Serviços Personalizados

Journal

Artigo

Indicadores

-

Citado por SciELO

Citado por SciELO -

Acessos

Acessos

Links relacionados

-

Similares em

SciELO

Similares em

SciELO

Compartilhar

Tourism & Management Studies

versão impressa ISSN 2182-8458

TMStudies vol.11 no.1 Faro jan. 2015

MANAGEMENT – RESEARCH PAPERS

Psychographic determinants of private-label adoption: a feasibility study in the Portuguese yogurt market

Determinantes psicográficos da adoção da marca do distribuidor: um estudo no mercado português de iogurtes

Ana Oliveira Brochado1; Susana Henriques Marques2; Pedro Mendes3

1Lisbon University Institute, ISCTE Business School, Business Research Unit (BRU-IUL), Av. Das Forças Armadas, 1649-026 Lisboa, Portugal, ana.brochado@iscte.pt

2Lisbon University Institute, ISCTE Business School, Business Research Unit (BRU-IUL), 1649-026 Lisboa, Portugal, susana.marques@iscte.pt

3Lisbon University Institute, ISCTE Business School, 1649-026 Lisboa, Portugal pedro_f_mendes7@hotmail.com

ABSTRACT

This study seeks to point out the main psychographic determinants of private-label brand proneness in a specific industry: the Portuguese yogurt market. This is a booming industry for store brands in Portugal, which account for nearly half of the total market share. An in-depth interview was held with a sales and marketing expert of the leading yogurt company in Portugal. Next, we conducted a survey targeting consumers of yogurt. Based on the results of a Tobit regression, we conclude that consumers base their decisions about private label versus national brands on three different types of variables: price-related variables, quality-related variables and variables related to involvement with the product category. Managerial implications are also discussed.

Keywords: Private labels, psychographics, Tobit regression, yogurt.

RESUMO

O presente trabalho tem como objetivo estudar os determinantes psicográficos da adoção da marca do distribuidor, no caso específico do mercado dos iogurtes em Portugal. Este é um setor em crescimento em Portugal, em que as marcas do distribuidor atingem quase 50% da quota de mercado total. Foi realizada uma entrevista em profundidade com o responsável pelo marketing e vendas de uma das empresas líderes neste setor. De seguida, foi administrado um questionário a consumidores de iogurtes. Com base nos resultados de um modelo de regressão Tobit, conclui-se que os consumidores baseiam as suas decisões de aquisição de marcas do distribuidor relativamente a marcas do fabricante em três tipos de variáveis: variáveis relacionadas com o preço, com a qualidade, e com o envolvimento com a categoria de produto. São igualmente discutidas as implicações para a gestão.

Palavras chave: Marca do distribuidor, variáveis psicográficas, regressão Tobit, iogurtes.

1. Introduction

Private label brands (PLBs) are owned and distributed by retailers, while national brands are generally owned by producers. Private labels are sold in particular retail chains, and thus they tend to have restricted distribution as compared to national brands. Producers tend to advertise each national brand separately while advertising efforts by retailers are distributed across all their products. The majority of private labels are cheaper than national brands. As PLBs hold the potential to drive store loyalty and to maintain profitability, retailers around the world continue to invest in private labels, which have experienced significant growth in the last two decades (Dawes & Nenycz-Thiel, 2013).

Retailers use PLB to increase sales as well as to win the loyalty of their customers. In addition, some store brands are no longer merely category killers but instead are comparable to national brands (De Wulf, Odekerken-Schroder, Goedertier & Van Ossel, 2005). Retailers are aware that consumers can purchase nationally branded items anywhere, but customers can only buy retailers store brands in their stores (Pepe, Abratt & Dion, 2011). PLBs are now integral elements of the retail landscape, having achieved impressive penetration in all markets (Boyle & Lathrop, 2013). Given their strategic importance, identification of private-label prone shoppers main characteristics has attracted the attention of both practitioners and academics (Baltas & Argouslidis, 2007).

A private-label prone shopper buys store brands more often than national brands. A large body of literature provides evidence that private label products attract both price and quality conscious consumers (Baltas & Argouslidis, 2007). Furthermore, the determinants of private-label proneness are known to vary across different product categories (Gonzalez-Benito & Martos-Pardal, 2012).

PLBs are a steadily growing phenomenon that has reached a large number of countries and product categories (Cuneo, Lopez & Yague, 2012). This study seeks to define the main consumer correlates of store brand proneness in a particular industry: the Portuguese yogurt market. The yogurt market is a booming industry for store brands in Portugal, which hold nearly half of the total market share. Indeed, store brands represent 45% of the market in value and 53% in volume, while the top three national brands (Nestlé, Danone and Lactogal) together represent 50% of the market in value and 41% in volume.

The remainder of this paper proceeds as follows. The next section presents a discussion of the variables considered in this study and a brief description of the hypotheses. Then, our methodology is presented, which encompassed both qualitative and quantitative approaches. The results section analyses the contents of an interview conducted with the marketing manager of one of the leading national brands of yogurt and the survey results. We finish with some conclusions and final remarks.

2. Literature review

2.1 Private-label brands

In recent years, retailing of consumer goods has been characterised by a proliferation of private labels (e.g. Richardson, Jain & Dick, 1996; Pauwels & Srinivasan, 2004; Dobson & Chakraborty, 2009). The number of national brands, in this context, has been reduced in favour of private labels.

The evolution of private label brands has been driven by a number of benefits for retailers, as follows:

- Increased bargaining power over manufacturers (Farris & Ailawadi, 1992; Pauwels & Srinivasan, 2004)

- Reactivation and expansion of stagnant categories (Hauser & Shugan, 1983; Scott & Zettelmeyer, 2004)

- Increased revenues, providing superior margins to those delivered by manufacturers brands (Ailawadi & Harlam, 2002, 2004; Hoch & Banerji, 1993)

- Strategic benefits, such as an improvement of store image, loyalty and differentiation (Ailawadi, Pauwels & Steenkamp, 2008; Corstjens & Lal, 2000)

From a strategic perspective, the entry of PLBs has modified the competitive dynamics between retailers and brand manufacturers (Hoch & Banerji, 1993; Pauwels & Srinivasan, 2004) and has set new challenges for both. Retailers have to adopt brand management practices to make their PLBs successful. Brand manufactures have to compete against these new players, who have control over distribution channels, and, at the same time, stay relevant to consumers. Above all, consumers play a key role in this dispute as they can determine the success or failure of PLBs with their choices. Hence, for retailers and brand manufacturers, identifying key consumer level factors that drive PLB choice is a top priority (Cuneo et al., 2012).

Several studies have attempted to understand and explain consumers behaviours towards private labels based both on psychographic and socioeconomic variables, as well as social class (Baltas, 1997), homemakers working conditions (Zeithaml, 1985) and family size (Richardson et al., 1996). A brief overview of these variables is provided below. Based on the results of previous research, a set of hypotheses was formulated.

2.2 Psychographic determinants of PLB adoption

2.2.1 Price consciousness

The concept of price consciousness is defined as the degree to which consumers focus exclusively on paying low prices (Lichtenstein, Ridgway & Richard, 1993). According to Burton, Donald, Lichtenstein, Netemeyer & Garretson (1998), consumers with positive attitudes towards private labels are extremely price conscious and tend to focus almost exclusively on paying low prices due to their desire to maximise their money, which minimises other factors when evaluating brands (Miranda & Josh, 2003). Therefore, we expect that (H1) the more customers are sensitive to price, the higher will be their proneness to buy private labels.

2.2.2 Value consciousness

Value consciousness has been defined as a concern for paying low prices subject to some quality constraints – relating perceived costs to perceived benefits (Lichtenstein et al., 1993). Garretson, Fisher & Burton, (2002) and Ailawadi, Nelsin & Gedenk (2001) believe that the low prices of store brands can be used as an incentive to improve the image of stores products and to attract consumers who are value conscious. Therefore, based on these studies, it is expected that (H2) perceived value has a positive influence on the purchase of private label goods.

2.2.3 Price-quality association

Generally, consumers tend to impute quality based on price (Agarwal & Teas, 2002; Brucks, Zeihaml & Naylor, 2000). Rao and Monroe (1989) argued that consumers evaluate product quality using a comparative process, so perceived differences in prices lead to relative judgements that product quality varies significantly. Volckner and Hoffman (2007) concluded that the perception of a price-quality relationship persists, albeit more weakly than in the past. However, even if price-quality benefits are present, they can vary according to whether consumers are familiar with the product categories or whether they perceive the products to be a risky choice (Peterson & Wilson, 1985) or a prestige purchase (Brucks et al., 2000). According to Lichtenstein et al. (1993), the perception of price-quality is defined as the generalised belief that the level of prices is positively related with the level of quality of products in all product categories.

Hansen and Singh (2008) found that heavy buyers of private labels tend to be attracted to new price-oriented retailers. This relationship suggests that private label buyers are more price conscious, which makes them more susceptible to promotional activities by retailers (Sudhir & Talukdar, 2004) and, hence, less store loyal, so they spread their purchases across retailers.

To other consumers, low prices of store brands cause these products to be seen as less attractive, constituting a sign of low quality. Therefore, we can expect that (H3) there will be a negative relationship between the price-quality perception of consumers and the adoption of private labels.

2.2.4 Perception of private labels

Consumers can make evaluations using a variety of information signals associated with products. The current literature shows that, when assessing the quality of private labels, consumers use either intrinsic cues (Sprott & Shimp, 2004) or extrinsic cues (Bao, Bao & Sheng, 2011). According to the cue utilisation theory, consumers tend to rely more on extrinsic cues than on intrinsic cues in their evaluation of private labels (Richardson et al., 1996). The idea that national brands are better quality than store brands is extremely persistent in customers minds and is influenced by publicity and advertising that helps to strengthen this characteristic. For this reason, consumers feel more confident when choosing branded goods that they believe offer them more benefits. Therefore, we expect that (H4) perceptions of private brands are positively related with consumers proneness to buy private labels.

2.2.5 Perceptional consequences of making bad choices

Kapferer and Laurent (1985) provided some insights into this variable in their study of product category involvement. Other researches regarding the degree of inconvenience of making a mistake have come to similar conclusions (Narasimhan & Wilcox, 1998). The results of making a bad choice are directly linked to consumers perception of risk and the value they give to a particular product category. Consequently, we maintain that (H5) a negative relationship is present between perceptional consequences of making bad choices and proneness to buy private labels.

2.2.6 Probability of making a bad purchase

The other half of the consequences of making a mistake notion deals not with the actual consequences of making a mistake but rather with the probability of doing this. The expected value of any decision is the product of its consequences times its likelihood (Dunn, Murphy & Skelly, 1986).

Narasimhan and Wilcox (1998) take the consumers perspective and argue that consumers prefer national brands to PLBs if the relative risk of purchasing within the category seems high. Therefore, the risky nature of product categories relates to private label success. This suggests that it is important to understand the degree of variability of quality in particular categories. This is different from the perceived PLB quality level, as it is variability that should create greater uncertainty and create more perceived risk. For Richardson et al. (1996), perceived quality variation leads to a reduced perceived value-for-money of private labels – both directly and via perceived risk. This eventually leads to reduced private-label brand proneness. Therefore, we expect that (H6) a negative relationship exists between perceptional consequences of making bad purchases and proneness to buy private labels.

2.2.7 Symbolic aspect (social consciousness)

The symbolic aspect of brands is the associations that consumers make with brands or with particular social status, personal tastes and lifestyles. In this way, consumers purchase their products not only for their function but also for what they represent. According to Aaker (1992), associations with brands correspond to something that creates links between consumers and brands. These can be situations in which products are used, a combination of features or attributes of products or even the sensations products or brands can provoke in consumers. In the case of store brands, this rarely happens, since these brands have little or no publicity that can incite customers associations. On this level, the adoption of private labels tends to be low. Thus, we assume that (H7) social consciousness is negatively related with proneness to buy private labels.

2.2.8 Hedonic value

Consumers associate products with a utility value or a hedonic value, taking into account the strategic objectives of brands. Chitturi, Raghunathan & Mahajan, (2008), as well as other authors, use the term hedonic benefit when referring to the aesthetic side of products, as well as the practical and emotional potential they offer. Ailawadi et al. (2001) reported that this variable is linked with intangible, experiential and affective attributes.

According to Richins (1994), while some products are consumed for their utility (utility benefits), others are consumed for their capacity to give pleasure (hedonic benefits). Therefore, consumers can attribute high risk to the performance of private labels in hedonic product categories because they fear that these brands might not provide the emotional benefits they desire. Therefore, we expect that (H8) hedonic value negatively affects proneness to buy private labels.

2.2.9 Interest

The literature about the variable of interest is similar to what was previously discussed for hedonic value. Consumers do not buy products only for their utility benefits. There are other features that are taken into consideration when making purchase decisions. Interest in certain products or categories can attribute high risk to the performance of private labels if consumers pay more attention to details and have more knowledge about related topics. As a result, consumers are willing to pay higher prices for national brands in these categories. This occurs because consumers give much importance to these products and want to have their expectations met. From previous studies, we expect that (H9) the importance given to a product category negatively affects the adoption of private labels.

2.2.10 Brand loyalty

Loyalty to brands is the intrinsic commitment to make repeat purchases of certain brands. In other words, brand loyalty is the degree to which clients have positive attitudes towards brands, showing commitment and a desire to continue buying them in the future. This is a bond created between consumers and brands, which translates into repeat purchases of products throughout a particular period. According to Garretson et al. (2002), consumers who are loyal to brands exhibit a strong tendency to buy the same brands they have always bought, so it is less likely they will make a change to a new or unknown brand. Burton et al. (1998) also verified that attitudes towards private labels are negatively related to consumers propensity to be loyal to brands in different product categories. In the same way, Ailawadi et al. (2001) referred to how customers who are loyal to national brands show a lesser tendency to adopt store brands, since the cost of changing is extremely high. However, in their study, this variable did not show high significance in the explanation of consumers consumption of private labels (Ailawadi et al., 2008).

One of the most important elements for private labels is a brands ability to fulfil promises to its consumer base. Continual fulfilment of promises usually results in a long-term, profitable relationship between retailers and consumers, and it is related to utilitarian benefits offered by brands (Carpenter, 2003). Corstjens and Lal (2000) demonstrated that premium quality store brands play a role in building store loyalty. Guenzi, Johnson and Castaldo (2009) found that customer trust in store brand products has an influence on store patronage, since it positively affects customers trust in stores, perceived value and store loyalty intentions. In summary, according to these authors, (H10) consumers position towards private labels is negatively related with consumers loyalty to brands throughout different product categories.

2.2.11 Product signatureness

The concept of product signatureness refers to the degree to which product categories are associated with stores in consumers minds (Bao et al., 2011). This is an external cue commonly associated with another variable – the store image, which is also frequently used in studies on consumers quality evaluation of private labels.

While signatureness refers to product categories, store image defines the global impression of retail stores. The fact that signature products epitomise retailers service means expertise is representative of the product quality associated with those stores and their general store image. Thus, (H11) when private labels are introduced into signature categories of stores, they need to be perceived as high quality by consumers (Bao et al., 2011).

3. Methodology

3.1 In-depth interview

An in-depth interview was carried out with a sales and marketing expert of the leading yogurt company in Portugal. The interview took place in his office and lasted for one hour. The objective of the interview was to gather information regarding the supply side of the market and, more specifically, about the role of private labels in this product category.

The interview guide comprised 11 questions, as follows: 1. Do you consider private labels a threat to your business? 2. What is the role of private labels in your product category? 3. Do you offer discounts through retailers loyalty cards? If so, what is the main objective of this sales tactic? 4. What are the main drivers of the market share increase for national brands in your product category? 5. Do you produce any national brands in your facilities? 6. Is there any brand love of fast moving consumer goods (FMCG) in your product category? 7. What are the main trends for private labels? 8. Are there still consumers loyal to brands? 9. Do you believe that retailers look for an equilibrium between national brands and private labels in their offer? 10. Is there a profile of consumers of private labels? 11. Do consumers plan to purchase national or private labels?

3.2 Survey development

In a second step, a survey was conducted targeting regular consumers of yogurt. The main objective was to identify the most important determinants in the adoption of private labels.

The information required for this study had to come from people who come regularly in contact with FMCG in their households, more specifically, yogurt. This includes people who shop, consume or intervene in any stage of the decision making process. The questionnaire was administered through face-to-face mall-intercept interviews. The fieldwork took place between December 2012 and February 2013.

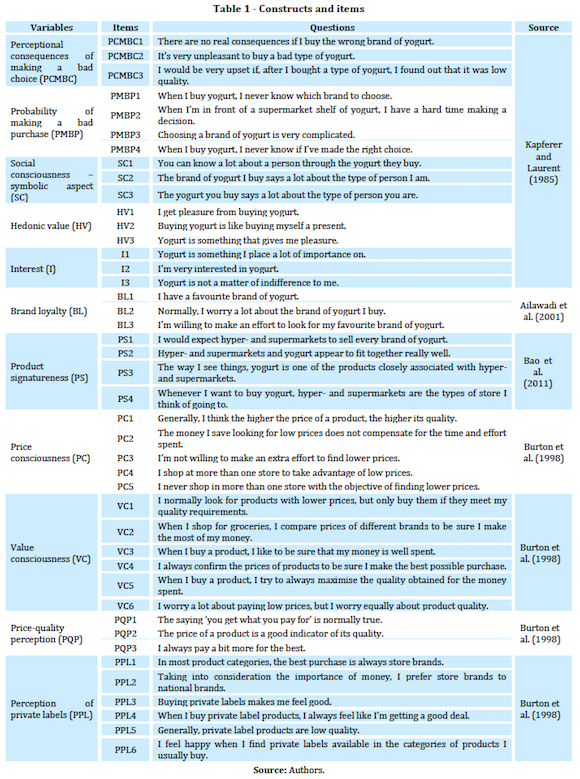

The questionnaire had four main sections. The first section presented questions focusing on general shopping behaviour and specific shopping behaviour in the yogurt category. Respondents were asked to provide the percentage of national and store brands they usually buy. In the second part, all 23 questions had to do mostly with yogurt and competition between national and store brands. This section focused on measuring individual factors within this specific category that were adapted from a previous study (Kapferer & Laurent, 1985), such as perceptional consequences of making a bad choice (PCMBC), probability of making a bad purchase (PMBP), social consciousness (SC), hedonic value (HV) and interest (I). The third section (20 questions) contained a more general evaluation of the individual factors considered when making a purchase decision. It included scales adapted from Burton et al. (1998), Ailawadi et al. (2001) and Bao et al. (2011) related to brand loyalty (BL), product signatureness (PS), price consciousness (PC), value consciousness (VC), price-quality perception (PQP) and perception of private labels (PPL). Table 1 presents the respective items for each variable. In the second and third sections, respondents had to indicate their level of agreement with the items presented, based on a scale with one meaning entirely disagree and five meaning entirely agree. The final part of the questionnaire was composed of a group of seven questions with the objective of evaluating demographic and socioeconomic factors.

4. Results

4.1 In-depth interview

In this section, we summarise the main conclusions obtained from the interview with the marketing manager of one of the main companies operating in Portugal in this sector, organised by question below.

1. Do you consider private labels a threat to your business?

The respondent recognised that private labels have strengthened their position in the Portuguese yogurt market. They offer new products targeting a wide range of consumers with innovative flavours and packages (e.g. for children). Moreover, the biggest retailers in Portugal began to use private labels to differentiate themselves from other retailers. These possess a high brand awareness and offer a good relationship of price to quality to consumers. In terms of a retailing mix, retailers could assign more space in their line to private labels. National brands did not anticipate the need for retailers to distinguish themselves with an active retail mix. Therefore, private labels represent a threat for national brands, and they should be considered serious competitors.

2. What is the role of private labels in your product category?

Private labels act as followers in the yogurt market. They offer products at a lower price and copy the innovations of national brands. However, as private labels offer products at lower prices, they force national brands to innovate.

3. Do you offer discounts through retailers loyalty cards? If so, what is the main objective of this sales tactic?

This managers company offers discounts through retailers loyalty cards. The main objective is to motivate new consumers to try and adopt more products. However, for existing products, promotional offers by national brands will only produce more sales in the short run.

4. What are the main drivers of the market share increase for national brands in your product category?

Price, quality, continuous innovation, merchandising, placement of products in stores close to national brands and effective advertisements designed to increase their brands equity were identified as the main drivers behind these increases in market share.

5. Do you produce any private labels in your facilities?

The manager indicated that his company does not produce any private labels, but other national brands do this.

6. Is there any brand love of FMCG in your product category?

Although some adults have good memories from their childhood, it is becoming more expensive to create and to maintain brand love. The market structure has changed, and a wide range of products is offered.

7. What are the main trends for private labels?

The importance of private labels will continue to increase. In this economic downturn, it is to be expected that national brands have fewer resources to innovate and to promote their products. As a consequence, private labels will strength their position However, there is an upside for this increase in some categories. As the profit margin of private labels for retailers is lower than their margin on national brands, retailers will continue to promote national brands. During 2012 and 2013, major retailers changed their strategy to focusing on the promotion of national brands.

8. Are there still consumers loyal to brands?

The respondent maintained that there is a segment of consumers loyal to specific brands of yogurt for product categories targeted at children. The challenge for brand managers is to find the best product mix to fulfil consumers needs and offer this at the right price.

9. Do you believe that retailers look for an equilibrium between national brands and private labels in their offer?

According to the respondent, managing the balance between the high sales volume generated by private labels and the high value offered by national brands is a complex task. The retail sector is not prepared to manage private labels in order to add value to the product category. As private labels have increased their market share, national brands have reduced their profits. Retailers target margin in specific categories should lead to an equilibrium between private labels and national brands. Retailers should be aware that this situation could force them to reduce innovation efforts.

10. Is there a profile of consumers of private-label yogurt?

The same consumer can select both national and private labels.

11. Do consumers plan to purchase national or private labels?

The respondent believes that the decision to buy specific brands is made either when consumers make their shopping lists or during visits to stores. Consumers first select the product category, then the brand and then the flavour. The decision process is different for loyal and non-loyal consumers.

4.2 Survey results

4.2.1 Demographic sample profile

Of the 305 respondents, 209 (68.5%) were female, and 96 (31.5%) were male. The age groups were quite evenly distributed in the three younger categories – 18 to 25, 26 to 35 and 36 to 50 – with 72 (23.6%), 74 (24.3%) and 81 (26.6%) respondents, respectively. The 51 to 64 group represents 15.7% of the total sample (48 respondents), while people over 65 represent 9.8% (30 respondents). As for the composition of the sample, in terms of marital status, the majority of respondents are married – a total of 172 (56.4%). Single people represent 32.1% of the total population in the study (98 respondents), while the divorced/widowed participants represent 11.5% or 35. Twenty-nine percent of the respondents have children under 18 years old.

4.2.2 Shopping behaviour description

The majority of the respondents (51.5%) revealed that in their household they usually buy yogurt once or twice a week. A further 35.7% (109 respondents) buy yogurt twice a month, 9.5% (29 respondents) once a month and 3.3% (10 respondents) more than twice a week. In terms of the number of types of yogurt they eat in their household, the respondents answered mostly two (41.6%) or three (30.8%). Forty respondents said they only ate one type (13.1%), while 44 people ate four or more (14.4%). The mean percentage of private labels purchased in the yogurt category was 45.7%, with a 95% confidence interval between 42.22% and 49.19%. The median was 0.5, and the standard deviation was 0.30972. This percentage ranged from a maximum of 100% (all types of yogurt are store brands) to 0% (all the types of yogurt are national brands). The percentages obtained from the sample match the average national results disclosed by Nielsen.

4.2.3 Exploratory factor analysis

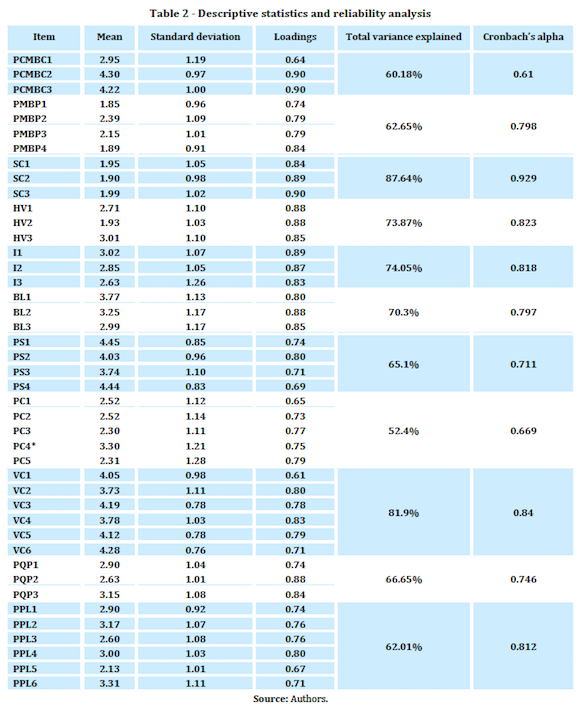

For this study, a factor analysis using the method of principal components was performed in order to identify a small set of uncorrelated variables to use in further analysis, followed by an internal consistency analysis of each scale. The Cronbachs alpha coefficient ranged from 0.610 (PCMBC) to 0.929 (SC), revealing adequate internal consistency (see Table 2 below). The primary objective of this study is to analyse the main factors that lead consumers to adopt private labels. Consequently, the percentage (%) of private labels bought in the yogurt category was regressed on the mean values of the 11 scales previously defined. Due to the nature of the dependent variable, ranging from 0 to 100, a truncated Tobit model was estimated.

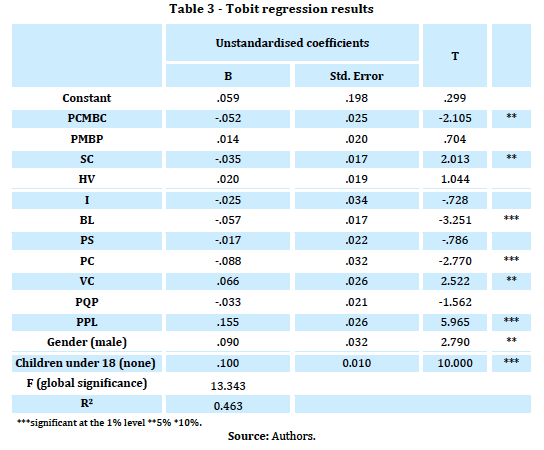

4.2.4 Tobit regression model results

The assumptions for the model were examined and confirmed. The Harvey test statistic rejected the null hypothesis of homoscedasticity, and the variance inflation factors revealed that the correlations between the independent variables do not jeopardise multicollinearity. Looking at the value of the R square (R²), the model explains 46.3% of the total variance. From the 11 constructs initially tested, six were found to have statistically significant correlation with the dependent variable. Looking at the model results, six of the 11 hypotheses were confirmed. Looking at the values of the coefficients (B) of the independent variables linked to psychographic determinants of PLB adoption associated with the product category, we conclude that brand loyalty has the strongest negative impact, followed by perceived consequences of making a bad choice and social consciousness. The signal of the coefficient estimates was in accordance with the theoretical expectations. Regarding the general psychographic determinants of PLB adoption, PPL is the most significant determinant, followed by PC and PQP.

Considering demographic variables, males buy a higher percentage of private labels as compared to females, and the existence of children under 18 is negatively related to private-label proneness (see Table 3 below).

5. Conclusion and managerial implications

The growth experienced by PLBs in recent years has not only been impressive but has also caused important changes in the competitive dynamics of the markets in which these brands operate. Retailers have become dominant in a large number of countries and have pushed the development of their own brands, driven by the high number of benefits on which they are able to capitalise (Cuneo et al., 2012). In this study, we examined several factors that help to explain variations in purchasing preferences for national brands of yogurt versus PLBs. In attempting to explain these variations, several psychographic variables were tested.

Our results show that the consumers sampled base their decisions to adopt a product on three different types of variables: price-related variables, quality-related variables and variables related to involvement with the product category. The price-related and quality-related variables (PPL, PC and VC) have the most influence on consumers when selecting store brands of yogurt. These types of variables are unlikely to vary throughout product categories because they have to do with individual perceptions and they are indifferent to the product type. The variables related to involvement with the product category (BL, PCMBC and SC) are also statistically significant in explaining the dependent variable in this study.

As an increase in perceived consequences of making a wrong brand choice is associated with a decrease in PLB adoptions, national brands could target their advertising campaigns to increase the awareness of benefits associated with their products. Tactically, national brands need to increase positive brand associations and challenge perceived quality equivalence between national brands and PLBs. One of the most interesting results regarding demographic variables is that having children under 18 decreases private-label proneness. This is a result anticipated by the manager of a national brand of yogurt, who maintained that product categories targeting children command high levels of BL. Therefore, the consumers sampled with children probably experience anxiety when buying yogurt. This follows the arguments presented by Batra and Sinha (2010), and this finding is in accordance with the research on childrens influence on purchases (see Tiago and Tiago (2013) for a review). Of course, the implications for retailers PLBs are the opposite. Retailers should continue to disclose information about the yogurt they offer on package labels and reduce the uncertainty faced by consumers. Retailers offering PLBs should be aware that BL to national brands would limit retailers potential to increase their market share. SC is also an important determinant regarding the adoption of PLBs of yogurt.

Regarding the general constructs, the consumers sampled who are more price conscious and who associate higher prices with higher quality would prefer national brands. PPL and PQP are significant determinants of private label purchases. Therefore, for those consumers that perceive PLBs as having equivalent quality when compared with national brands, promotional offers made by national brands would probably increase sales in the short term for these consumers. As this is a general construct regardless of the product category, national brands managing umbrella brands could spread the effectiveness of advertising campaigns across different product categories.

One of the limitations that must be taken into account relates to the fact that the sampling design was based on a convenience sampling procedure and the sample did not have a national scope. Thus, the results obtained cannot be generalised to all Portuguese consumers.

Future research needs to focus on more than one product category. As variables related to involvement with the product category vary from product to product in the FMCG industry, product categories that have retailer brands with higher and lower market shares could be compared.

References

Aaker, D. (1992). The value of brand equity. Journal of Business Strategy, 4, 27–32. [ Links ]

Agarwal, S. & Teas, R. (2002). Cross-national applicability of a perceived quality model. Journal of Product & Brand Management, 11, 213-236. [ Links ]

Ailawadi, K. & Harlam, B. (2002). The effect of store brands on retailer profitability: an empirical analysis. Working Paper No. 02-6, Tuck School of Business at Darmouth, Hanover, [ Links ] NH.

Ailawadi, K. & Harlam, B. (2004). An empirical analysis of the determinants of retail margins: the role of store-brand share. Journal of Marketing, 68, 147-65. [ Links ]

Ailawadi, K., Nelsin, S. & Gedenk, K. (2001). Pursuing the value-conscious consumer: store brands versus national brand promotions. Journal of Marketing, 61(1), 71-89. [ Links ]

Ailawadi, K., Neslin, S. & Gedenk, K. (2001). Pursing the value-conscious consumer: store brands versus national brand promotions. Journal of Marketing, 65, 71–89. [ Links ]

Ailawadi, K., Pauwels, K. & Steenkamp, J-B. (2008). Private-label use and store loyalty. Journal of Marketing, 72, 19–30. [ Links ]

Araújo, C. & Loureiro, S. (2014). The effect of subjective norm, perceived control, attitude and past experience on purchase intention of luxury clothes brands in Brazil. Tourism & Management Studies, 10 (Special Issue), 103-110. [ Links ]

Baltas, G. & Argouslidis, P. (2007). Consumer characteristics and demand for store brands. International Journal of Retail and Distribution Management, 35, 328-341. [ Links ]

Baltas, G. (1997). Determinants of store brand choice: a behavioural analysis. Journal of Product & Brand Management, 6(5), 315-24. [ Links ]

Bao, Y., Bao, Y. & Sheng, S. (2011). Motivating purchase of private brands: effects of store image, product signatureness, & quality variation. Journal of Business Research, 64(2), 220-226. [ Links ]

Batra, R. and Sinha, I. (2010). Consumer-level factors moderating the success of private label brands, Journal of Retailing, 76 (2), 175-191. [ Links ]

Boyle, P. & Lathrop, E. (2013). The value of private label brands to U.S. consumers: an objective and subjective assessment. Journal of Retailing and Consumer Services, 20, 80-86. [ Links ]

Brucks, M., Zeihaml, V. & Naylor, G. (2000). Price and brand name as indicators of quality dimensions for consumer durables. Journal of the Academy of Marketing Science, 28, 359-374. [ Links ]

Burton, S., Donald, R. Lichtenstein, R., Netemeyer, G. & Garretson, J. (1998). A scale for measuring attitude toward private label products and an examination of its psychological and behavioral correlates. Journal of the Academy of Marketing Science, 26(4), 293-306. [ Links ]

Carpenter, J. (2003). An examination of the relationship between consumer benefits, satisfaction, and loyalty in the purchase of retail store branded products. Unpublished doctoral dissertation, University of Tennessee, Knoxville, TN. [ Links ]

Chitturi, R., Raghunathan, R. & Mahajan, V. (2008). Delight by design: the role of hedonic versus utilitarian benefits. Journal of Marketing, 72(3) 48-63. [ Links ]

Corstjens, M. & Lal, R. (2000). Building store loyalty through store brands. Journal of Market Research, 37, 281-91. [ Links ]

Cuneo, A., Lopez, P. & Yague, M. (2012). Private label brands: measuring equity across consumer segments. Journal of Product & Brand Management, 21(6), 428-438. [ Links ]

Dawes, J. & Nenycz-Thiel, M. (2013). Analyzing the intensity of private label competition across retailers. Journal of Business Research, 66, 60-66. [ Links ]

De Wulf, K., Odekerken-Schroder, G., Goedertier, F. & Van Ossel, G. (2005). Consumer perceptions of store brands versus national brands. Journal of Consumer Marketing, 22(4), 223-32. [ Links ]

Dobson, P. & Chakraborty, R. (2009). Private labels and branded goods: consumers horrors and heroes. In: Ezrachi, A., Bernitz, U. (Eds.), Private Labels, Brands and Competition Policy. Oxford University Press, England, 99-124. [ Links ]

Dunn, M., Murphy, P. & Skelly, G. (1986). Research note: the influence of perceived risk on brand preference for supermarket products. Journal of Retailing, 62, 204-217. [ Links ]

Farris, P. & Ailawadi, K. (1992). Retail power: monster or mouse? Journal of Retailing, 68(4), 351-69. [ Links ]

Garretson, J., Fisher D. & Burton, S. (2002). Antecedents of private label attitude and national brand promotion attitude: similarities and difference. Journal of Retailing, 78(2), 91-99. [ Links ]

Gonzalez-Benito, O., & Martos-Pardal, M. (2012). Role of retailer positioning and product category on the relationship between store brand consumption and store loyalty. Journal of Retailing, 88(2), 236-249. [ Links ]

Guenzi, P., Johnson, M. & Castaldo, S. (2009). A comprehensive model of customer trust in two retail stores. Journal of Service Management, 20(3), 290-316. [ Links ]

Hansen, K. & Singh, V. (2008). Are store brands buyers store loyal? An empirical investigation. Management Science, 54(10), 1828-34. [ Links ]

Hauser, S. & Shugan, S. (1983). Defensive marketing strategies. Marketing Science, 2(4), 319-60. [ Links ]

Hoch, S. & Banerji, S. (1993). When do private labels succeed?. Sloan Management Review, 57-67. [ Links ]

Kapferer, J. & Laurent, G. (1985). Consumers involvement profile: new empirical results. Advances in Consumer Research, 12, 290-295. [ Links ]

Lichtenstein, D., Ridgway, N. & Richard G. (1993). Price perceptions and consumer shopping behaviour: a field study. Journal of Marketing Research, 30, 234-245. [ Links ]

Miranda, M., & Josh, M. (2003). Australian retailers need to engage with private labels to achieve competitive difference. Asia Pacific Journal of Marketing and Logistics, 15(3), 34-47. [ Links ]

Narasimhan, C. & Wilcox, R. (1998). Private labels and the channel relationship:a cross-category analysis. Journal of Business, 71(4), 573–600. [ Links ]

Pauwels, K. & Srinivasan, S. (2004). Who benefits from store brand entry? Marketing Science, 23(3), 364-90. [ Links ]

Pepe, M., Abratt, R. & Dion, P. (2011). The impact of private label brands on customer loyalty. Journal of Product & Brand Management, 20(1), 27-36. [ Links ]

Peterson, R. & Wilson, W. (1985). Perceived risk and price-reliance schema. In: J. Jacoby & J. Olson, (Eds.), Perceived Quality (pp. 247-268). Lexington, MA: Heath.

Rao, A. & Monroe, K. (1989). The moderating effect of prior knowledge on cue utilisation in product evaluations. Journal of Consumer Research, 15, 253-24. [ Links ]

Richardson, P., Jain, A. & Dick, A. (1994). Extrinsic and intrinsic cue effects on perceptions of store brand quality. Journal of Marketing, (58), 28-36. [ Links ]

Richardson, P., Jain, A., & Dick, A. (1996). Household store brand proneness: a framework. Journal of Retailing, 72(2), 159-185. [ Links ]

Richins, M. (1994). Valuing things: the public and private meanings of possessions,.The Journal of Consumer Research, 21, 504 - 521. [ Links ]

Scott, F. & Zettelmeyer, F. (2004). The strategic positioning of store brands in retailer-manufactuer negotiations. Review of Industrial Organisation, 24(2), 161-94. [ Links ]

Sprott, D. & Shimp, T. (2004). Using product sample to augment the perceived quality of store brands. Journal of Retailing, 80(4), 305-15. [ Links ]

Sudhir, K. & Talukdar, D. (2004). Does store brand patronage improve store patronage. Review of Industrial Organisation, 24, 143-160. [ Links ]

Tiago, M. & Tiago, F.(2013). The influence of teenagers on a familys vacation choices. Tourism & Management Stududied, 9(1), 28-34. [ Links ]

Volckner, F. & Ackerman, N. (1984). Price-quality correlations in the Japanese market. Journal of Consumer Affairs, 18(2), 251-265. [ Links ]

Volckner, F. and Hofmann, J. (2007): The perceived price-quality relationship. A meta-analytic review and assessment of its determinants. Marketing Letters, 18 (3), 181-196. [ Links ]

Zeithaml, V. (1985). The new demographics and market fragmentation. Journal of Marketing, 49, 64-75. [ Links ]

Article history:

Received: 25 May 2014

Accepted: 10 November 2014