crise global. Esta investigação foi conduzida com base num questionário aos operadores de infra-estruturas com condições para organizar este tipo de eventos. Os inquiridos foram questionados sobre dados quantitativos relacionados com o tráfego de turistas de negócios, mas as perguntam também diziam respeito a opiniões relacionadas com o desenvolvimento deste segmento de mercado. No início do estudo foi feita uma revisão da literatura dedicada às questões da formação da procura de turismo de negócios, considerando especialmente o impacto da crise económica. Na parte empírica são apresentados resultados de pesquisas conduzidas em Cracóvia, em 2008 -2010, que ilustram o número de eventos tipo MICE na cidade, a sua estrutura e sazonalidade. Foram listados os setores da procura de eventos MICE na cidade e foi analisado o número de participantes dos eventos, dividido entre participantes nacionais e internacionais. Os resultados da pesquisa permitiram constatar que a crise económica afetou o nível, e acima de tudo, a estrutura de eventos MICE, o que se tornou visível em 2010, com algum atraso. Foram organizados menos eventos na cidade, mas eles registaram mais participantes. Isto tem uma justificação económica e psicológica, e pode-se deduzir que as alterações referidas foram induzidas pela crise económica.

PALAVRAS-CHAVE: Turismo, Indústria de Reunião, Crise, Cracóvia.

1. INTRODUCTION

Globalization has changed the world economy forever. The introduction of open market economies in many countries, the liberalization of capital flows and free movement of persons create an integrated and interdependent economy, in which tourism plays an important role. (UNWTO, 2009). The tourism industry is highly sensitive to global economic developments, so vulnerable to crises. The World Tourism Organization (UNWTO) estimated that international arrivals decreased by 4% in 2009 (UNWTO, 2010).

Business travel and tourism seem to be particularly dependent on the condition of the global economy, since the growing globalisation forces people to travel on business. According to the director of American Express Consulting, "a business that needs people to travel so they can generate revenue can’t afford to cut out travel" (Rice, 2001: 15).

Some economists consider crises as shocks to the entire economic system (Friedman, 2008; Fukuyama, 2009; Klein, 2008; Krugman, 2000; Samuelson, 2004). The subjects of crises in tourism and the MICE sector have long been a concern of academic literature & research (e.g. Davidson, 2003; Gleasser, 2006; Laws & Pireadeaux, 2006; Hall, 2010; Papatherodorou, 2010; Ritchie, 2008, 2009; Rogers 2008). Furthermore, many international institutions publish annual reports & studies concerning this subject. (UNWTO, 2009; MPI, 2009; MPI, 2010)

The recent crisis has also affected the tourism industry in Poland. The aim of this paper is to identify and explain the consequences of the global tourism crises for the meeting industry in the city of Krakow.

2. LITERATURE REVIEW

The recession of 1990s and the Persian Gulf conflict very seriously affected the financial condition of many international companies for the first time after WW2. So far the greatest stamp on the development of global tourism, and business trips in particular, was left by the terrorist attacks of September 11, 2001. Since the key symbols of the global business sector collapsed together with the WTC buildings, i.e. the World Trade Center and the jet plane as a safe means of transport (Davidson, 2003). At the moment the global MICE sector is strongly affected by a global economic crisis which emerged as a result of, inter alia, subprime loans in the real estate deals in the US (UNWTO, 2009: 5-6). The progressing economic recession resulting from that process gave rise to the reduction of business events ordered and organised in many countries of the world.

In particular, the effects of the economic recession of the last three years have had an unfavourable impact on the condition of companies and corporations, thus also on the situation of business events clients. This is why changes in the behaviour of decision makers and persons travelling on business can be seen worldwide. They reveal themselves in: shortening the duration of business trips, considerable reduction of budgets for company meetings, conferences and incentive trips and, in connection with this, searching for destinations and service providers, competitive in terms of prices (a ratio of high quality service to a low price is important for the decision makers), reducing expenditures on high class hotels and airplane tickets, reducing the number of intercontinental trips in favour of intra-regional or national meetings i.e. trips "closer to home", the emergence of a "fashion" for travelling with one’s family, particularly among conference and congress participants, which undoubtedly brought business trips closer to classical recreation tourism, shortening the duration of events and the number of participants, in particular of incentive trips, clients’ stress on the highest possible return on investment (i.e. ROI) and increasing the effectiveness of meetings, paying attention to sustainable development and ecology, hence the growing popularity of ecological destinations and the so-called green events, the frequent use of modern technologies and replacing traditional events with virtual meetings(e.g. video conferences) (Davidson, 2009; Davidson, 2010, MPI, 2009; MPI, 2010).

In light of the above, clients at the moment are looking for savings and reducing expenditures on business trips. For this reason in 2010 a majority of meeting planners predicted budget cuts and controls (MPI, 2010). Also 2009 was a time of crisis for the industry. From the MPI FutureWatch 2009 report it is evident that companies’ expenditures on business trips in that year were cut by as much as 17%, in the event of associations by 12%, while of government organisations by 10% in relation to 2008 (MPI, 2009). These unfavourable tendencies also apply the Polish market. 2009 was not particularly good for the organisers of MICE events. The companies, using the crisis as an excuse, were looking for savings. This is why they either fully resigned from meetings planned earlier, or considerably decreased their number in the last year (MICE Poland, 2009).

According to the survey conducted at MeetingsPoland EXPO 2009 fairs, among employees of the MICE sector, in 2009 a decrease of orders for conferences and congresses (10 to 20%), events for employees (10-15%) and incentive trips (10 to 50%) was noticed – depending on the sector (MICE Poland, 2009).

The crisis affected, in particular, the clients’ condition and this is why in 2009-2010, there were spectacular bankruptcies, customer take-overs and the emergence of several new entities on the Polish MICE market (MICE Poland 2010)[i]. In connection with the financial crisis, customers of the meeting industry are more and more often searching for confirmation whether costs paid on conference or incentive events have economic justification, demanding the highest return on investment (ROI).

Programmes of business events are also subject to time pressure according to the valid tendency: Time is money, time is precious. This is why in 2010, the average number of nights per incentive event fell from 6.5 to 4 (Davidson, 2009). Due to economic reasons many companies also decide to replace conferences and trips with the so-called video conferences or conferences over the computer networks. From the survey research conducted in 2009 on a group of American meeting planners it is evident that nearly half of them referred to alternative types of meetings, making use, inter alia, of so-called webinars[ii] in 54%, teleconferences in 48%, and videoconferences in 30% (PCMA/AMEX/Y, 2009).

Globalisation and growing competition in practically each sector forces the organisation of various types of meetings connected with the work conducted at many business destinations. In 2009, 25% of American meeting planners considered the organisation of meetings in Eastern Europe (including Poland) (Davidson, 2009). On the business tourism map, Krakow is still a "new" direction of travel, particularly for international meeting planners. During the last three years (2008-2010), over 25 thousand business events of various types were organised in this city, which points to a growing interest in Krakow as a place of meetings, training or conferences. However, during the last year, the global economic crisis also affected a noticeable decrease of business events organised here.

3. METHODOLOGY

The results of survey research conducted in 2009-2010 were used to verify the research objective adopted in the article. The purpose of the research was to diagnose the MICE tourism market in Krakow. The research was conducted on the basis of a questionnaire sent by mail or email to entities possessing their own infrastructure allowing for the organisation of MICE events. The authors’ research tool consisted of three parts: the first concerned quantitative data of the demand side of the MICE tourism market; the second connected with experts’ opinions concerning the business tourism market in the city, and the third – respondents’ particulars. The questionnaire was given to 247 entities from the base prepared by the research team members based on the data of institutions connected with tourism and available telephone and address bases. The rate of return was 50.42% in 2009 and 31.58 % in 2010. Entities with an infrastructure making it possible to organise MICE-type events took part in the conducted research, and the predominating type of the examined tourism enterprise was a hotel with over 110 beds, located within the Old Town, possessing 1 room that could host up to 80 persons, providing the comprehensive organisation of business events, i.e. offering a full scope of services: accommodation, food, professional organisation and servicing of the conference, as well as possessing rest and recreation facilities.

It must be emphasised that in 2010, despite a smaller return of questionnaires than in the previous year, the profile of a typical tourist facility with an infrastructure making it possible to organise MICE type events did not change in essence (the only difference was in the number of offered rooms – in 2009: 1 room, in 2010: 2-3 rooms), thus ensuring the comparability of results in the examined years. Due to the existing definition difference of fairs and exhibitions and due to the fact of their organisation in Krakow by four recognisable companies, the meeting industry was considered in the article without those categories.

4. MAIN RESULTS

The results of the conducted research indicate that a level of MICE-type tourist traffic in facilities of the examined operators in Krakow in 2008-2009 stayed on a similar level: in 2008 there were 8,397 events, in 2009 – 8,406, so there was even a growth by 0.11%, while in 2010 their number went down by 21.2% (6,615 meetings).[iii]The analysis of MICE-type events in Krakow shows that in all three years over a half of them were training sessions and courses, respectively 53%, 57.3% and 50.9%. The aforementioned event structures in 2008 and 2009 were very similar to each other, it is proven by the similarity of structures measure wp=95.56%. While in 2010 changes occurred consisting in the growth of the share of seminars and training up to 22.99% (therefore by 14.75 percentage points) and a decrease of the conference share down to 18.22%, (therefore by 14.18 percentage points) in relation to 2008.

The analysis of the distribution of MICE-type events schedule in Krakow shows that in 2009 events were most preferably organised in spring months: 12.1% in May, 11.3% in April, 10.5% in March; and a bit fewer events were organised in September and October, 9.5% in each month. While in 2010, the greatest intensity of events occurred in the autumn period: 14.3% in September and 13.2% in October, while in spring 11.7% events were organised in May and 10.9% in June, about 7% of all events was organised in each of the remaining spring months. The aforementioned changes, however, could have been partially caused by flight restrictions in April in the entire European airspace connected with the eruption of the Icelandic volcano.

The crisis also affected the size of tourist traffic in Krakow. Namely, already in 2009, a considerable reduction of the number of participants of MICE events in the city was observed – by 10.36% (from 333,646 persons to 299,086 persons). 2010 brought another decline, however decisively smaller – only by 2.50% (down to 291,620 persons). On the whole, in the analysed period, the number of guests participating in Krakow business meetings went down by 12.60%.

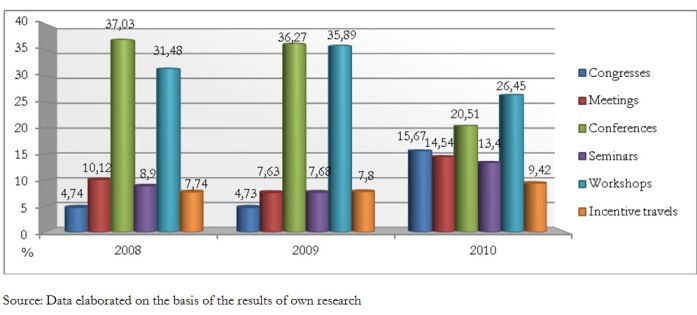

A change, though smaller, is also seen in the structure of the business traffic in the city (Figure 1). In 2009, compared to 2008, only a small shift was noted (similarity of structures measure [Starzyńska, 2004: 74] on the level of 93.55%). While only in 2010 (thus with some delay), the crisis clearly made itself known. Since the share of guests coming to conferences and training decisively decreased (respectively by 16.52% and 9.44%). While other types of events were more popular, including, in particular, large conferences (growth in the number of participants by 10.95%).

Figure 1: The Structure of participants of MICE events organised in Krakow in 2008-2010

As a result of those circumstances, the structure similarity ratio of participants of the meeting industry in Krakow for 2009 and 2010 was only on the level of 74.74%. It is also worth analysing the structure of guests coming to the city to national and international events. Insofar as the share of participants in particular types of meetings (both national and international) was very similar in 2008 and 2009 (the structure similarity ratio on the level of 96.44% and 87.71% respectively), in 2010 considerable changes were noted (the structure similarity ratio of: 77.08% and 48.85%, respectively). Namely, in the group of persons participating in national events, the percentage of people taking part in conferences went down (from 32.71% to 20.86%), and training sessions (from 41.62% to 30.55%) in favour of participants of meetings (increase from 7.59% to 16.19%) and seminars (from 7.61% to 14.91%). In turn, among tourists taking part in international events, all types of meetings lost their importance (conferences above all: decrease from 50.79% to 18.58%), except for large congresses (growth from 11.13% to 62.28%).

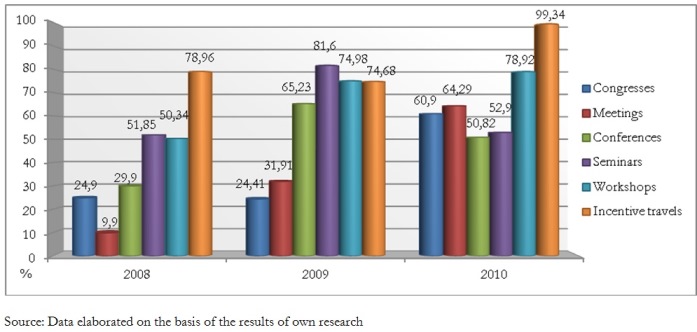

Therefore, this confirms previous conclusions, both about the delayed effects of the 21st century crisis in the meeting industry and those about a greater preference for large events on the part of participants in the age of economic collapse. It cannot be disregarded that fluctuations of a share of foreign participants in international business meetings organised in Krakow (Figure 2) were also a consequence of the economic crisis. Although in 2009 a percentage of foreigners participating in international incentive events decreased slightly (by 4.28 percentage points) and large congresses (by 0.49 percentage points), an increase was recorded in other types of events (the largest growth in international conferences and seminars, respectively by 35.25 percentage points and 29.75 percentage points).

Figure 2: The Structure of forein participants of international events organised in Krakow in 2008-2010

On the whole, the percentage of foreigners participating in international meetings of the MICE type in the city increased in 2008-2009 as much as by 27.51 percentage points (which demonstrates the delayed crisis effects) i.e. from 33.91% to 61.54%, and kept a nearly identical value (61.42%) the next year. Nevertheless, however, considerable movements occurred in 2010. Namely a percentage of foreign guests taking part in international seminars and conferences decreased (respectively by 28.70 percentage points and 14.41 percentage points), and large and small congresses and incentive events organised in Krakow (growth by 36.49 percentage points, 32.38 percentage points and 24.65 percentage points, respectively) were decisively more popular with foreigners. These results point to a greater popularity of large events at the time of an economic collapse. Additionally, they allow for the conclusion that during the crisis companies chose less expensive countries as the place for the organisation of incentive trips for their employees, but with an interesting offer, and Krakow certainly has such an offer.

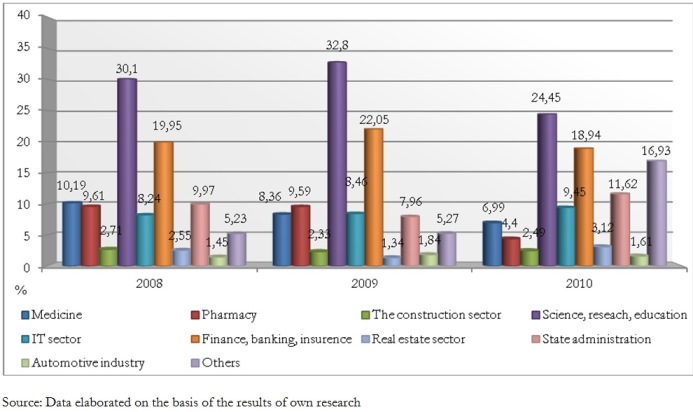

The analysis of empirical material obtained from the research also made it possible to identify the ordering parties sectors. A conclusion can be drawn about a large share of the science, research and education sector among all ordering parties of MICE type events (except for fairs and exhibitions) on the basis of data presented in figure 3. It must be noticed, however, that in 2010, a considerable decline of events ordered by this sector occurred (by 8.3% in relation to the previous year and nearly by 6% in relation to 2008) (compare Figure 3).

Figure 3: The Structure of MICE events according to the structure of industry clients in 2008-2010

The effects of the economic crisis quite considerably influenced the number of events organised not only in the sector of science, research and education, but also in the sector of medicine, pharmacy, banking and insurance, and construction. On the other hand, it is necessary to record an increase of events ordered to operators by the entities from the following sector: IT and telecommunication, state administration, automotive, real estate, and, to the largest degree by entities classified as "other" sectors. Inter alia the following ones are listed: production and trade, clothing industry, media/entertainment, producers of process equipment, tobacco industry, power sector, environmental protection, multi-sector associations, cosmetology, tourism and catering, culture and art, museology, training for people, transport.

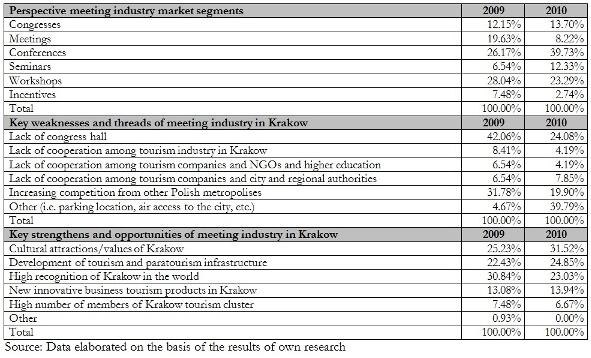

The development of business tourism in a given tourist destination is connected with the changes within its area, but also with changes taking place in its national and international surroundings. Research into business tourism in Krakow was also connected with learning the opinions of business event operators as regards the most perspective segments of this market within the next 5 years. Respondents, in both years of the research, had different opinions about segments which will be of key importance for Krakow. A growth in interest in segments such as congresses (by 2 percentage points), conferences (by 14 percentage points) and seminars (by 5 percentage points) is noticeable, but the greatest increase was recorded in the case of conferences. At the same time those changes were connected with forecasting lower chances for the dynamic growth of other market segments. And so: meetings, workshops and incentive trips recorded a decline in their potential by 12 percentage points, 5 percentage points and 4 percentage points, respectively). It can be stated that, on the one hand, the construction of the congress centre in Krakow slightly improved positive prospects for this market segment, while a shift of greater events (meetings) towards smaller (conferences and meetings) was observed – Table 1.

Table 1: Selected problems of business tourism in Krakow mentioned in 2009 and 2010 (by respondents) connected with its development in the next five years

Another aspect of the analyses of changes in business tourism in Krakow was the examination of the operators’ opinion concerning the weaknesses and threads for the development of tourism in the city. Due to the fact of adding additional answers (reported in the first edition by single respondents) in the second edition, the structure of answers was strongly shifted. The inclusion of those additional weaknesses and threads resulted in the fact that in the second year those answers were listed by as many as 40% of the examined persons, whereas a year earlier only 5%. In return, indications mentioning the lack of a congress hall (from 42% to 24%) were considerably reduced, as well as risks resulting from the growing competition from other Polish metropolises (from 32% to 20%). The remaining changes were on a relatively low level.

Building an effective policy of development of business tourism in Krakow must be based on substantive information on strengths and opportunities the city should use. In light of such conducted research it must be stated that a greater number of respondents specified the following strengths of the city: cultural assets of the city and the development of the tourist and tourist-related infrastructure (growth by 7% and 3%, respectively). Recognition for new innovative business tourism products in Krakow also increased slightly (by just under 1%). The greatest decline in 2010 was recorded in terms of Krakow’s high recognition in the world as an opportunity for the development of business tourism in Krakow in the upcoming 5 years.

5. CONCLUSION

The results of the conducted research lead to the conclusion that in 2010 a decrease of MICE type events organised in Krakow was recorded, with a simultaneous small decline in number of their participants, and changes of the structure of meetings were also noticed. It can be explained by the fact that in the period of economic collapse (half of 2008), a large part of participants had already had planned (and often also financed) the meetings for the next year. The "locking effect" known in economics took place most probably in the event of the remaining group, (Krasiński, Piasny, Szulce, 1984: 156-157), also known as Thore’s age-consumption hypothesis (Thore, 1956: 17-21 and 71-74).

This law refers to markets with a formed tourist demand that is such markets where the need for travel is an extremely important need (and participation in MICE tourism seems to be such a need). Tourists of those segments demonstrate (at least for some time) a tendency to retain the already reached level of tourism activity (the aroused need to participate in group business events is so strong that a change of economic conditions only later leads to resignation from the trip), which is connected with the use of credits and reduction of expenditures in other areas (Seweryn, 2010: 275). Therefore, only planning in 2009 the meetings for 2010 did the business tourists consider the financial situation, both their own and of their company. The consequence was a change of the tourism consumption structure i.e. participation in large events, thus less expensive. In preparing events for a large number of participants (congresses, in particular) organisers can obtain significant discounts from accommodation, catering and conference facilities operators as well as from companies offering accompanying events (museums, theatres, paintball, etc.). For this reason, the fees for participating in such meetings are reduced, the reduction of which is further increased by the synergy effect (decrease of a unit cost with the growth of the number of identical operations). As a result, a large number of persons can afford to participate in meetings. One also cannot fail to notice that many potential participants of group business meetings in a situation of a limited budget, their own or the employers’, very often resign from several smaller events in favour of one larger event.

To sum up: the results of the research conducted in Krakow allowed for the ascertainment that the economic crisis affected the changes of the level, and above all the structures of MICE type events in the city, which was marked in 2010, therefore with some time delay.

BIBLIOGRAPHY

DAVIDSON, R. (2003), "Business Travel", Pearson Education Limited, Essex. [ Links ]

DAVIDSON, R. (2009), "EIBTM 2008 Industry Trends&Market Share Report", Barcelona. [ Links ]

DAVIDSON, R. (2010), "EIBTM 2008 Industry Trends&Market Share Report", Barcelona. [ Links ]

FRIEDMAN, M. (2008), "Milton Friedman on Economics: Selected Papers", University of Chicago Press, Chicago. [ Links ]

FUKUYAMA, F., AND COLBY, S. (2009), "What Were They Thinking? The Role of Economists in the Financial Debacle", The American Interests, 5 (1), 18-25. [ Links ]

GLEASSER, D. (2006), "Crisis management in the tourism industry", Butterworth-Heinemann, Oxford. [ Links ]

HALL, M. (2010), "Crisis events in tourism: subjects of crisis in tourism", Current Issus in Tourism, 13 (5), 401-417. [ Links ]

KLEIN, N. (2008), "The shock doctrine. The rise of disaster capitalism", Metropolitan Books, New York. [ Links ]

KRASIŃSKI, Z., PIASNY, J., AND SZULCE, H. (1984), "Economics of Consumption", PWE, Warszawa (in Polish). [ Links ]

KRUGMAN, P. (2000), "Crises: the price of globalization", University of Chicago Press, Chicago. [ Links ]

LAWS, E., AND PRIDEAUX, B. (2006), "Crisis management: A suggest typology", Journal of Travel and Tourism, 19 (2/3), 1-8. [ Links ]

MICE POLAND (2009), "From fair to fair under the sign of the crisis", Warsaw (in Polish). [ Links ]

MICE POLAND (2010), "It was like in a Brasilian soap opera", Warsaw (in Polish). [ Links ]

MPI (2009), "FutureWatch 2009", Luxembourg. [ Links ]

MPI (2010), "FutureWatch 2010", Luxembourg. [ Links ]

PAPATHEODOROU, A., ROSSELLO, J., AND XIAO, H. (2010), "Global economic crisis and tourism: Consequences and perspectives", Journal of Travel Research, 49 (1), 39-45. [ Links ]

PCMA, AMEX and YPARTNERSHIPS (2009), "PCMA/ AMEX and Partnership's Meeting Planners Intentions Survey", Chicago. [ Links ]

RICE, K., (2001), "A more incentive way to fly", Financial Times, 17 April. [ Links ]

RITCHIE, B.W. (2008), "Tourism disaster planning and management: From response and recovery to reduction and readiness", Current Issues in Tourism, 11 (4), 315-348. [ Links ] RITCHIE, B.W. (2009), "Crisis and disaster management for tourism", Channel View, Bristol. [ Links ] ROGERS, T. (2008), "Conferences and Conventions, A global industry", Butterworth&Heinemann, Oxford. [ Links ]

SAMUELSON, P. (2004), "Economics: An Introductory Analysis", McGraw–Hill, New York. [ Links ] SEWERYN, R. (2010), "Competitiveness of Krakow on the tourist market during the economic crisis (based on results of research of tourist traffic)" in J. Sala (eds.) "Competitiveness of cities and regions on the global tourist market", PWE, Warszawa, 272-292 (in Polish). [ Links ]

STARZYŃSKA, W. (ed.) (2004), Basic Statistics, Difin, Warsaw (in Polish). [ Links ]

THORE, S.A.O. (1956), "A Critique of the Theory of the Consumption Function", Institut Universitaire d’Etudes Europeennes de Turin, Turyn. UNWTO (2009), "Global Financial and Economic Crisis: What are the Implication for World Tourism", UNWTO Press Release, Madrid. [ Links ] UNWTO (2010), "International tourism on track for a rebound after an exceptionally challenging 2009", UNWTO Press Release, Madrid. [ Links ]

Submitted: 14.08.2011

Accepted: 21.10.2011

NOTES

[i] The most spectacular bankruptcy concerns the fact of declaration of bankruptcy in 2010 by the largest and oldest Polish travel agency, Orbis Travel, whose Congress Office was the first one in Poland.